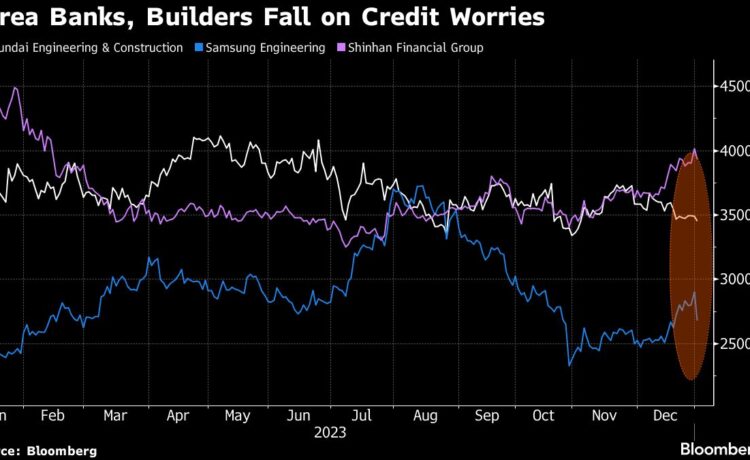

(Bloomberg) — Jitters about South Korea’s credit market extended into Tuesday, with bank and developer shares sliding and JPMorgan Chase & Co. warning of insolvency risks for financial firms and developers due to real estate exposure.

Most Read from Bloomberg

Leading the drop among lenders was Shinhan Financial Group Co., which recorded its biggest intraday decline in a year. Shares of builders including Samsung Engineering Co. Ltd. also retreated on a day the country’s stock benchmark hit a 19-month high.

The bonds of Shinsegae Engineering & Construction Co. dropped by the most since October, according to Bloomberg-compiled data.

Investors are on edge after builder Taeyoung Engineering & Construction last week announced plans to reschedule its debt, reigniting concerns about a 2022 credit crunch triggered by the default of a property developer on debt for project financing. Bank of Korea Governor Rhee Chang-yong warned in a New Year’s speech of the risk of financial instability due to the central bank’s restrictive monetary policy.

“Given a prolonged high rate interest environment, we expect that some mid-to-small sized non-bank lenders and/or developers are likely to go insolvent,” JPMorgan analyst Jihyun Cho wrote in a note. “Asset quality issue remains the key agenda item for the financial industry as non-bank lenders may face more challenging situations.”

Taeyoung’s trouble is the result of a slump in South Korea’s real estate market coupled with high interest rates and some lenders’ over-reliance on property-related loans as a source of profit. Although Taeyoung was particularly exposed to the project financing sector, according to officials, it’s a toxic mix that may cause trouble for others in the sector as well.

Korea’s financial industry has 577 billion won ($442 million) of direct exposure to Taeyoung E&C’s loans, according to Korea Investors Service, in addition to the developer’s 280 billion won of outstanding bonds. That suggests it is not likely to cause significant pressure on financial institutions, the ratings agency said.

With the memory of the 2022 crisis triggered by the default of an amusement park developer on its project financing debt still alive, Korean authorities have pledged to step up support to stabilize markets, if needed.

They are considering expanding the size of a bond market stabilization fund size to 30 trillion won from the current 20 trillion won, Maeil Business Newspaper reported. Korea’s Financial Services Commission declined to comment on the newspaper’s report.

Having lost roughly a third of their value in December, Taeyoung E&C’s shares jumped as much as 20% in Seoul on Tuesday. The price of its July 2024 bond recorded its biggest single-day rise since at least June 2023, according to Bloomberg-compiled data. Even so, the note was indicated at 64% of par, a level typically considered distressed.

Shinsegae’s bond was indicated at 101% of par.

–With assistance from Shinhye Kang, Nicholas Reynolds, Ishika Mookerjee and Jeanny Yu.

(Updates with reference to overall market in second, prices in tenth paragraphs)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.