Government wrangling over spending could shutter the Internal Revenue Service (IRS) just weeks before April 15, making a harried tax season even more more chaotic than usual.

If gridlock reigns on Capitol Hill, Americans trying to phone the IRS may have trouble getting through and families owed a refund may have to wait longer for the checks to arrive.

The uncertainty comes after lawmakers reached a deal last week that avoided a partial government shutdown on March 2 but pushed the deadline for some of the thorniest parts of the current funding fight to March 22 — just 24 days before tax returns are due.

The leaders did agree on how to fund less contentious parts of the government, and votes there are likely to begin Wednesday. But even if that plan is passed, the most challenging issues will still be looming at the end of the month.

Those include funding for the IRS as well as the Pentagon, the Department of Homeland Security, and even the White House itself.

This setup could put the government’s tax collector into uncharted territory, having never before had to grapple with a shuttered government during the height of tax season.

“There’s some uncertainty there,” said IRS commissioner Daniel Werfel, who told reporters earlier this year that he could preserve some functions if this were to happen.

Larry Pon, a former IRS employee and is currently a CPA based in San Francisco Bay, told Yahoo Finance that it’s likely IRS computers will be able to still accept electronically filed tax returns.

“However, refunds may be slower,” he said. “Let’s hope this does not happen!” he added.

A high probability of at least some disruptions

This is a problem the IRS normally does not have to worry about. Government shutdowns almost always occur in the fall and early winter around the opening of the government’s fiscal year on Oct. 1.

The 2018-2019 shutdown was the longest in history and led to disruptions as that year’s tax season was just getting underway. IRS offices around the country were closed, phones went unanswered, and refund checks were delayed before the government reopened on Jan. 25.

The government has never been closed in February, March, or April.

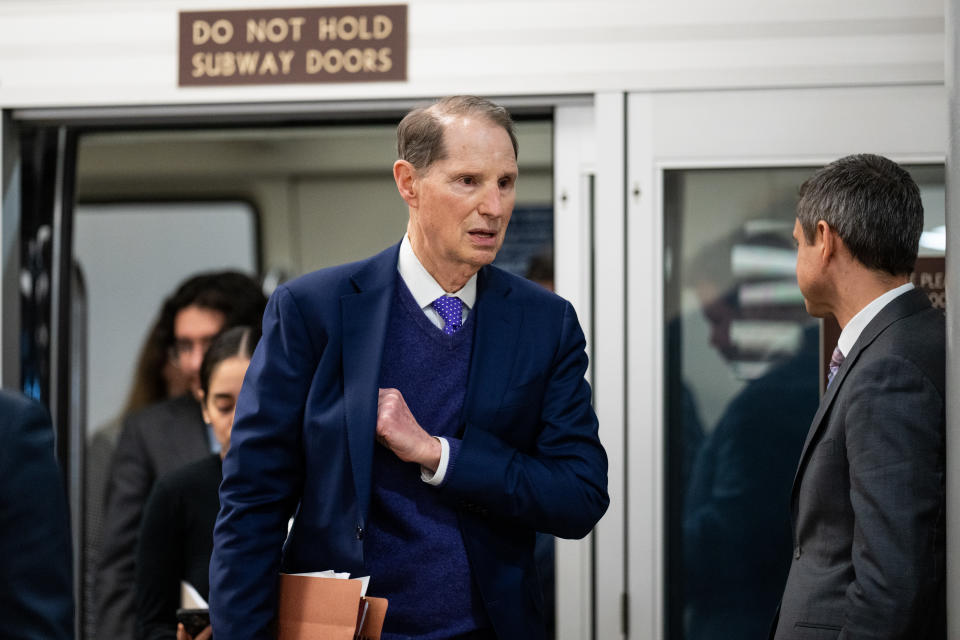

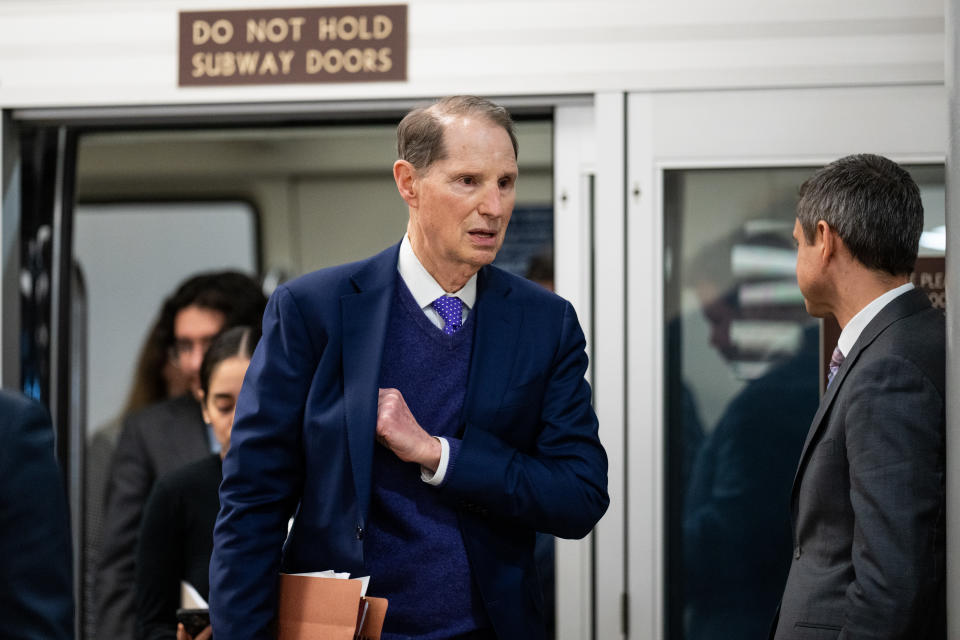

One lawmaker concerned about timely returns during this tax season is Senator Ron Wyden (D.-Ore.), the Senate Finance Committee chair who helps oversee the agency on Capitol Hill.

He says the agency should look at any option to get checks out on time.

“Part of the reason that we’ve been financially building up the IRS is to prevent those kinds of things,” he said as he headed between meetings on Capitol Hill last week.

Prior shutdowns temporarily trimmed the number of personnels answering phones and processing manual returns, a disruptive change for taxpayers if enacted during filing season.

The 144-page IRS contingency plan offers the most recent guide for how the service will respond to a stoppage. But it paints an incomplete picture as it was drafted last September and focused on plans during the non-filing season.

The plan foresees the possibilities of massive furloughs — approximately two-thirds of the workforce — but includes flexibility, noting that “additional positions” could be exempted and stay on the job during filing season.

Haris Talwar, a spokesperson for the Treasury Department which oversees the IRS, touted the agency’s record during the filing season so far and added in a statement that the Biden administration “is committed to minimizing disruptions to taxpayers and ensuring world class service continues throughout filing season.”

The IRS regularly updates its plans and is all but certain to issue revised guidance in the weeks ahead if shutdown odds increase. The current contingency plan, for example, was released on Sept. 28, 2023, only a couple days before the-then shutdown deadline of Oct. 1.

Previous contingency plans — notably one for fiscal year 2023 — offered a much different outlook and suggested that billions from the 2022 Inflation Reduction Act could help keep most of the agency’s 83,000 employees on the job and that, by and large, “normal IRS operations will continue.”

Wyden helped author that 2022 law, which sent billions to the agency outside of the normal appropriations process to improve its enforcement capabilities, customer service, and overall operations. Of that money, Wyden says “obviously it will have some effect.”

A second headache

And it’s not just the shutdown that could complicate the current tax season.

Tax preparers have a second headache to consider with a bipartisan tax deal that would impact some current returns. It has passed the House of Representatives but is currently stalled in the Senate.

The Tax Relief for American Families and Workers Act of 2024 includes a trio of business deductions that could impact 33 million small businesses and an expansion of the child tax credit, which is claimed by nearly 46 million Americans annually. Most of the bill’s provisions would apply retroactively to 2023 federal returns as well as 2024 and 2025 returns.

Wyden is the co-author of the pact with Rep. Jason Smith, a Missouri Republican, but their effort has run into hurdles among the Senate GOP.

Sen. Mike Crapo (R-Id.) is Wyden’s Finance Committee counterpart and he announced this week he’s voting no unless the bill goes through a series of changes.

The bottom line, Crapo says, is that the bill as-is has “no near-term path forward in the Senate.” What remains to be seen is if Democrats like Wyden and Senate Majority Chuck Schumer try and proceed anyway or accede to an amendment process that would delay the bill — and could even kill it altogether.

In a note to clients last Friday, Tobin Marcus, head of US policy and politics at Wolfe Research, noted that “the likelihood of a tax deal is gradually falling, now dipping below 50% in our view.”

He added that these twin taxpayer concerns — both a shutdown and this tax bill — may come to a head at the same time later this month with the bipartisan tax bill could be included in an overall compromise bill that would also keep the IRS funded.

The bipartisan tax bill could be included in an overall compromise bill that would also keep the IRS funded.

But it’s far from a sure bet and, for now, tax preparers and filers will just have to wait.

Rebecca Chen is a reporter for Yahoo Finance and previously worked as an investment tax certified public accountant (CPA). Ben Werschkul is a Washington correspondent for Yahoo Finance.

Click here for politics news related to business and money

Read the latest financial and business news from Yahoo Finance