(Bloomberg) — Demand has grown so fervent for corporate bonds that investors are once again willing to finance big mergers and acquisitions — something they hesitated to do for much of last year.

Most Read from Bloomberg

In just the past two weeks, about $50 billion of bonds have been sold to help finance acquisitions and spinoffs. The deluge, which included notes tied to AbbVie Inc., Bristol Myers Squibb Co. and Cisco Systems Inc., marks a steep surge in M&A financing after the slowest year for dealmaking in a decade.

To Arvind Narayanan at Vanguard Group, there’s even more to come. Corporate debt markets have grown busy as investors hunt for new, attractively yielding debt before policymakers can pull interest rates lower. That’s encouraging finance chiefs to raise capital while the conditions are ideal.

“We do think M&A is going to continue,” said Narayanan, the firm’s co-head of investment-grade credit, in a phone interview. It’s “going to be front and center.”

At least $276 billion of pending M&A activity stands to be financed in the US investment-grade debt market this year, according to data compiled by Bloomberg. Broadcom Inc.’s takeover of VMware Inc. is among the deals that could lead to more issuance this year.

Buyout activity is filtering into other markets, too, from European debt to US leveraged loans. Not only are many of these offerings being met with strong demand from money managers, but borrowing costs — while still elevated compared to a few years ago — have been trending downward since October.

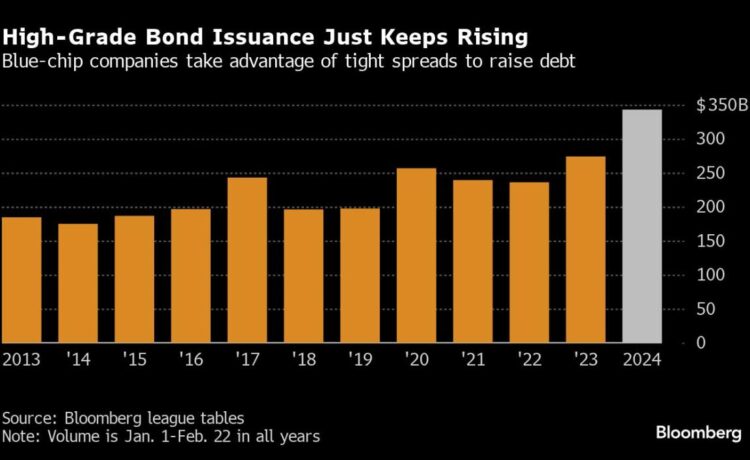

The average spread for high-grade bonds traded at the lowest level since November 2021 this past week as investors bet on Federal Reserve easing at some point later this year.

Another $35 billion of blue-chip debt is expected in the coming week — and at least one more jumbo deal may be possible before the end of the month, according to people familiar with the matter, who asked not to be identified discussing deals.

“The ability to lock in historically low spreads and to appeal to investors who are more motivated by yield — all while the economy is saying we’re in great shape — is a perfect storm to compel borrowers to step in and take advantage of the backdrop,” Meghan Graper, global co-head of debt capital markets at Barclays Plc, said in a phone interview.

For finance chiefs, it’s hard to ignore the success of recent deals as bond buyers — from pension funds to retail traders — look to take advantage of currently high all-in yields. AbbVie drew in more than $80 billion of orders from investors, while Bristol Myers’ deal raked in more than $85 billion.

WATCH: AbbVie Sees More Than $80 Billion Demand for Bond Sale

The hot demand is allowing companies to sell bonds at yields similar to what their existing debt pays. Borrowers in the US high-grade market, on average, paid 0.4 basis point more yield on Thursday for new bonds compared with the levels on their outstanding notes.

Corporations usually have to pay much more than that to convince investors to sell their current holdings and buy newer bonds: These so-called concessions averaged 8.5 basis points for all of 2023 and 13 basis points the year before that.

Rising Activity

In Europe, there’s been about $72.5 billion worth of M&A dealmaking so far this year, a 77% jump from the same period a year ago, according to data compiled by Bloomberg.

Even US firms are raising money there. Boston Scientific Corp. sold €2 billion to finance its acquisition of Axonics Inc. The deal was met with more than €5.7 billion of demand at pricing, according to people familiar with the matter, who asked not to be identified discussing private details. CreditSights analysts are now looking ahead for BAE Systems to tap markets to refinance the $4 billion bridge loan used to acquire Ball Aerospace.

Even the junk-debt market is seeing new financings for leveraged buyouts re-emerge after months of lackluster activity. Roughly $8 billion in debt is set to start hitting the market in March for Clayton Dubilier & Rice and Stone Point Capital’s buyout of Truist Financial Corp.’s insurance brokerage business.

Banks have gotten increasingly interested in private equity transactions, particularly less risky purchases requiring relatively low levels of debt. JPMorgan Chase & Co. beat private credit lenders to provide around $2.5 billion in debt financing to support Cohesity Inc.’s proposed acquisition of a unit of Veritas Technologies.

“The market feels like it’s stabilizing,” said Lauren Basmadjian, global head of liquid credit at Carlyle Group. “It’s the most encouraging it’s been in nearly two years.”

Week in Review

-

Investment banks including Goldman Sachs Group Inc. and Barclays Plc are striving to get a lucrative fee-making machine back in action.

-

The $1.4 trillion US junk-bond market is getting junkier, as more debt gets either downgraded or elevated out of the high-yield universe altogether, leaving greater potential risks for investors.

-

A little-watched corner of Canada’s credit market is being shaken up by the country’s largest lenders as they pile into securities that shift credit risks to other investors — a play likely to be copied by their counterparts on Wall Street.

-

Credit markets are signaling optimism about China’s latest stimulus steps aimed at easing the property-market crisis, alleviating some of the earlier skepticism seen over the impact of efforts to shore up the sector.

-

Chinese builder Jinke Properties and its wholly-owned Chongqing unit applied for restructuring to a local court, saying the company and its subsidiaries are all exposed to capital liquidity risks.

-

A group of China South City Holdings Ltd. bondholders has asked Hong Kong’s securities regulator to investigate the defaulted developer over what it says could be a potential breach of financial rules.

-

Demand for US high-grade corporate bonds is getting “unusually strong,” raising the risk of a market overshoot as investors absorb a glut of supply, according to Bank of America Corp.

-

The financing opportunity for private lenders has the potential to reach $1.5 trillion, according to Ares Management Corp.

-

The US Supreme Court turned away an appeal that might have upended the $1.4 trillion leveraged loan market, leaving intact a legal victory for JPMorgan Chase & Co. and other banks.

On the Move

-

Bank of Nova Scotia has recruited Bank of Montreal’s Raad Hossain as a director for structured products in the fixed income, currencies and commodities group.

-

Allen & Overy has hired John Goldfinch from Milbank as partner for its global structured finance practice.

–With assistance from Ronan Martin and Jill R. Shah.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.