-

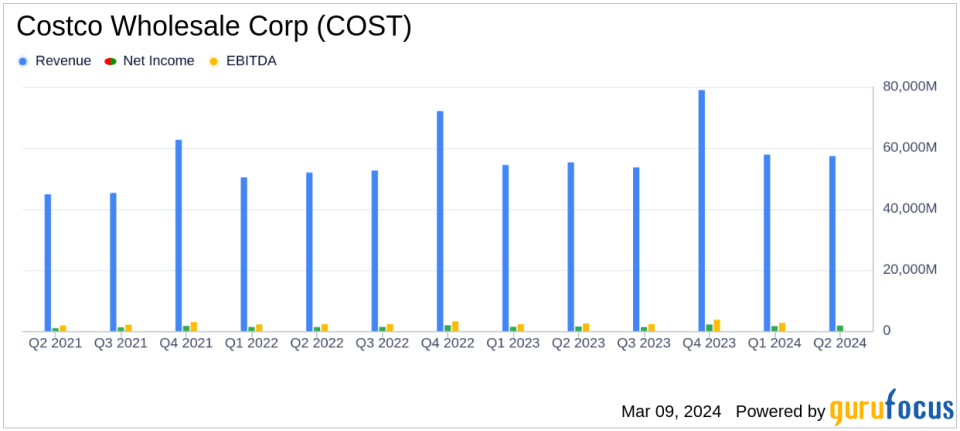

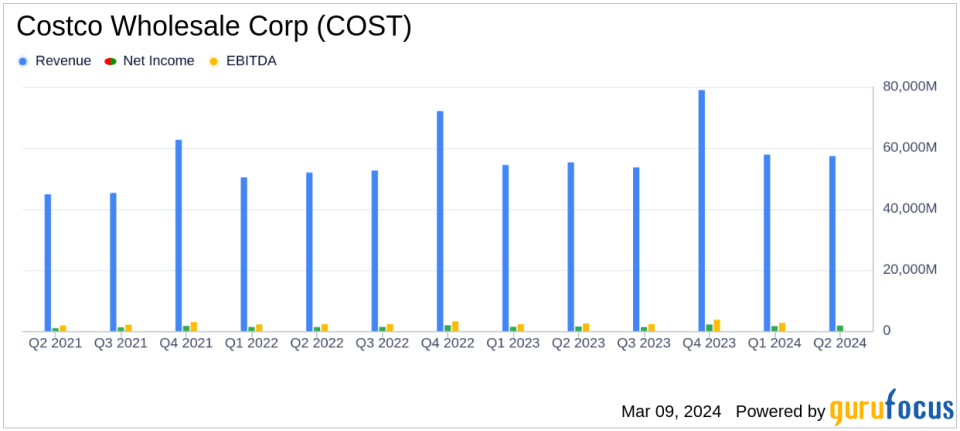

Net Sales: Increased by 5.7% to $57.33 billion in Q2 and 5.9% to $114.05 billion YTD.

-

Net Income: Rose to $1.743 billion in Q2, with earnings of $3.92 per diluted share.

-

Membership Fees: Grew to $1.111 billion in Q2, contributing to total revenue growth.

-

E-commerce Growth: Soared with an 18.4% increase in Q2 and 12.2% YTD.

-

Warehouse Expansion: Costco operates 875 warehouses globally, with a strong presence in the U.S. and international markets.

On March 7, 2024, Costco Wholesale Corp (NASDAQ:COST) released its 8-K filing, detailing the company’s financial performance for the second quarter and year-to-date of fiscal 2024, which ended on February 18, 2024. The report shows a robust increase in net sales and net income, highlighting the company’s continued growth in a competitive retail landscape.

Financial Performance Overview

Costco’s net sales for the quarter rose by 5.7 percent to $57.33 billion, up from $54.24 billion in the same period last year. The first 24 weeks of fiscal 2024 saw a 5.9 percent increase in net sales, reaching $114.05 billion. This growth was achieved despite a negative impact from the shift of the fiscal calendar due to the fifty-third week last year.

The company’s net income for the quarter was notably strong, standing at $1,743 million, or $3.92 per diluted share, compared to $1,466 million, or $3.30 per diluted share, in the previous year. This increase was partly due to a $94 million tax benefit related to the special dividend paid to 401(k) plan participants. For the first 24 weeks, net income reached $3.33 billion, or $7.49 per diluted share, up from $2.83 billion, or $6.37 per diluted share, in the prior year.

Membership Fees and E-commerce Performance

Membership fees continued to be a strong revenue driver, increasing to $1,111 million in the second quarter, contributing to the total revenue of $58.44 billion. E-commerce sales also showed impressive growth, with an 18.4 percent increase in the second quarter and a 12.2 percent increase year-to-date, excluding the impacts from changes in gasoline prices and foreign exchange.

Global Presence and Future Outlook

Costco’s global footprint continues to expand, with 875 warehouses in operation, including 603 in the United States and Puerto Rico. The company’s international presence is also significant, with warehouses in Canada, Mexico, Japan, the U.K., and other markets. Costco’s e-commerce sites are operational in multiple countries, supporting the company’s growth in the digital retail space.

The company’s financial health is further evidenced by the details provided in the condensed consolidated statements of income and balance sheets. With a solid operating income and careful management of operating expenses, Costco maintains its position as a leader in the Retail – Defensive industry.

Analysis of Costco’s Performance

Costco’s performance in the second quarter of fiscal 2024 reflects the company’s ability to grow its membership base and increase sales across its warehouse and e-commerce platforms. The rise in net income and per-share earnings indicates effective cost management and a strategic approach to capitalizing on consumer trends. The growth in membership fees underscores the value proposition Costco offers to its customers, which is critical for sustaining long-term growth.

The company’s e-commerce growth outpaces the overall net sales increase, highlighting the importance of digital channels in the retail sector. Costco’s continued investment in its online presence is essential to compete with other major players in the industry. The expansion of warehouse locations demonstrates Costco’s commitment to increasing its market share and reaching new customers globally.

Costco’s financial results are a testament to its resilient business model and its ability to adapt to changing market conditions. With a strong emphasis on value and efficiency, Costco is well-positioned to continue its growth trajectory in the competitive retail landscape.

For a more detailed analysis and to stay updated on Costco’s financial journey, investors and interested parties are encouraged to visit GuruFocus.com for comprehensive reports and investment insights.

Explore the complete 8-K earnings release (here) from Costco Wholesale Corp for further details.

This article first appeared on GuruFocus.