pixelfit/E+ via Getty Images

Bain Capital Specialty Finance (NYSE:BCSF) started as a curiosity for me. I recognized the Bain name, infamous from the days of the 2012 Presidential Election and the negative impact it had to Romney campaign. I naturally found it tempting to look at this company and see what’s there.

Overall, I found this to be a decent business with a secure risk profile and attractive yield just over 11%. It may not the best bargain ever found, but at the current price it’s a BUY.

Relationship To Bain Capital

What is the connection to Bain Capital? The latest Form 10-K (pg. 6) puts it plainly:

Bain Capital Credit is a wholly-owned subsidiary of Bain Capital, LP (“Bain Capital”) and the Advisor is a majority-owned subsidiary of Bain Capital Credit.

There are a couple of layers here, but essentially BCSF is a fund that allows Bain Capital to earn additional income through management fees.

Investment Approach

Like many of its peers, the fund deals in private companies to give shareholders exposure to these opportunities through the public shares of BCSF. It primarily invests in the middle market, which it defines as those businesses with annual EBITDA ranging between $10 million and $150 million.

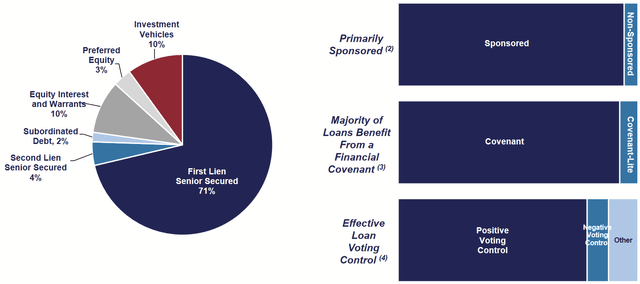

The company’s preferred form of investment is first or second lien loans that are secured by collateral. To a lesser extent, it opportunistically issues junior debt, invests in equity, or purchases other investments. Nearly all of these loans are floating-rate.

Leveraging the information sources and contacts of Bain Capital Credit, BCSF derives ideas for investment, performs a process of due diligence, seeks approval from the credit committee, and then carefully monitors the performance of its portfolio companies (2022 Form 10-K, pg. 8). Due diligence often entails interviews with management and on-site visits to have a stronger, hands-on grasp of the business’s fundamentals.

First and foremost, BCSF’s investment priority is minimizing its risk.

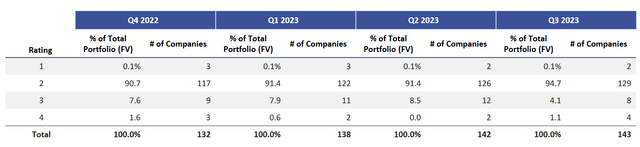

Many of the investments are of credit ratings that would be considered below investment grade. Consequently, to indicate the company’s own view of its portfolio, it created a rating scheme of 1 through 4 (pg. 11).

- Investments that perform above expectation.

- Those that perform as expected.

- Those that perform less than expected.

- Those that significantly underperform.

As of Q3 2023, almost 95% of the portfolio was Tier 1 or 2.

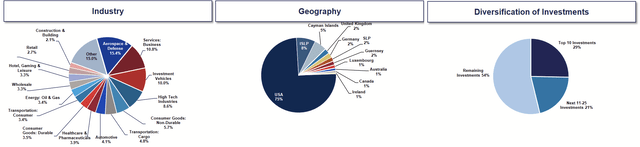

The fund is largely diversified but with some subtlety. In the slide above (which I cropped for convenience), BCSF’s 122 portfolio companies come from dozens of industries primarily in the United States. The top ten investments account for about 29% of the portfolio.

Financial History

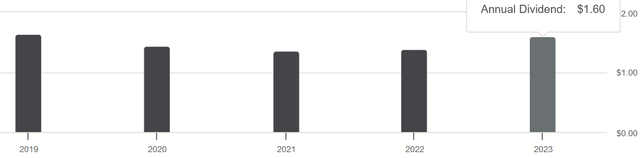

The financial history of this company is not as extensive as others. While Bain Capital has been around a long time, BCSF had its IPO in 2018. Being a Registered Investment Company, it must distribute most of its earnings as dividends, so let’s review that history.

Dividends and Capitalization

For the past five years, the company has paid annual dividends per share (on a quarterly basis) ranging as low as $1.36 and as high as $1.64. What have been the factors that impacted this? For one, the various challenges in the macro-environment that were kicked off by COVID clearly had an impact.

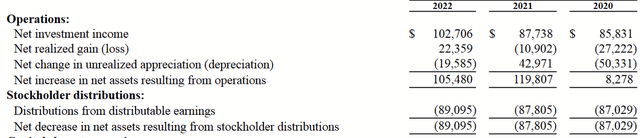

Changes in Net Assets (2022 Form 10K)

Secondly, I think it’s important to recognize how this business is capitalized.

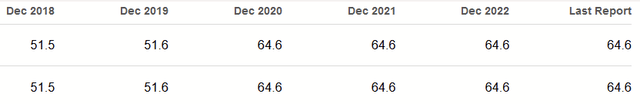

Shares Outstanding (Seeking Alpha)

Capital continued to be raised after the IPO, but since 2020, the shares outstanding have remained at 64.6M.

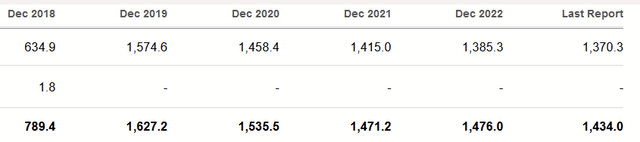

Long-Term Debt (Seeking Alpha)

Similarly, the company has been paying down its long-term debt after 2019. Due to their distribution requirements, it is common for many BDCs and similar companies to sell shares on a recurring basis in order to raise more capital. Many investors who automatically reinvestment their dividends effectively allowing these companies to retain their earnings for investment and pursue growth opportunities.

BCSF isn’t doing that here, and I think that’s interesting. It is working with the same balance sheet and rolling over whatever isn’t eaten by expenses, losses, or distributions. Why the rise in the dividend, then? In the Q3 2023 Earnings Call, Michael Boyle (President) explained:

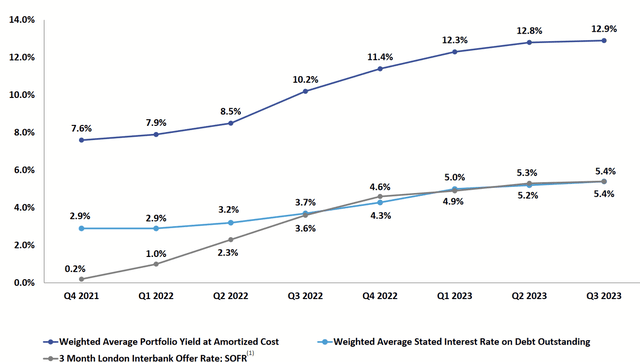

As of September 30, 2023, the weighted average yield on the investment portfolio at amortized costs and fair value were 12.9% and 13.1%, respectively, as compared to 12.8% and 13% as of June 30, 2023. The increase was primarily driven by higher reference rates on our loans. And as a reminder, 94% of our debt investments bear interest at a floating rate.

As interest rates have risen, there are higher yields for distribution to shareholders.

Portfolio Yield Spread (Q3 2023 Company Presentation)

Risk Profile

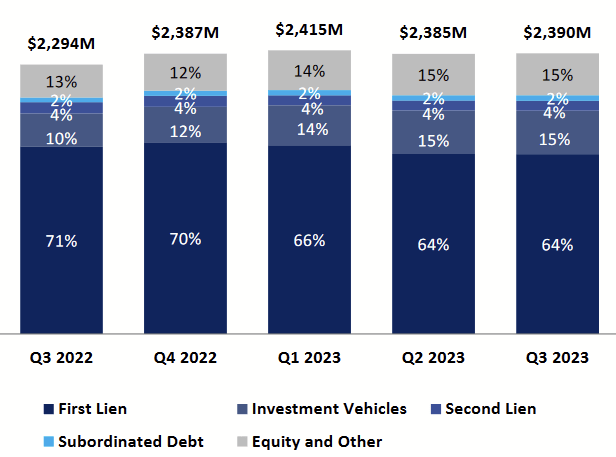

Q3 2023 Company Presentation

Some folks have noticed also that the portfolio have been continually decreasing its concentration in first lien debt. Yet, this is based on how the company must report their assets. As clarified in the same earnings call:

As we have highlighted to our shareholders in prior earnings calls, the decline in our stated first lien exposure is driven by the growth in our joint ventures. Notably, 94% of the underlying investments held in these investment vehicles consist of first lien loans, resulting in a look through first lien exposure of approximately 82% of the portfolio.

As such, the company has been maintaining its commitment to the security provided by first lien debt.

A Look to the Future

As Q4 2023 results approach, concerns remain about the strength of regional banks in the United States. This could prove to be fertile ground for a BDC such as BCSF. The aftermath of the 2008 Financial Crisis resulted in big banks trimming down their exposure to the middle market, in favor of large companies. There’s similar potential here if regional banks find themselves pinched by the bubble of commercial real estate. When capital dries up, a sufficiently prepared BDC can enjoy a wider array of candidates and demand higher yields with tighter covenants, thus providing them strong returns with lower risk.

Moreover, while the law only requires an asset coverage ratio of at least 150%, BCSF recently stood at 182.2% (Form 10-Q, pg. 131). This gives them room to lever more for growth in a context of better investment options. I believe it will be important to monitor this as Q4 results come out and as commercial U.S. real estate loans are tested throughout the year.

All of that aside, we have to consider the future of the dividend, since that’s main way shareholders receive a return. Since actual equity is a small sliver of the portfolio, and since and most increases in payouts are due to the benefit of the floating-rate portfolio, a reversal in rates can just as easily reduce the distributable earnings. While rate hikes have paused, it remains to be seen how soon it will be before a rate cut is announced.

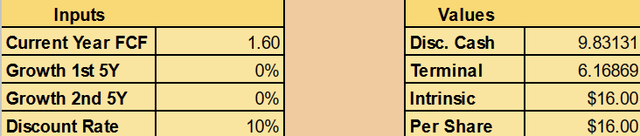

Valuation

Because the draw is the dividend, I’ll value this through a Discounted Cash Flow. I’ll use 2023’s total distribution of $1.60 per share as a baseline. I won’t assume any growth since I perceive a mixture of forces that could increase and decrease earnings. I’ll give a terminal multiple of ten since BDCs often yield in a range of 10% as well.

That would give an intrinsic value of $16 even.

Conclusion

Since inception, Bain Capital Specialty Finance has been a consistently profitable operation, offering a high (if variable) dividend yield even in distressed environments. With a portfolio invested in secured debt and no rush on management’s part to grow their balance sheet by continually raising capital, I believe shareholders who like the yield to be in relatively good hands. If rates remain high, while distress in regional banking materializes, BCSF might be in a good position to ride that wave.

Whatever happens, the shares are at a modest discount to non-growth, and so I think they’re a fair buy.