CAMP ZAMA, Japan – While serving in the Army, Han Xue had worked in the public health field. But his curiosity and doubt over his financial future steered him in another direction.

Xue decided to use the Army’s tuition assistance to enroll in courses that led him to obtain a bachelor’s degree in finance. He then earned his master’s degree on the same subject following his military career.

“I didn’t have that peace of mind when it came to money, and I wanted to learn more things about money management,” he said. “And I just fell in love with it, and I started helping others.”

As a Soldier, Xue’s leadership and battle buddies noticed his fiscal aptitude grow, and it didn’t take long for him to become the unit’s finance guru, as they often sought his advice.

Now, he helps guide the financial journeys of service members and their families as a certified financial planner at Camp Zama.

“I was once in their shoes,” he said. “I want to empower them. Knowledge is power, and I want to help them understand how money works, how to save money, and how not to live paycheck to paycheck.”

Last spring, Xue began to teach monthly financial education classes to strengthen the personal finance skills of members in the Better Opportunities for Single Soldiers program. Topics have included how to create a budget, investing, the Thrift Savings Plan, cryptocurrency, how to use a Veterans Affairs home loan, tax planning, and credit management.

Xue, who has years of experience in the wealth management industry as a financial advisor, recognized that finance is not a subject typically taught in high school, and for many people, they either need to study it in college or comb through online resources to educate themselves.

“I feel like it’s a big missing piece in a puzzle,” he said. “How can you be mission-ready without having your money ready? That’s why I’m doing this.”

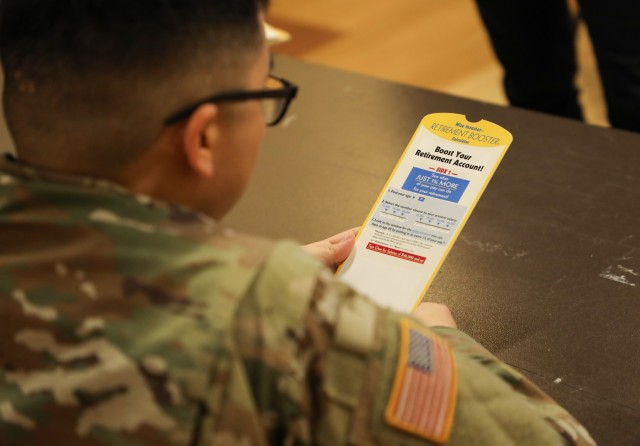

On Tuesday, Xue taught his latest one-hour class, which was on the TSP, inside the Community Recreation Center here.

Sgt. Minh Le, the 88th Military Police Detachment’s S-1 noncommissioned officer in charge, attended the training session to gain a better understanding of his future retirement.

“I have been putting money into TSP,” Le said, “but I haven’t seen what else I can do with it.”

Xue briefly explained the TSP funds beneficiaries can invest in, such as the C fund, which tracks the S&P 500, or the G fund, which invests in U.S. treasury securities, as well as lifecycle funds that tailor investments to one’s projected retirement date.

Using rough estimates of someone contributing monthly for 30 years to the TSP with only a small percentage of their pay, Xue showed they could have well over $1.5 million by the time they reach 60 years old.

“I didn’t know it would jump by that much, but it looks pretty nice,” Le said of the potential of his investments. “It’s something to look forward to when you retire.”

And with tax season underway, Xue said he plans to teach Soldiers how to file their tax returns in his next classes scheduled for March 4 and April 8 at 2 p.m. inside the center.

Xue said financial readiness plays a big role in the Army’s ability to complete its missions, like how Soldiers conduct physical training to be combat-ready.

“It’s a skill set,” he said. “If you don’t learn that skill set, you will have no idea how [you are] supposed to save money or where the money that [you] saved is going for the future.”

By setting financial goals, Xue said Soldiers can witness their money compound over the years through various investment options such as the stock market or a high-yield savings account.

“That can help them be ready financially even if they stay in [the Army] for 20 years or get out to find a new opportunity in the civilian world,” he said. “Having that skill set is essential to living a comfortable life and for that peace of mind too.”

For more information on the financial classes, call DSN 263-5316 or 046-407-5316, or 080-4456-8899 to schedule an appointment with Xue for one-on-one counseling sessions or unit-level training.

Related links: