-

Comprehensive SWOT analysis based on FNF’s latest SEC 10-K filing.

-

Insight into FNF’s competitive advantages, market opportunities, and potential challenges.

-

Strategic evaluation of FNF’s financial health and operational strategies.

-

Forward-looking perspective on FNF’s plans to leverage its strengths and address industry threats.

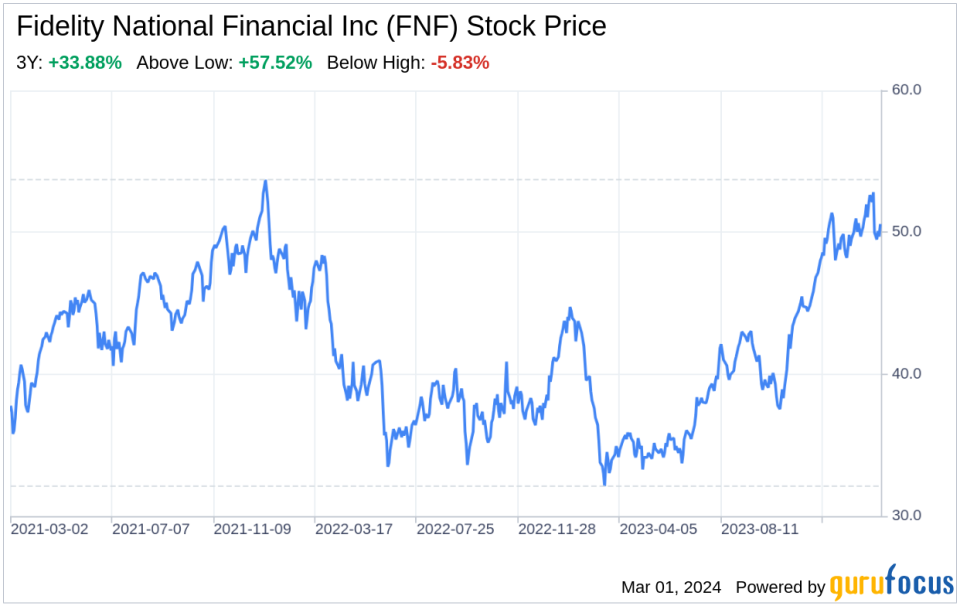

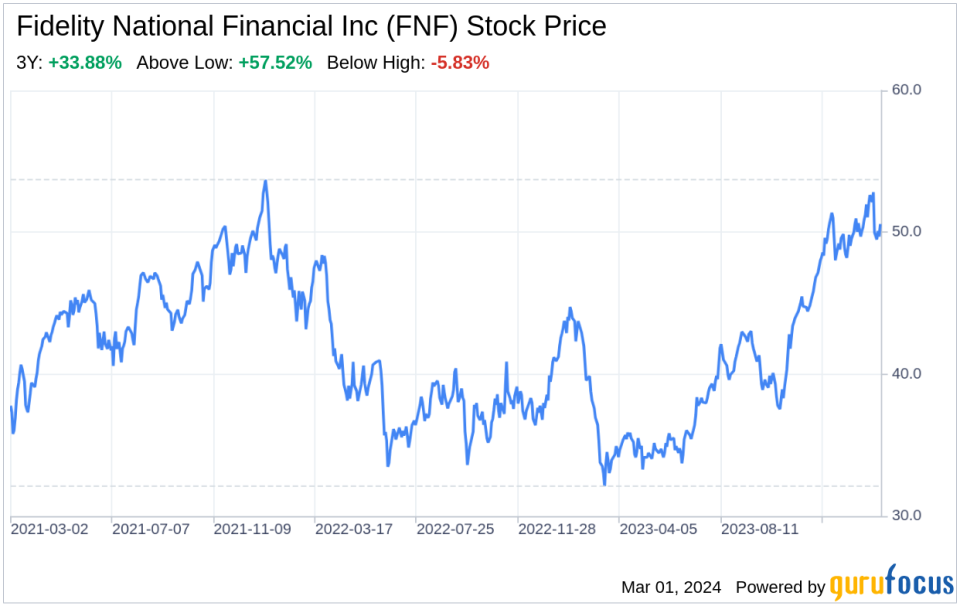

On February 29, 2024, Fidelity National Financial Inc (NYSE:FNF) filed its 10-K with the SEC, offering a detailed view of its operational and financial performance. As a leading provider of title insurance, escrow, and other title-related services, FNF operates through its Title, F&G, and Corporate and Other segments, with the Title segment being the primary revenue generator. The company’s extensive network, including over 5,200 agents, and strong brand recognition across multiple title brands, positions it favorably in the U.S. market. The financial tables from the filing reveal a robust financial position, with competitive operating margins and a disciplined focus on cost management contributing to its industry-leading status. This SWOT analysis aims to dissect FNF’s strategic and financial nuances to provide investors with a comprehensive understanding of its potential.

Strengths

Brand Recognition and Market Presence: FNF’s multiple title brands, including FNTIC, Chicago Title, and Commonwealth Land Title, have cultivated strong brand recognition, allowing the company to access a broader client base. This multi-brand strategy has enabled FNF to attract customers loyal to specific brands, enhancing its market presence and competitive edge. The company’s Title segment, with its extensive network of agents, is among the largest in the United States, providing a solid foundation for sustained growth and market share expansion.

Operational Efficiency and Profitability: FNF has demonstrated industry-leading margins and a disciplined operating focus, which have been instrumental in maintaining competitive operating margins. The company’s efficient structure allows for lower overhead costs compared to industry competitors, translating into higher profitability. FNF’s management team has a proven track record of successful acquisitions and navigating business cycles, further solidifying the company’s financial strength.

Weaknesses

Regulatory Risks and Geographic Concentration: FNF’s significant reliance on California and Texas for title insurance premiums exposes the company to regulatory risks and economic downturns specific to these states. Approximately 13.0% and 14.3% of FNF’s title insurance premiums come from California and Texas, respectively. Adverse regulatory developments or economic challenges in these states could materially impact FNF’s operations and financial results.

Competitive Industry Landscape: The title insurance and financial services industries are highly competitive, with many players possessing greater financial resources and broader product ranges. FNF faces the challenge of maintaining its market position and profitability amidst intense competition, which could lead to lower sales or higher lapses of existing products.

Opportunities

Technological Advancements and Product Innovation: FNF is committed to improving its products and technology to meet evolving industry standards. The company’s focus on deploying new information system technologies and enhancing the real estate transaction process presents opportunities for growth and efficiency gains. By anticipating industry changes and offering innovative solutions, FNF can strengthen its competitive position and attract new customers.

Strategic Acquisitions and Market Expansion: FNF has a history of strategic acquisitions that have contributed to its growth and service offerings expansion. The company’s approach to acquiring quality companies with strong management teams and growth opportunities can drive value for shareholders and enable FNF to enter new markets or enhance its current offerings.

Threats

Cybersecurity Risks: As a company highly dependent on information technology, FNF faces significant cybersecurity risks. Despite comprehensive risk management strategies, the threat of data breaches and cyber-attacks remains a constant concern that could lead to operational disruptions, financial losses, and reputational damage.

Economic and Market Volatility: FNF operates in a cyclical industry, with its Title segment particularly susceptible to fluctuations in the real estate market. Economic downturns, interest rate changes, and other macroeconomic factors can adversely affect the demand for title insurance and related services, posing a threat to FNF’s revenue and profitability.

In conclusion, Fidelity National Financial Inc (NYSE:FNF) exhibits a strong market position with a diverse brand portfolio and operational efficiency that drive its profitability. However, regulatory risks, competitive pressures, cybersecurity threats, and economic volatility present ongoing challenges. FNF’s strategic focus on technological innovation, product development, and market expansion through acquisitions positions the company to capitalize on opportunities and mitigate threats. By leveraging its strengths and addressing its weaknesses, FNF is poised to navigate the dynamic landscape of the title insurance and financial services industries.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.