Bajaj Finance Q3 Results 2025 Live Updates: Bajaj Finance, India’s largest non-banking finance company (NBFC), reported that its net interest income grew by 23% year-on-year to ₹9,382 crore in the December 2024 quarter, up from ₹7,655 crore in December 2023. Bajaj Finance’s profit after tax increased by 18% in Q3 FY25, rising to ₹4,308 crore from ₹3,639 crore in Q3 FY24.

The number of new loans booked in Q3 FY25 was the highest ever at 12.06 million, compared to 9.86 million in Q3 FY24, marking a 22% increase. The customer base grew to 97.12 million by 31 December 2024, up from 80.41 million a year earlier, showing a 21% growth. In Q3 FY25, the company saw its biggest ever quarterly increase in customer numbers, adding 5.03 million. Assets under management (AUM) grew by 28%, reaching ₹398,043 crore as of 31 December 2024, up from ₹310,968 crore a year ago. AUM increased by ₹24,119 crore in Q3 FY25.

Bajaj Finance Q3 Results Live: Performance highlight of subsidiary Bajaj Financial Securities

BFinsec acquired approximately 75,000 customers in Q3 FY25. Overall customer franchise stood at approximately 908,000 as of 31 December 2024.

Margin trade financing (MTF) book grew by 70% to ₹5,392 crore as of 31 December 2024 from ₹3,167 crore as of 31 December 2023.

Net interest income increased by 123% in Q3 FY25 to ₹69 crore from ₹31 crore in Q3 FY24.

Net total income increased by 49% in Q3 FY25 to ₹110 crore from ₹74 crore in Q3 FY24.

Profit before tax increased by 127% in Q3 FY25 to ₹50 crore from ₹22 crore in Q3 FY24.

Profit after tax increased by 119% in Q3 FY25 to ₹35 crore from ₹16 crore in Q3 FY24.

Bajaj Finance Q3 Results Live: Subsidiary performance – Bajaj Housing Finance Limited – Q3 FY25

Assets under management grew by 26% to ₹108,314 crore as of 31 December 2024 from ₹85,929 crore as of 31 December 2023.

Net interest income increased by 25% in Q3 FY25 to ₹806 crore from ₹645 crore in Q3 FY24.

Net total income increased by 25% in Q3 FY25 to ₹933 crore from ₹746 crore in Q3 FY24.

Loan losses and provisions in Q3 FY25 were ₹35 crore as against ₹1 crore in Q3 FY24.

Profit before tax increased by 25% in Q3 FY25 to ₹713 crore from ₹572 crore in Q3 FY24.

Profit after tax increased by 25% in Q3 FY25 to ₹548 crore from ₹437 crore in Q3 FY24.

Gross NPA and Net NPA as of 31 December 2024 stood at 0.29% and 0.13%, respectively, as against 0.25% and 0.10% as of 31 December 2023. BHFL has a provisioning coverage ratio of 55% on stage 3 assets.

Capital adequacy ratio (CRAR) (including Tier-II capital) as of 31 December 2024 was 27.86%.

-BHFL enjoys the highest credit rating of AAA/Stable for its long-term debt program.

Bajaj Finance Q3 Results Live: A look at standalone performance – PAT up 17%, NII 22%

• Assets under management grew 26% to ₹293,370 crore as of 31 December 2024 from ₹232,040 crore as of 31 December 2023.

• Net interest income increased by 22% in Q3 FY25 to ₹8,500 crore from ₹6,973 crore in Q3 FY24.

• Net total income increased by 25% in Q3 FY25 to ₹10,617 crore from ₹8,486 crore in Q3 FY24.

• Operating expenses to net total income for Q3 FY25 was 34.2% as against 34.7% in Q3 FY24.

• Profit before tax increased by 16% in Q3 FY25 to ₹4,978 crore from ₹4,291 crore in Q3 FY24.

• Profit after tax increased by 17% in Q3 FY25 to ₹3,706 crore from ₹3,177 crore in Q3 FY24.

• Gross NPA and Net NPA as of 31 December 2024 stood at 1.41% and 0.61%, respectively, as against 1.18% and 0.46% as of 31 December 2023. The company has a provisioning coverage ratio of 57% on stage 3 assets.

Bajaj Finance Q3 Results Live: CRAR at 21.57%

Bajaj Finance Q3 Results Live: Capital adequacy ratio (CRAR) (including Tier-II capital) as of 31 December 2024 was 21.57%. The Tier-I capital was 20.79%.

Bajaj Finance Q3 Results Live: Gross NPA and net NPA see an uptick in Q3

Bajaj Finance Q3 Results Live: Gross NPA and Net NPA as of 31 December 2024 stood at 1.12% and 0.48% respectively, as against 0.95% and 0.37% as of 31 December 2023. The provisioning coverage ratio on stage 3 assets was 57%.

Bajaj Finance Q3 Results Live: Loan losses & provisions rise sharply

Bajaj Finance Q3 Results Live: Loan losses and provisions for Q3 FY25 were ₹2,043 crore as against ₹1,248 crore in Q3 FY24. Loan losses and provisions to average assets under finance for Q3 FY25 were 2.16%.

Bajaj Finance Q3 Results Live: AUM grows 28% YoY to ₹398,043 crore

Bajaj Finance Q3 Results Live: Assets under management (AUM) grew by 28% to ₹398,043 crore as of 31 December 2024 from ₹310,968 crore as of 31 December 2023. AUM grew by ₹24,119 crore in Q3 FY25.

Bajaj Finance Q3 Results Live: Number of new loans booked highest ever

Bajaj Finance Q3 Results Live: Number of new loans booked in Q3 FY25 was the highest ever at 12.06 million as against 9.86 million in Q3 FY24, a growth of 22%. Customer franchise stood at 97.12 million as of 31 December 2024, as compared to 80.41 million as of 31 December 2023, a growth of 21%. In Q3 FY25, the Company recorded the highest ever quarterly increase in its customer franchise of 5.03 million.

Bajaj Finance Q3 Results Live: NII rises 23% YoY to ₹9382 crore

Bajaj Finance Q3 Results Live: Net interest income grew by 23% YoY to ₹9,382 crore in the December 2024 quarter from 7,655 crore in the December 2023 quarter.

Bajaj Finance Q3 Results Live: Bajaj Finance posts 18% YoY increase in PAT

Bajaj Finance Q3 Results Live: Bajaj Finance’s profit after tax increased by 18% in Q3 FY25 to ₹4,308 crore from ₹3,639 crore in Q3 FY24.

Bajaj Finance Q3 Results Live: Anand Rathi on what to expect from Bajaj Finance earnings

Bajaj Finance Q3 Results Live: According to analysts at Anand Rathi, Bajaj Finance’s PAT could grow by 18% YoY and 7% QoQ to ₹4194 crore in Q3. Meanwhile, NII is seen at ₹11054 crore, up 30% YoY and 12% QoQ.

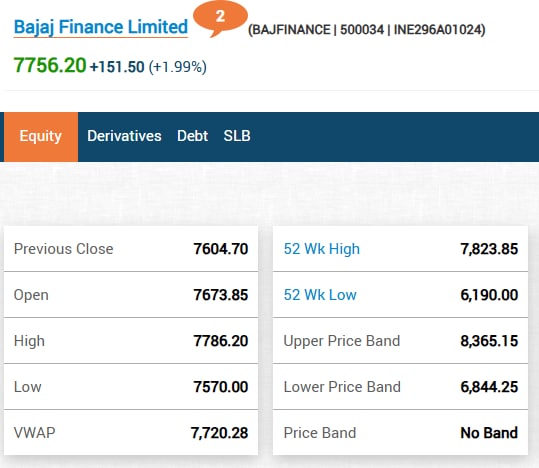

Bajaj Finance Q3 Results Live: Bajaj Finance shares end 2% higher ahead of earnings

View Full Image

Bajaj Finance Q3 Results Live: BAF’s strategic partnership with Bharti Airtel to create new growth levers: BofA

Bajaj Finance Q3 Results Live: Bajaj Finance (BAF) recently announced a strategic partnership with Bharti Airtel (one of India’s largest telecom services providers), to create one of India’s largest digital platforms for financial services and transform last mile delivery.

While BAF has built up a strong customer franchise of 97.1mn, backed by a strong customer acquisition funnel with more than 17mn customers acquired in FY25, BofAe believes that this partnership will help BAF create new growth levers towards achieving its medium-term AUM growth guidance of 25-27%. The partnership will allow BAF to offer its diverse bouquet of 27 financial products to Airtel’s 370mn customer base (220mn MAUs on Digital Assets) by leveraging its digital assets (Airtel Thanks App, 100mn Airtel users) as well as a 1.2mn+ strong distribution network over time, said the global brokerage.

Bajaj Finance Q3 Results Live: BofA says Bajaj Finance’s net profit growth should start to inflect from Q3

Bajaj Finance Q3 Results Live: We continue to believe that BAF’s net profit growth should start to inflect from the current quarter (3Q). Net profit growth (YoY) has decelerated from 40% to 13% (in 2Q’FY25) over the past 7 quarters on (i) NIM compression, (ii) higher credit costs. With NIMs stabilizing/recovering and credit costs likely peaking in 3Q’FY25, we see a trend reversal with 17.6% YoY PAT growth in 2H’FY25 and 25% in FY26. We see PAT growth converging to AUM growth (BofAe: 27%) FY26 onwards. Further, operating cost efficiencies are expected to provide another upside risk to earnings.

Bajaj Finance Q3 Results Live: PAT growth likely at 15% YoY, NII could rise 22%, says brokerage Deven Choksey

Bajaj Finance Q3 Results Live: Provisional AUM growth was reported at 28.0% YoY / 6.4% QoQ as of December 31, 2024, with the highest-ever new loan bookings for the same period.

NII growth for Q3FY25E is expected to be 22.1% YoY / 5.8% QoQ, under the base case, led by the AUM growth. However, the higher cost of borrowing will continue to put pressure on the company’s profit margins.

Net Profit will likely grow by 15.2% YoY / 4.5% QoQ in the base case scenario, driven by the healthy operating performance.

We expect credit costs to be around 2.0% for the quarter, while asset quality will continue to see some pressure due to its rising risks in the unsecured loan portfolio.

Bajaj Finance Q3 Results Live: KIE sees 18% YoY rise in PAT & 23% jump in revenue

Bajaj Finance Q3 Results Live: Kotak Institutional Equities (KIE) sees NII at ₹9376.6 crore, a growth of 22.5% YoY and 6.1% QoQ. PAT could rise 18% YoY and 7% QoQ to ₹4294.8 crore. NIM could degrow 47 bps to 9.7% on a YoY basis.

Bajaj Finance reported 6.4% QoQ AUM growth (5.6-7.1% QoQ in the last four quarters), driving 28% YoY AUM growth. We bake in QoQ flat spreads and NIM as borrowings cost has almost topped off.

We expect the cost-to-average AUM ratio to remain moderate at 3.9% (4.0% in 2QFY25 and 4.2% in 3QFY24). We pen down credit costs to 2.1% for 3QFY25 (1.5-2.1% in the previous four quarters).

Bajaj Finance Q3 Results Live: Bajaj Finance share price rises nearly 2% ahead of earnings

Bajaj Finance Q3 Results Live: Bajaj Finance shares gained ahead of the announcement of the Q3 earnings announcement. The NBFC stock was trading 1.84% higher at ₹7745 apiece on the BSE around 12.45 pm.

Bajaj Finance Q3 Results Live: MOSL shares earnings expectations for Bajaj Finance

Bajaj Finance Q3 Results Live: MOSL expects Q3 net profit at ₹4106.9 crore, a growth of 12.9% YoY while it sees net interest income at ₹9331.1 crore, up 21.9% YoY. Here are the brokerage’s other expectations:

- BAF is likely to report AUM growth of 28% YoY / 7% QoQ.

- Credit costs are expected to increase ~10bp QoQ to ~2.2%.

- Margin is likely to contract ~5bp QoQ to ~9.7%.

- Commentaries on NIM trajectory and credit costs are the key monitorables.

Bajaj Finance Q3 Results Live: Bajaj Finance to declare Q3 results today

Bajaj Finance Q3 Results Live: Bajaj Finance, India’s largest non-banking finance company (NBFC), is set to announce its Q3 results today. Bajaj Finance board of directors will consider and approve the financial results for the third quarter of FY25 today, January 29.