Decentralized finance (DeFi) lending protocols have seen exponential growth in 2025, as their total value locked (TVL) surged by more than 70%, according to research conducted by Binance. One key player leading this change is Maple Finance, a crypto asset management firm bringing decades of traditional finance (TradFi) experience on-chain.

The company recently surpassed BlackRock’s BUIDL as the largest asset manager on-chain with $2.9 billion in assets under management (AUM). The milestone came as Maple’s TVL surged by more than 650% since the start of the year, currently exceeding $2.2 billion.

In an interview with Techopedia, Sidney Powell, the co-founder and CEO of Maple, talks about the firm’s remarkable comeback and how the collapse of FTX in late 2022 affected Maple, where institutional DeFi lending is headed, and the growth of the yield-bearing syrupUSDC stablecoin.

Key Takeaways

- Maple Finance surpassed $2.9 billion in assets under management (AUM), overtaking BlackRock’s BUIDL as the largest asset manager on-chain.

- After the FTX scandal in late 2022 caused a 97% drop in deposits, Maple Finance had to adapt by transitioning to over-collateralized lending and self-underwriting.

- SyrupUSDC, Maple’s yield-bearing stablecoin, has surpassed $1 billion in market capitalization and is now the largest yield-bearing dollar-backed stablecoin on Solana.

- Maple Finance continues to focus on institutional clients, providing large-scale loans with a focus on security and predictability.

- Sid Powell remains optimistic about the future of DeFi lending, citing the growth of tokenized assets, stablecoins, and private credit as key factors driving continued expansion in the space.

Table of Contents

Table of Contents

One of the earliest adapters of crypto lending, Maple Finance was founded at a time when the crypto industry was still heavily shaped by scepticism and speculation. Coming from a background in TradFi, the company co-founders’ ideas seemed ahead of their time in 2019 and 2021 when Maple was founded and later launched.

Powell explained that the company faced challenges in launching its initial business model, which centered around tokenizing bonds, and uncertainty remained high regarding whether people were allowed to take out loans on-chain and whether they would be treated as securities or not.

Speaking of the company’s early days, Powell said:

“At the time, it was very much not clear that this was going to take off as a sector, and we went through a bit of an idea maze. The biggest moment where we had to really think about how we wanted to shape the business model, and circumstances were very bleak, was post-FTX.”

Perhaps, Maple’s biggest challenge was not the delayed adoption of DeFi by institutional investors, but the FTX collapse in November 2022, which triggered a 97% drop in deposits for Maple after one of its borrowers, Orthogonal Finance, defaulted.

In response, Maple shifted to over-collateralized lending, adopted self-underwriting, and expanded its collateral options to include Bitcoin (BTC) and Ethereum (ETH). This pivot, coupled with a focus on institutional investors, helped the company rebuild confidence, and by 2024, it surpassed $1 million in monthly revenue.

Lending Has a Place on Blockchain

Powell shared that following the collapse of FTX, several “very influential people within the space” had told him that credit did not belong on blockchain. However, the co-founder added that Maple as a team was contrary to this belief and “ultimately correct.”

He said:

“Credit lending is the oldest product in finance. What are the odds that it’s not going to be around in this new paradigm, which is blockchain?”

As the market slowly thawed in early 2024, Powell saw a return to the table by many institutions that had initially written off DeFi credit.

To protect against volatility, particularly in collateral like BTC, the company set up buffer loans that required borrowers to over-collateralize their positions. For example, a $10 million loan would typically require $15 million in Bitcoin. Powell explained that if the value of Bitcoin drops, the platform triggers a “top-up” request to maintain the original collateral ratio.

However, as BTC’s market cap and institutional adoption through exchange-traded funds (ETFs) continue to grow, the token’s volatility has tempered.

“You don’t have a [BTC price] move of 15% in a day anymore, and so the positions have become even better protected,” Powell explained.

SyrupUSDC Continues Reaching Milestones

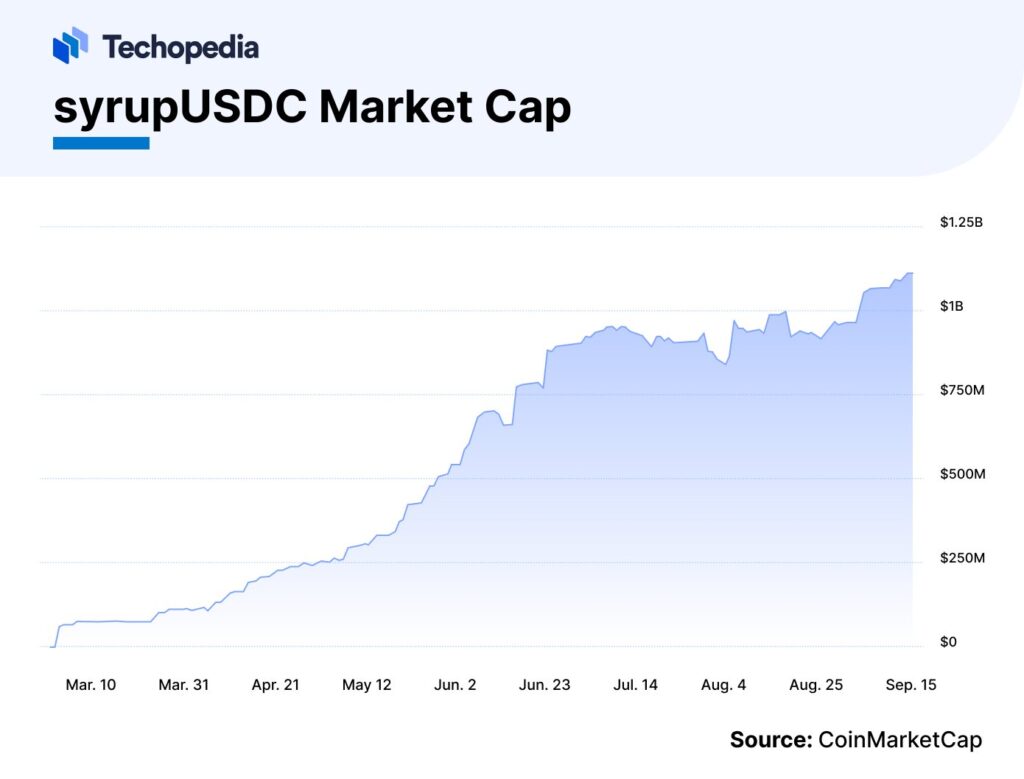

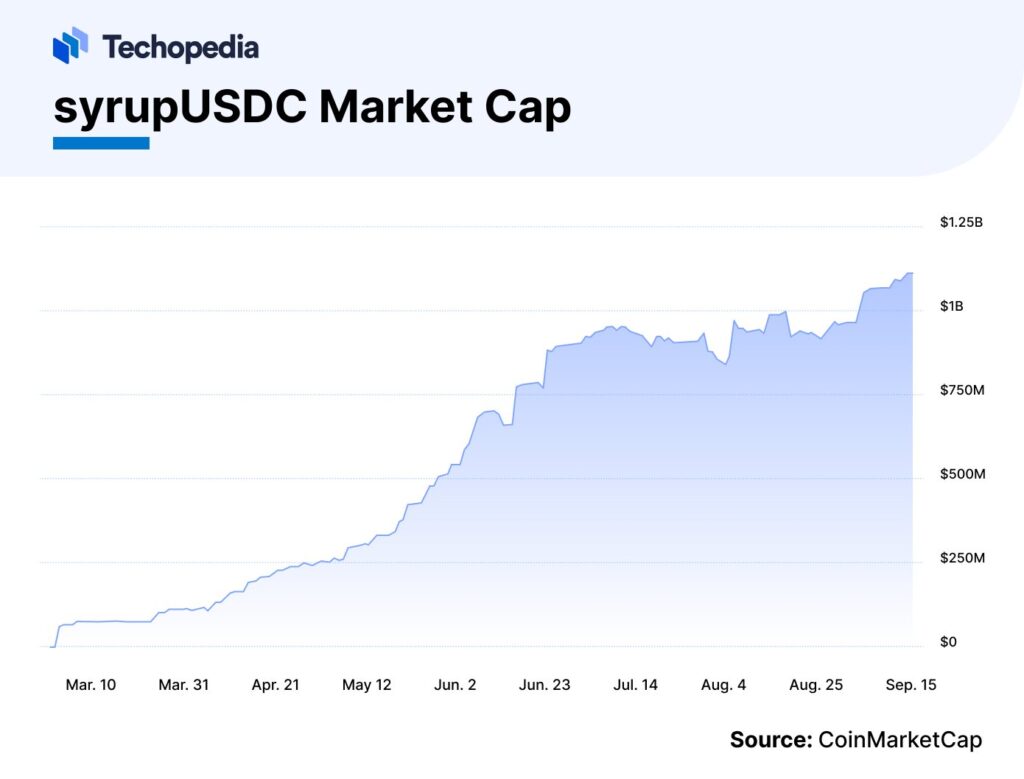

At the start of September, syrupUSDC, a yield-bearing stablecoin on the Syrup protocol, a platform by Maple Finance, surpassed $1 billion in market capitalization, up by more than 90% since the start of the summer.

In addition to the market cap milestone, syrupUSDC also became the largest yield-bearing dollar-backed stablecoin on Solana, with over $200 million in supply, and surpassed $100 million in deposits on Jupiter Exchange.

Unlike traditional stablecoins designed for payments, Syrup was created as a yield-focused product, built on top of stablecoins like USDC and USDT. According to Powell, the idea behind syrupUSDC was to combine the composability and flexibility of DeFi with a product that could integrate seamlessly with other protocols, enabling more institutional investors to tap into the power of DeFi’s liquidity pools.

Powell told Techopedia:

“Ultimately, it was a bit of a risky move at the time, because this was the midst of the regulatory breakdown from the prior administration in 2024, which is why we needed to have that separate branding of being syrup and not Maple. But since then, I think it’s panned out… and now syrupUSD is 90% of our brand.”

Institutional Focus & Innovation

In a space dominated by fluctuating interest, Maple has strategically carved out a niche by focusing on institutional lending.

Powell explained that although the team had considered extending their services to retail clients, the operational challenges and regulatory complexities made it a difficult shift.

Instead, Maple has doubled down on institutional players, handling large-scale loans with a focus on securing more predictable, long-term business.

However, even with a focus on institutions, Maple has partnered with retail lenders.

“We have found a way to partner with retail lenders … so, we provide them with wholesale finance, and then they manage their customer relationships,” Powell said.

The Bottom Line

Looking back to 2020, Powell admitted that he was confident the DeFi industry would “hit the S curve” in terms of growth, especially leading up to DeFi Summer in 2021. Seeing how things have panned out now, it may be challenging to guess what the future brings.

Still, Powell remains positive:

“I think DeFi lending will continue to grow because the natural tailwinds are more tokenization of assets, growth of private credit, where people actually expect more lending to be done away from banks, as we are seeing in traditional finance. Stablecoins will continue to grow.”

As institutions increasingly embrace DeFi, platforms like Maple could be well-positioned to capitalize on this long-term shift.

FAQs

Maple Finance has become the largest on-chain asset manager, surpassing BlackRock’s BUIDL, by focusing on institutional lending and secure, over-collateralized loans.

SyrupUSDC is Maple Finance’s yield-bearing stablecoin, designed for DeFi liquidity pools. It recently surpassed $1 billion in market cap and leads on Solana.

After a 97% drop in deposits, Maple shifted to over-collateralized lending, self-underwriting, and new collateral types like Bitcoin and Ethereum to rebuild trust.