LAWTON, Okla. (KSWO) – The City of Lawton Finance Department sent 7News further explanation on previously asked questions regarding the $40 million loan and a General Revenue Summary.

In the original article, 7News sought answers to various questions pertaining to recent CIP activity. However, after receiving the original responses, 7News had some follow ups.

The first question the city first responded to regarding our seeking of clarification was: Why weren’t there enough CIP funds to cover the proposed 2019 projects?

Q: Why weren’t there enough CIP funds to cover the proposed 2019 projects?

A: The life of any project hardly ever extends past 3 years. It either completes or amends to become more or different. Large projects nearly always cross over a minimum of one new budget year due to the natural life of when they start. Every new budget year accounts for the money for each project as it exists at that time for the next year time frame (completed portions would not carry forward).

However, more questions became relevant after we received the responses to 7News’ first round of questions. The question and answer conversation took place over email, since we were unable to speak with a individual from the finance department in person.

Q: Why was the process changed from how it’s been, to approving a loan? Especially if the 2019 can cover everything?

A: 2019 can cover the costs of the projects over the life of the CIP; Council is choosing to borrow money to pay for projects now before future inflation forces us to cut projects due to lack of funding.

The 2019 CIP does not have an inflation factor according to the Resolution of Intent for the 2040 extension. The proposed 2040 does account for inflation.

The City goes on to state the $40 million loan isn’t to make up for loss of funding, but to move the timeline forward to begin construction.

Q: Does this not mean the city is technically $40 million dollars short?

A: No; if we didn’t obtain a $40 million loan, then $40 million in expenditures would be cut from the 2019 CIP Fund.

The city said there are no interest or fees from the $40 million loan that won’t be paid back by CIP funds.

During the Lawton City Council meeting where they approved the $40 million loan, the city’s Finance Director told 7News that COVID had an affect on the CIP sales tax.

Councilman Kelly Harris also stated this during the meeting, saying, “I just want to point out that every single one of these projects were on Propel 2019, and when people say why didn’t we do it sooner, well because one word, COVID. COVID messed with all of our finances. Part of the way this works, if I understand, is that we have to have a percentage of the money before we’re ready to go to the bonding agencies.”

This is what led us to ask whether or not COVID had an impact on the CIP.

Q: Did COVID not have an impact on the sales tax?

A: No; sales tax remained steady through COVID.

Your 7News team also came across a General Revenue Fund Summary during research for a story.

In this picture, it states the 2019 CIP sales tax brought in $2.4 million in revenue, so we asked the City of Lawton for clarification, which they provided.

Q: I just need a clear explanation on why the highlighted line is what it is. How does this effect the city?

A: The only effect to the city is where we report the sales tax revenue (General Fund vs. CIP Fund) and the lack of transfer between the General Fund and the CIP Fund. This means that before, when we received money from the CIP sales tax, it’d first go into the General Fund. Then, we’d transfer it to the 2019 CIP Fund, which is where it needed to be. But now, we skip the transfer step because the CIP sales tax goes directly into the 2019 CIP Fund from the start.

Q: What is the background information needed to understand what this is? Or is it normal to be -91.7% under budget?

A: Not it’s normal, but can be explained by the change in accounting procedure. The way we handle the money from the 2019 CIP sales tax has changed. Instead of putting the money into the General Fund first and then moving it to the 2019 CIP Fund, we now just put it directly into the 2019 CIP Fund right away.

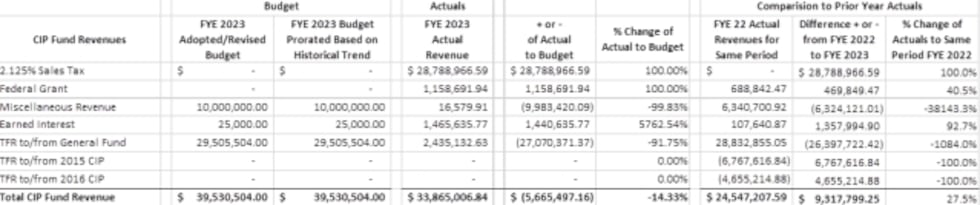

They shared the following screenshot of the CIP fund.

Copyright 2024 KSWO. All rights reserved.