Estimated reading time: 8 minutes

Factoring is often underappreciated.

Yet, while it may not receive all the attention other trade finance products do, it is equally important.

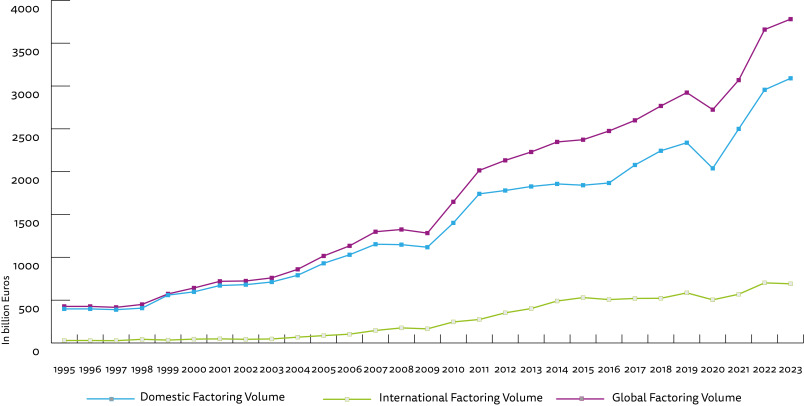

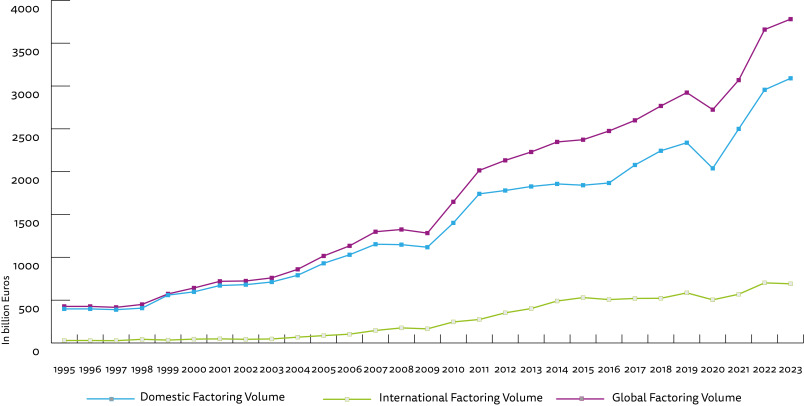

According to FCI’s report released on 21 May 2024, the world factoring industry demonstrated robust resilience and growth in 2023, with a notable 3.6% increase in volume compared to 2022, bringing the total to €3,791 billion.

This follows two consecutive years of double-digit growth, marking a return to pre-pandemic stability.

Over the past two decades, factoring has shown remarkable strength, with a compounded annual growth rate of 8.3%.

This highlights its critical role in supporting SMEs and corporates by providing liquidity, protecting against customer bankruptcies, and offering global collection support.

While Europe remains the largest contributor, accounting for approximately 68% of the global volume, emerging markets in regions like Asia-Pacific, the Americas, and Africa are showing significant growth, presenting vast opportunities for expansion.

Figure 1: Evolution of Global Factoring Volume (in Euro billions). Source: FCI

To learn more about the factoring market, including important growth regions, and Islamic finance, Trade Finance Global (TFG) spoke with Federico Avellán Borgmeyer, Chief Partner Officer at efcom, Abdelrahman Elbeltagy, Islamic Factoring specialist at efcom, and Vikram Nair, CEO of Xilligence.

Factoring’s countercyclical importance for trade finance

Factoring involves selling receivables at a discount to a third party, providing immediate cash flow to businesses.

This financial tool is essential for many small and medium enterprises (SMEs) that might otherwise struggle to secure traditional bank loans.

Factoring also tends to grow countercyclically.

Avellán Borgmeyer said, “Factoring or residual finance has always grown well when the markets are uncertain, and we have a lot of this right now.”

During economic downturns, businesses often face extended payment terms from their buyers, increasing the need for immediate cash flow solutions.

Factoring ensures companies can continue to operate smoothly even when the broader economic environment is unstable, making it indispensable for SMEs in emerging economies.

Strategic focus on emerging markets, and the value of partnership

While Europe remains a dominant player in the global factoring market, contributing to approximately 70% of the total volume, the focus is gradually shifting towards emerging markets.

German-based company efcom, operating in emerging markets worldwide, is uniquely positioned to observe these changes.

Importantly, implementing factoring strategies into new markets like India or MENA requires engaging with partners.

Vikram Nair, CEO of Exilligence, said, “The reason why we partnered with efcom was because [they are] a clear industry leader in the factoring space with their software and solutions. Given our presence and experience in India and in the Middle East, GCC countries, we thought that there would be a seamless fit.”

Avellán Borgmeyer added, “When we look into markets like the Indian market, for instance, a huge and dynamic market, we don’t say that efcom is going to do it alone, we look for partners like Xilligence, and we try to grow the market together.”

This strategic pivot, using partners to help enter emerging markets, is driven by the maturity of European markets, where factoring penetration has reached significant levels.

For instance, Germany has achieved a factoring volume of 10% of its GDP. In contrast, many emerging markets still exhibit low penetration rates, presenting vast growth opportunities.

The ifX product, by efcom, is designed to address the growing demand for Shariah-compliant services.

With its workflow and risk management capabilities, the cloud-based solution offers high security, modularity, and scalability.

Aligned with international Islamic accounting standards, ifX ensures compliance while providing a high level of automation and real-time interactivity.

Avellán Borgmeyer said, “If you take any country outside Europe, like India, African nations, or the Gulf region, they all move in a very low single-digit range. We believe that within the next 10 years, all these economies will see a steep rise in development.”

Currently, the African continent only accounts for 1.2% of global volume, and the Middle East accounts for just 0.3% of the market.

The attraction to these regions is not just about untapped potential; it is also about the intrinsic characteristics of factoring that align well with the needs of emerging markets.

Factoring provides immediate working capital, crucial for businesses in developing economies where access to traditional finance is often limited.

Moreover, the emphasis on risk-sharing and the ethical considerations embedded in certain types of factoring, such as Islamic factoring, resonates well with these regions’ cultural and economic contexts.

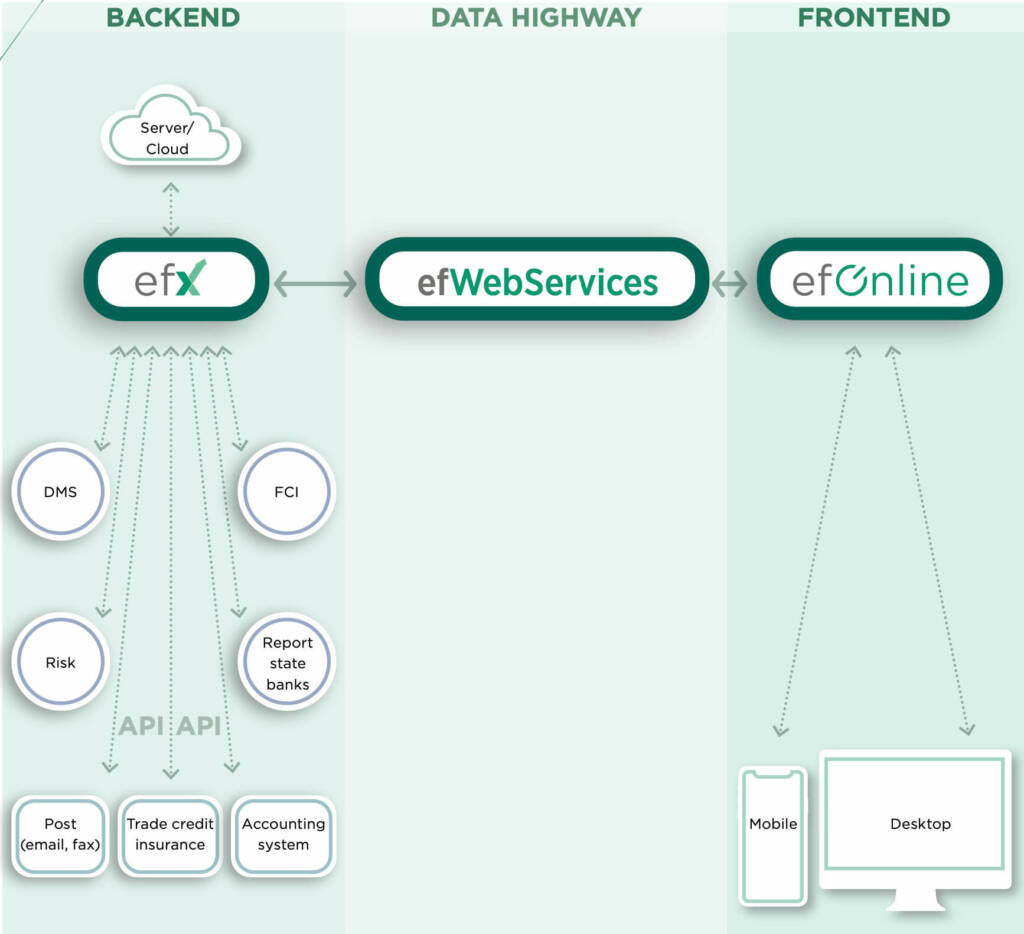

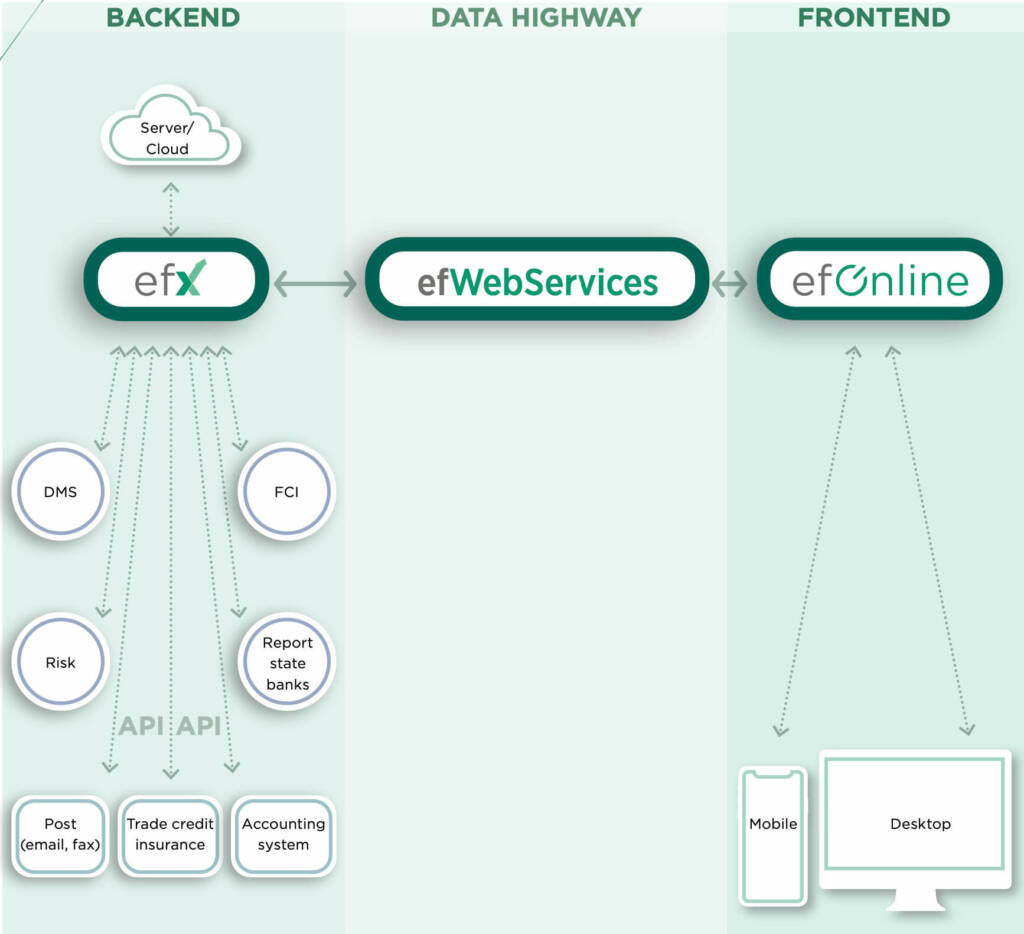

The online platform, efcom’s efOnline, enhances the interaction between factors and clients.

This web-based application provides a real-time dashboard, live data reports, and comprehensive debtor and invoice overviews.

Clients can request limits, report direct payments, and manage outpayments autonomously, reducing the workload on factoring staff and increasing operational efficiency.

Adoption and development of Islamic factoring

Islamic finance, governed by Sharia law, prohibits the charging of interest and emphasises risk-sharing, asset-backed transactions, and ethical investments.

These principles form the foundation of Islamic factoring, a niche yet rapidly growing segment within the broader trade finance industry.

ifX exemplifies these principles by offering a Shariah-compliant factoring solution.

ifX covers the Wakalah Bi-Al Istithmar contract and is designed for seamless integration through numerous standard APIs.

The product’s cloud-based nature ensures accessibility from anywhere, enhancing its appeal to financial institutions in the MEA and APAC regions.

What is Shariah finance?

Shariah finance, governed by Islamic law, is a financial system that adheres to principles promoting ethical, interest-free, and risk-sharing transactions.

Unlike conventional finance, Shariah finance prohibits the charging or paying of interest (riba) and emphasises asset-backed financing, profit-and-loss sharing, and investments in socially responsible and economically productive activities.

In Shariah finance, transactions must involve tangible assets or services, ensuring that financial activities are rooted in real economic value.

This system also prohibits speculative behaviour and investments in industries considered harmful or unethical, such as gambling, alcohol, and tobacco.

Key principles of Shariah finance include:

- Risk-sharing: Both parties in a financial transaction share the risks and rewards, fostering a fair distribution of profits and losses.

- Asset-backing: Transactions must be backed by physical assets or services, promoting stability and security in financial dealings.

- Ethical investments: Investments must align with ethical and socially responsible values, avoiding activities deemed harmful to society.

By adhering to these principles, Shariah finance aims to create a more equitable and stable financial system that supports sustainable economic growth and social welfare. This approach is particularly relevant in the context of factoring, as it provides a compliant, ethical alternative for businesses in Muslim-majority regions and beyond.

Elbeltagy said, “If you look at Islamic finance, you find that it’s a more ethical way of financing that aims for more productive financial activities as it focuses on real economic activities that cause economic growth.”

Given its asset-backed nature, factoring is particularly well suited for adaptation to comply with Sharia law.

This adaptation involves structuring transactions to ensure they do not involve interest and adhere to risk-sharing and asset-backing requirements.

The potential for Islamic factoring is significant, given the economic growth and increasing sophistication of financial markets in the Gulf Cooperation Council (GCC) and other Muslim-majority regions like the Middle East and North Africa (MENA) region.

Avellán Borgmeyer said, “Today, most of the finance done in Islamic countries is still in the Western style, but there is a growing tendency towards Islamic finance. In that respect, there is a big opportunity to provide a product that is appealing to the region.”

Implementing Islamic factoring involves adapting existing technologies and workflows to meet Sharia requirements.

This process includes developing new software solutions or modifying existing ones to accommodate the unique aspects of Islamic finance.

The goal is to create flexible, scalable, and compliant products tailored to the specific needs of different clients and markets.

By offering Sharia-compliant options, financial institutions tap into a growing market and contribute to the overall development and stability of the financial system in these regions.

With over 20 years of experience and a network spanning MEA and APAC, efcom has established itself as a market leader in Islamic factoring.

Its ifX product has successfully processed over 100 million invoices for more than 15,000 clients annually, moving a factoring volume in excess of $200 billion.

The increasing recognition of factoring’s importance in trade finance, the strategic focus on emerging markets, and the development of Islamic factoring all point to a dynamic and evolving landscape.

As businesses worldwide navigate economic uncertainties, factoring will play an increasingly vital role in ensuring financial stability and fostering international trade.