-

Strengths: Robust advisor network and diversified financial services offerings.

-

Weaknesses: Regulatory challenges and the necessity for continuous technological advancements.

-

Opportunities: Expansion into global markets and leveraging digital transformation.

-

Threats: Intense competition and evolving regulatory landscape.

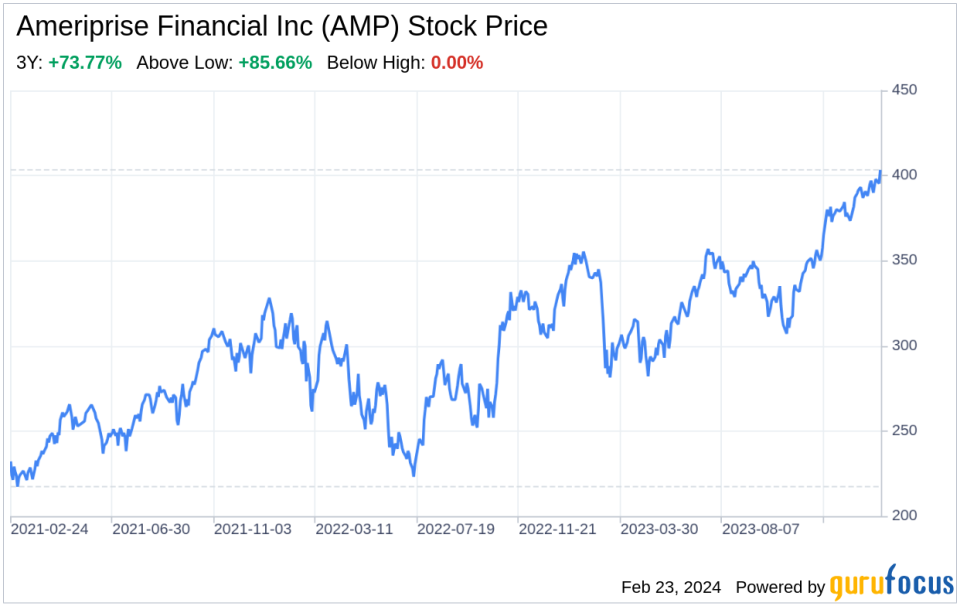

On February 22, 2024, Ameriprise Financial Inc (NYSE:AMP) filed its 10-K report, revealing a comprehensive overview of its financial status and strategic direction. As a leading entity in the U.S. asset and wealth management sector, Ameriprise Financial boasts approximately $1.4 trillion in assets under management and administration, supported by a vast network of around 10,000 advisors. The company’s revenue is primarily derived from its asset and wealth management segments, accounting for about 80% of its total income. The financial tables within the filing indicate a solid financial foundation, with significant revenue streams from fee-based services and a strategic shift towards a more integrated business model. This SWOT analysis delves into the strengths, weaknesses, opportunities, and threats as presented in the latest SEC filing, providing investors with a nuanced understanding of Ameriprise Financial’s market position.

Strengths

Brand Recognition and Advisor Network: Ameriprise Financial Inc (NYSE:AMP) stands out with its strong brand presence and one of the largest branded advisor networks in the industry. The company’s history of nearly 130 years has cultivated a reputation for reliability and expertise in financial planning and wealth management. This legacy, coupled with strategic acquisitions, has fortified its market position and expanded its service offerings. The robust advisor network not only contributes to a stable revenue stream but also ensures deep market penetration and client retention.

Diversified Financial Services: The company’s diversified portfolio of financial services, including asset management, wealth management, and banking products, provides a comprehensive suite of solutions to meet various client needs. This diversification helps mitigate risks associated with market volatility and enables cross-selling opportunities. The fee-based revenue model, particularly in the Advice & Wealth Management segment, offers a predictable and stable income, insulating the company from market fluctuations.

Weaknesses

Regulatory Compliance and Legal Risks: Ameriprise Financial Inc (NYSE:AMP) operates in a highly regulated environment, which necessitates significant resources to ensure compliance. The company’s recent withdrawal of applications related to banking structure changes and the need to maintain “well-capitalized” and “well-managed” statuses highlight the complexity of regulatory requirements. Additionally, the company faces legal risks, as evidenced by a $50 million accrual for a regulatory matter with the SEC, underscoring the potential for financial impact from non-compliance.

Technological Advancements: In an industry that is rapidly evolving with technological innovations, Ameriprise Financial must continuously invest in its digital capabilities to remain competitive. The company’s reliance on a combination of contractual rights and intellectual property laws to protect its technology underscores the importance of maintaining a cutting-edge technological infrastructure. Failure to keep pace with technological advancements could hinder the company’s ability to attract and retain clients.

Opportunities

Global Market Expansion: Ameriprise Financial Inc (NYSE:AMP) has strategically expanded its asset management capabilities to serve clients worldwide, moving beyond its traditional markets in the U.S. and the U.K. The acquisition of BMO Financial Groups European-based asset management business and the presence in key global markets present opportunities to capture new assets and diversify revenue sources. This international expansion strategy positions the company to capitalize on emerging market growth and global investment trends.

Digital Transformation: The company’s focus on enhancing its digital infrastructure and service offerings aligns with the broader industry shift towards digitalization. By leveraging technology, Ameriprise Financial can improve client engagement, streamline operations, and develop innovative products that meet evolving client demands. The digital transformation journey offers opportunities to increase efficiency, reduce costs, and create new revenue streams.

Threats

Competitive Landscape: Ameriprise Financial Inc (NYSE:AMP) faces intense competition from both traditional financial institutions and emerging fintech companies. Competitors with more aggressive pricing, superior technology, or specialized investment strategies could erode the company’s market share. The competitive pressure to maintain investment performance, product offerings, and fee structures requires continuous innovation and investment to stay ahead.

Regulatory Changes: The financial industry is subject to frequent regulatory changes, which can impact business operations and profitability. Ameriprise Financial must navigate an evolving regulatory landscape, including the implementation of new capital requirements and compliance with privacy and anti-money laundering laws. These changes could impose additional costs, limit business activities, and necessitate strategic adjustments to maintain compliance.

In conclusion, Ameriprise Financial Inc (NYSE:AMP) exhibits a strong foundation with its extensive advisor network and diversified financial services. However, it must navigate the complexities of regulatory compliance and technological advancements to maintain its competitive edge. The company’s opportunities for global expansion and digital transformation are promising, but it must remain vigilant against the threats posed by a competitive market and regulatory shifts. Overall, Ameriprise Financial is well-positioned to leverage its strengths and opportunities while addressing its weaknesses and threats to sustain long-term growth and profitability.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.