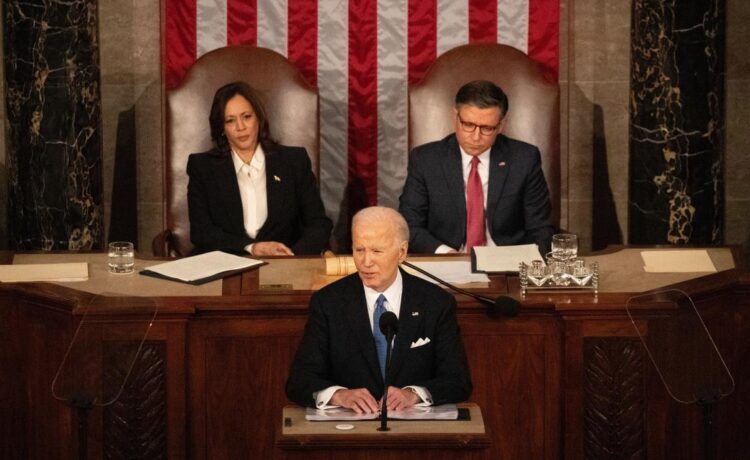

President Joe Biden addressed several financial issues during his State of the Union speech on March 7, which could have wide-ranging consequences for consumers.

Social Security: What Biden’s Updated Payment Plan Means for Your Money

Owe Money to the IRS? Most People Don’t Realize They Should Do This One Thing

While some of the issues he talked about were proposals the administration has been pushing for months — such as tax changes — he also presented new housing programs and incentives that could help first-time homebuyers.

As Moody’s Analytics associate economist Nick Luettke explained, these housing programs aim to tackle a range of issues which have swelled to create affordability issues for Americans across the income spectrum.

“Many of these proposals will need to make their way through Congress first — a particularly arduous task in an election year — though their inclusion in the address underscores the salience of the skyrocketing cost of housing for Americans nationwide,” said Luettke.

Learn More: A $150K Income Is ‘Lower Middle Class’ In These High-Cost Cities

Housing Proposals

The housing market has been an arduous one for many would-be buyers lately, as soaring mortgage rates, high prices and low inventory have left many of them in the lurch.

Now, the Biden administration announced plans to lower costs via a slew of measures.

In response, former President Donald Trump live-posted the address on Truth Social, writing: “CROOKED JOE BIDEN IS ON THE RUN FROM HIS RECORD–AND LYING LIKE CRAZY TO TRY AND ESCAPE ACCOUNTABILITY FOR THE HORRIFIC DEVASTATION HE AND HIS PARTY HAVE CREATED.”

And regarding the housing market, Trump posted a meme of Biden, which read: “After three years of Bidenomics: The 30-year mortgage rate has hit a 23 year high.”

$5,000 Mortage Credit for First-Time Home Buyers

First-time homebuyers would benefit from a tax credit of up to $5,000 for two years, which would make homeownership more accessible and affordable. According to the administration, this is the equivalent of reducing the mortgage rate by more than 1.5 percentage points for two years on the median home, and will help more than 3.5 million middle-class families purchase their first home over the next two years.

“If you’re planning to buy your first home, this credit could reduce your tax liability and provide financial relief during the home purchase process,” said Mark Friedlich, CPA and vice president of government affairs at Wolters Kluwer Tax & Accounting. “It should make purchasing that first house more affordable and encourage more people to enter the housing market.”

One-Year Tax Credit of up to $10,000 to Middle-Class Families Who Sell Their Starter Home

Starter homes are defined as homes below the area median home price in the county, and which are sold to another owner-occupant, under this proposal. The proposal is estimated to help 3 million families, according to the Biden administration.

This proposal seeks to address America’s expensive single-family market struggling from high prices and lingering interest rates, per Luettke.

“If implemented, these tax-credit programs could help transactions in the single-family housing market by offering tax-credits to both first-time purchasers and sellers of starter-homes in hopes of easing pressure on middle-class homeowners,” he said, adding that elevated interest rates have locked many owners into current rates while also forcing would-be first-time buyers to remain renters.

Lowering Costs By Building and Preserving 2 Million Homes

The president is calling on Congress to pass legislation to build and renovate more than 2 million homes. Doing so would perhaps close the housing supply gap and lower housing costs for renters and homeowners.

“It remains unclear which of these policies are most likely to succeed in Congress in this hotly contested election year,” said Luettke, noting that housing affordability has become a key issue for Americans spanning all demographics and political divides. Luettke also indicated housing policy has mostly remained steady in recent congressional budgets.

“Private-public partnerships are likely to be a key strategy for the future of America’s housing as programs seek to help make new developments financially viable while simultaneously expanding housing inventory in order to ease housing prices,” he added.

Helping Renters

Another proposal includes fighting rent gouging by corporate landlords, aiming at combating “egregious rent increases and other unfair practices that are driving up rents,” according to the White House.

As Moody’s Luettke noted, as of Q4 2023, Americans spent about 27.1% of their incomes on rent on average — with popular metros like New York City, Miami, and Los Angeles remaining above the 30% threshold to be considered rent burdened.

Taxes

Billionaire Tax

The president reiterated his proposal for a billionaire tax, which is a 25% minimum tax on unrealized income for households with a net worth of more than $100 million.

“That would raise $500 billion over the next 10 years,” Biden said during his address, adding that it could help restore the child tax credit.

According to Friedlich, some argue that taxing the wealthy more could lead to economic growth and reduce income inequality. However, opponents worry about potential negative effects on investment and job creation, he noted.

Some experts had a different take on the subject.

“Our problem is we spend too much, not that wealthy Americans aren’t contributing,” said William Ruger, president of the American Institute for Economic Research. “The wealthiest Americans already pay a huge share of overall taxes: the top 25% of earners pay nearly 90% of all income taxes paid and the top 1% more than 40%.”

Raising Corporate Taxes

In his speech, Biden announced a proposal to deny corporations a tax deduction when they pay more than $1 million to any employee.

“He also described his plans to bump the corporate tax rate up to 28% from the level set by former President Trump’s 2017 tax cuts, which put it at 21%,” said Friedlich.

In terms of how this would affect consumers, Friedlich noted that if you own stocks or invest in companies, higher corporate taxes could reduce corporate profits.

“This might affect stock prices and dividends,” he said, adding that corporations are likely to pass on any increased tax burden to consumers through higher prices for goods and services.

Not Raising Taxes for Individuals With Income Under $400,000

Biden also repeated his position that taxes won’t be raised for any Americans making less than $400,000 a year.

President Trump’s tax cuts are set to expire in 2025, with Democrats opposing a blanket extension of the law. Republicans hope to extend it if they win Congress and the White House, added Friedlich. He also noted that “Most of his tax-related goals are not likely to see the light of day given the divisive environment in Washington, D.C.”

More From GOBankingRates

This article originally appeared on GOBankingRates.com: 6 Biggest Financial Takeaways From Biden’s SOTU (and Trump’s Reactions)