Overview of Jim Simons (Trades, Portfolio)’s Recent Transaction

On December 29, 2023, Renaissance Technologies, led by Jim Simons (Trades, Portfolio), reported a reduction in its holdings of Nicholas Financial Inc (NASDAQ:NICK). The transaction involved the sale of 8,025 shares at a price of $6.90 per share. Following this trade, the firm’s total shareholding in Nicholas Financial stands at 351,951 shares. Despite the reduction, the position still represents 4.83% of Simons’s portfolio.

Jim Simons (Trades, Portfolio) and Renaissance Technologies: A Brief Profile

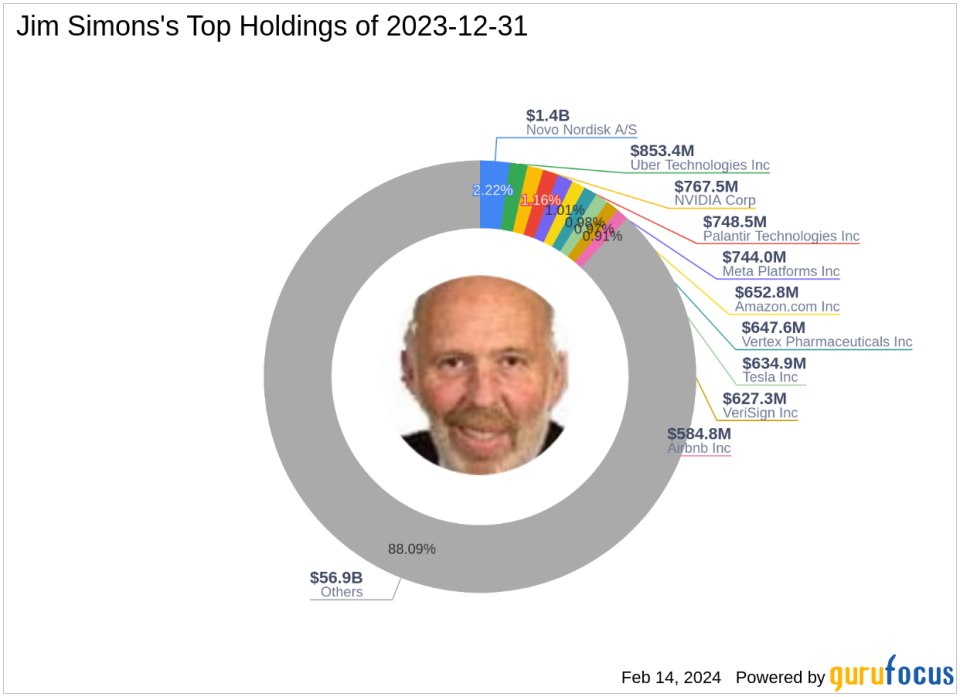

Jim Simons (Trades, Portfolio), the founder of Renaissance Technologies, has been a prominent figure in the investment world since 1982. The firm is renowned for its quantitative, data-driven approach, utilizing complex mathematical models to predict market movements. Renaissance Technologies is a pioneer in the use of high-frequency trading and has a reputation for its scientific and statistical analysis of market trends. The firm’s top holdings include Meta Platforms Inc (NASDAQ:META), NVIDIA Corp (NASDAQ:NVDA), and Novo Nordisk A/S (NYSE:NVO), with a significant focus on the technology and healthcare sectors. The firm’s equity stands at a substantial $64.61 billion.

Nicholas Financial Inc at a Glance

Nicholas Financial Inc, trading under the symbol NICK in the United States, has been a player in the specialized consumer finance market since its IPO on December 30, 1997. The company’s primary business involves the acquisition and servicing of automobile finance installment contracts for both new and used vehicles. Additionally, Nicholas Financial originates direct consumer loans and markets related financial products. The company operates as a single segment and generates the majority of its revenue from interest and fee income.

Detailed Transaction Specifics

The recent trade by Jim Simons (Trades, Portfolio) resulted in a 2.23% decrease in the firm’s holdings in Nicholas Financial Inc, with no significant impact on the overall portfolio due to the trade’s 0% trade impact. The trade price was set at $6.90, and the current total shareholding of 351,951 reflects a 4.83% position in the company.

Nicholas Financial’s Financial Snapshot

With a market capitalization of $51.099 million and a current stock price hovering around $6.9999, Nicholas Financial Inc is considered modestly overvalued according to GuruFocus’s GF Valuation. The stock’s GF Value is calculated at $6.23, and the price to GF Value ratio stands at 1.12. Notably, the company’s PE Percentage is not applicable, indicating that it is currently operating at a loss.

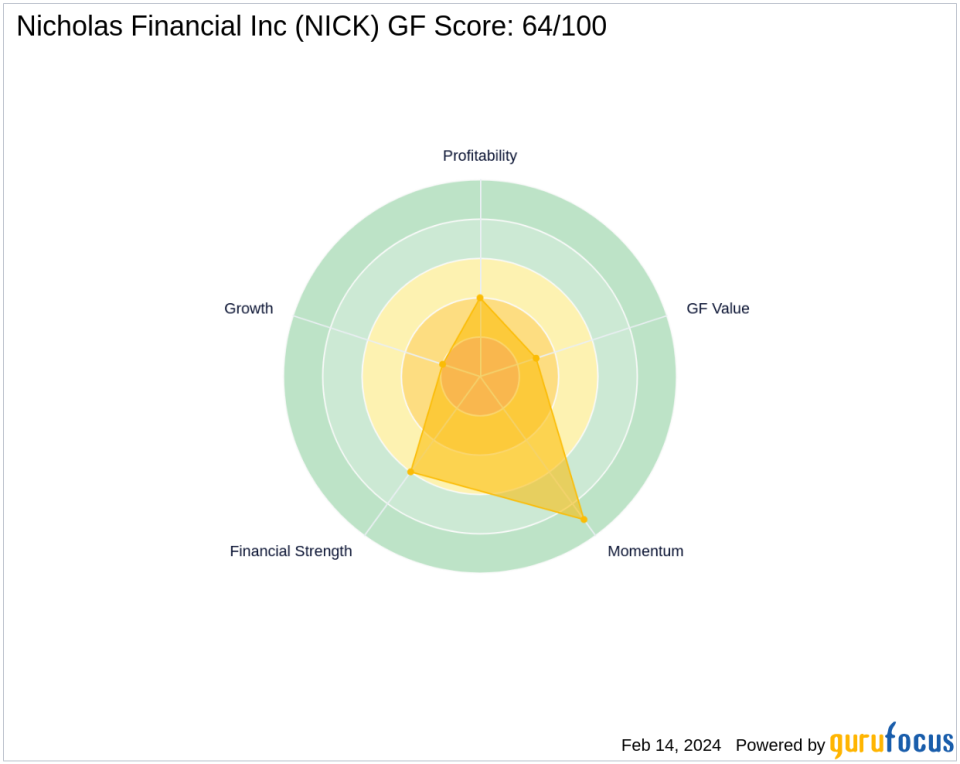

Stock Performance and Rankings

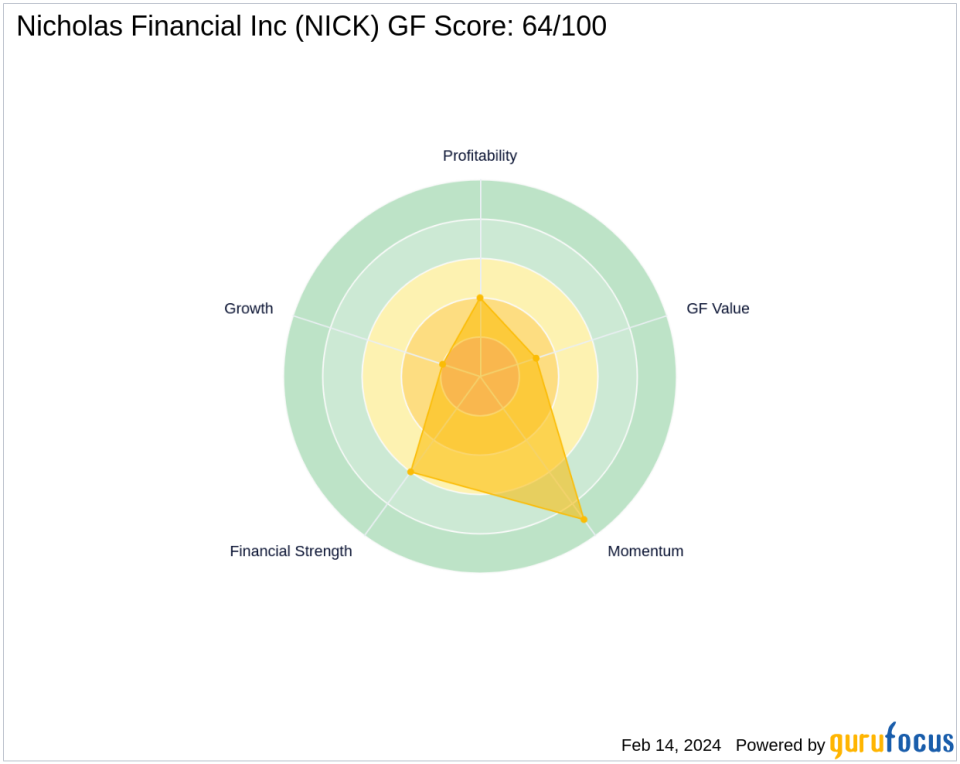

Since its IPO, Nicholas Financial’s stock has seen a price change of 284.61%. However, the year-to-date performance is not applicable. Since the transaction, the stock has gained 1.45%. The company’s GF Score is 64/100, indicating poor future performance potential. Nicholas Financial’s Financial Strength and Profitability Rank are 6/10 and 4/10, respectively, while its Growth Rank and GF Value Rank are lower at 2/10 and 3/10. The Momentum Rank is higher at 9/10.

Comparative Sector Analysis

Jim Simons (Trades, Portfolio)’s top sector holdings are primarily in technology and healthcare, which contrasts with Nicholas Financial’s industry of Credit Services. Within its sector, Nicholas Financial’s position is influenced by various factors, including its financial strength, profitability, and growth prospects.

Future Outlook and Implications

The decision by Jim Simons (Trades, Portfolio) to reduce holdings in Nicholas Financial Inc may be influenced by the company’s current financial metrics and market valuation. For value investors, this move could signal a reassessment of the stock’s potential, considering its modest overvaluation and the firm’s investment philosophy. The transaction’s influence on the stock and Simons’s portfolio appears minimal, but it underscores the importance of continuous evaluation of investment positions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.