-

The rapid growth of private could end up being a risk to broader market stability, the IMF says.

-

The “opaque” corner of financial markets grew to $2.1 trillion last year.

-

Infrequent valuations and unclear credit quality are risk factors in the space, the IMF said.

The rapid rise of the private credit industry could end up threatening financial stability, given how little is actually known about the sector, the International Monetary Fund wrote in a blog post on Monday.

As more and more lending to businesses moves from regulated banking institutions to less regulated firms like private credit funds, risks grow as the window into lending practices becomes opaque, the group said.

“The migration of this lending from regulated banks and more transparent public markets to the more opaque world of private credit creates potential risks,” analysts wrote on Monday, noting that the sector topped $2.1 trillion in assets and capital last year.

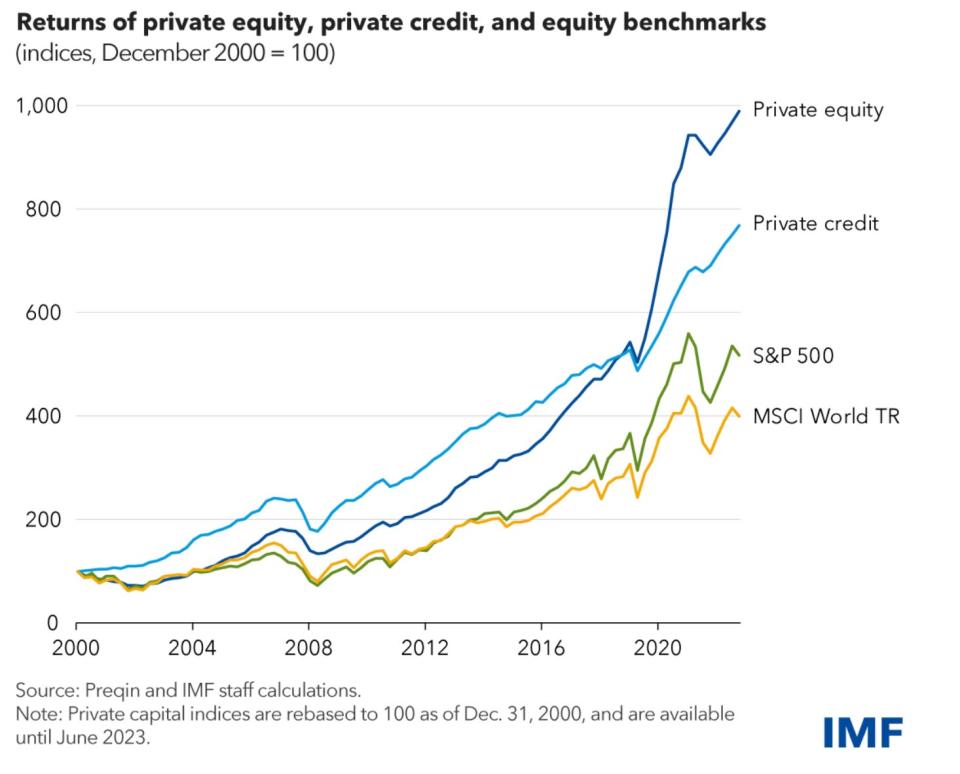

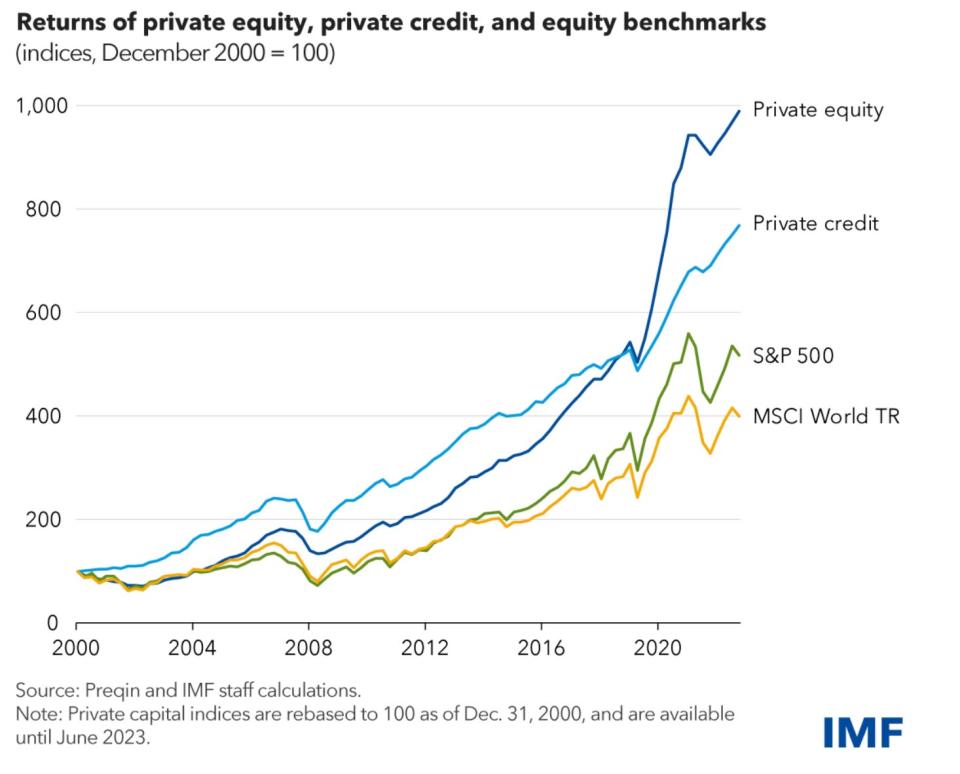

And since the start of the century its returns have boomed, increasingly outperforming the S&P 500 and MSCI World index.

This industry emerged to provide much-needed financing for firms deemed too risky for commercial lenders. Despite being illiquid, the market’s rich returns, speed, and flexibility have won over investors, the IMF wrote.

But the sector is also largely unsupervised, and there are some troubling signs as more of the loan market’s share goes to private credit.

“Valuation is infrequent, credit quality isn’t always clear or easy to assess, and it’s hard to understand how systemic risks may be building given the less than clear interconnections between private credit funds, private equity firms, commercial banks, and investors,” analysts wrote.

First, borrowers tend to be indebted firms, already relying on leveraged loans or public bonds. That means that they’re more at risk as interest rates rise, with a third of borrowers already facing interest rate costs that exceed earnings, the IMF said.

However, credit providers aren’t tightening their lending standards, as private credit increasingly comes into competition with larger banks, and since the loans trade infrequently, they can be difficult to value.

Not only could private credit standards be worse than they appear, but analysts might not fully appreciate how interconnected the sector is with the wider financial system.

For instance, banks may have more exposure to private credit than many realize, while pension funds and insurers have been acquiring more shares of these assets, the IMF said. Meanwhile, new funds are cropping up that target individual investors, spreading risk from Wall Street to Main Street.

Given these factors, private credit has the potential to amplify a recession whenever one hits, one of the blog’s authors separately said at a Brookings Institution event last week.

“I think we don’t see a financial stability risk, but … from a macro-financial standpoint, we don’t know (how) the sector, given the size, would operate under a severe prolonged recession, Fabio Natalucci said, according to the industry news service Pensions and Investments.

Read the original article on Business Insider