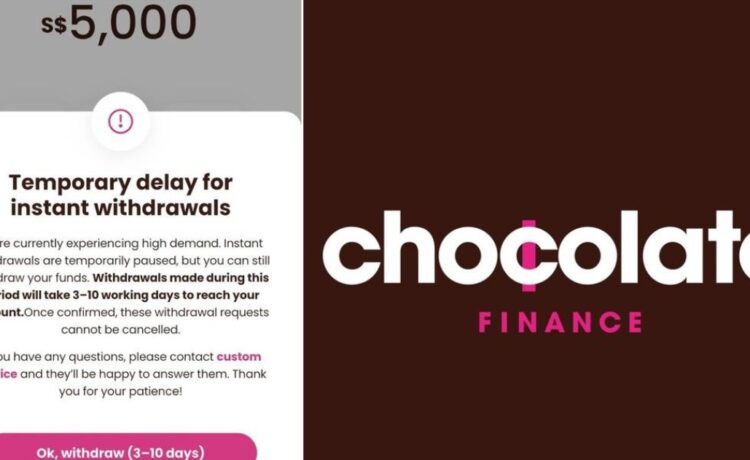

SINGAPORE – Financial services firm Chocolate Finance on March 10 suspended instant withdrawals, citing high demand.

It said on its mobile app that it was experiencing an unusually high volume of withdrawal requests, so users making requests during this period would have to wait between three and 10 days to get back their money.

In a media statement released on March 10, Chocolate Finance said it wanted to “reassure our customers” that it “remains a strong and stable place for” their spare cash, and that customer funds are “always safe”.

It said that the pause in instant withdrawals and its Chocolate card transaction service is “not a liquidity issue but a matter of managing our increased transaction volume”.

The pausing of transactions on its card is also so that it could “implement measures to manage this volume and expedite the return to normal service”.

Earlier on March 10, on social media platforms such as Reddit and HardwareZone, several users posted about the instant withdrawal being suspended. Chocolate Finance’s most recent Instagram post on March 7 drew comments asking for more information about the status of its instant withdrawals.

The platform, which was launched in August 2024, promises users an annual return of 3.3 per cent on their first $20,000 deposited. The money from customers is invested in short-term, investment-grade bonds. It may also be invested in short-term, fixed-income funds.

Therefore, instant withdrawals, the FAQ page says, may be paused from time to time and may not always be available.

It further added that the platform will not take fees and that Chocolate Finance will not make money until the target returns are delivered.

As at February 2025, it has cash assets close to $1 billion and more than 60,000 customers.

Chocolate Finance operates under private company ChocFin and was founded by Singapore permanent resident Walter de Oude, the founder of insurer Singlife. It is licensed as a fund management service provider by the Monetary Authority of Singapore (MAS), and is required to safeguard users’ money, which is separated from the company’s own finances using licensed custodian banks such as HSBC.

Though the platform invests in short-duration, fixed-income funds and money market funds through its managed account, it makes clear on its website that it is not a money market fund.

A money market fund is one that invests in short-term debt securities and cash, and is considered a low-risk option for investors wanting to park their money for a short period of time.

Chocolate Finance is a platform that invests in a range of funds that include a money market fund, and does not have its own fund.

In response to the pause of some services by Chocolate Finance, MAS said that with ChocFin being a capital markets services licence holder in fund management, it is also required to put in place a risk management framework and provide clear and transparent disclosures on the terms of its services, including circumstances where redemptions may not be instantly available.

The regulator said that ChocFin has provided clarifications on its redemption timelines, and that it has instructed the company to ensure that it “meets all redemptions in an orderly manner and to keep customers informed of developments”.

MAS added that it is separately querying ChocFin about its representations of its instant withdrawals programme.

This article was first published in The Straits Times. Permission required for reproduction.