Millions of UK drivers could be entitled to compensation following the investigation.

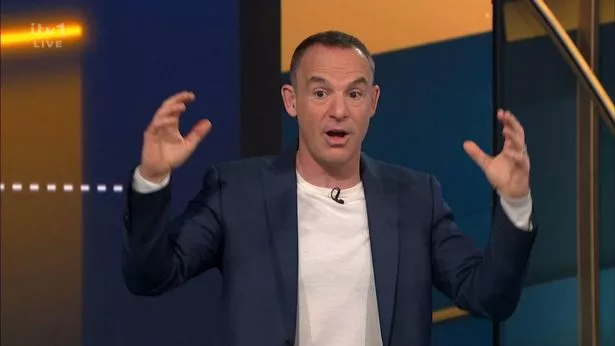

Following Martin Lewis’ car finance scandal update, drivers have been left wondering if they will be amongst the millions entitled to refunds.

The Financial Conduct Authority (FCA) announced on Tuesday, March 11, that they have now settled on a ‘redress scheme’ following their investigation into mis-sold car finance. The FCA believes that some customers ‘may have been charged too much’ on car finance loans before January 2021.

According to Martin Lewis, there are currently two main types of car finance mis-selling being looked atDiscretionary Commission Arrangements (DCAs)

This is about 40% of car finance deals, and applies where brokers and dealers could increase the amount of interest they charged customers (without telling them) on PCP and Hire Purchase agreements up to 2021 in order to increase their commission. This hidden commission was obviously problematic.

The finance guru said: “This is the one I have been talking about and suggesting people complain about. If you’re one of the 2 million who has put complaints in through my site, then it is very likely it was a DCA complaint.”

Commission Disclosure complaints

These are based on the Court of Appeal surprise ruling that if car finance agreements didn’t tell consumers all details of commission, including the amount (they rarely did), they were unlawful. It applies to up to 99% of car finance cases (including DCA cases).

The amount of redress paid out will depend of the Supreme Court ruling, however, Martin estimates it will typically be around £1,140 per arrangement.

The FCA says you may be affected by the issue if:

- You bought a car under a finance scheme (such as hire purchase or personal contract purchase) before 28 January 2021.

- There was a discretionary commission arrangement between your lender and broker.

You might not already know if your broker and lender had a discretionary commission agreement, but they should be able to tell you if you contact them.

The investigation won’t apply to you if you used car finance on or after 28 January 2021, or if you used a hire agreement such as personal contract hire.

Speaking after the FCA’s announcement Martin told motorists road users they will now not need to formally complain to their previous car finance companies to receive a payout, as it was originally believed.

He said: “The regulator @TheFCA has just put out a statement saying it will consult on “an industry-wide redress scheme“. Now, ‘consult’ is mostly technical, this really means it’s made up its mind. I’ve bashed out at top speed an explanation.

“It plans a Section 404 redress scheme that will require lenders to proactively contact all borrowers who met the mis-selling criteria, and offer them a fixed redress based on FCA rules.

The latest FCA statement reads: “Under a redress scheme, firms would be responsible for determining whether customers have lost out due to the firm’s failings.

“If they have, firms would need to offer appropriate compensation. We would set rules firms must follow and put checks in place to make sure they do.

“A redress scheme would be simpler for consumers than bringing a complaint.”