elxeneize

This article analyzes Lument Finance Trust’s (NYSE:LFT) 2Q24 results and earnings call. It also revisits the company’s valuation and the rating (coming from two Holds in February 2024 and March 2023).

Lument’s 2Q24 results were not surprising, with the loan book shrinking sequentially (as the 2021 CLO finished its reinvestment period) and some loans entering non-accrual status (a situation that is worrying but not critical given the company has managed through distressed loans before).

Lument today offers an attractive ~14% earnings yield, including provisions. The future yield depends on the trends in loan book size, loan book spread, and loan loss provisions. I expect annualized net interest income to decrease by $5.6 million in the next twelve months as the 2021 CLO is repaid unless LFT finds new financing in similar terms, which seems unlikely. Lower loan loss provisions could offset this, but contrary to that, I believe the provisions will increase as more loans reach maturity and cannot be extended further. With similar loan loss provisions and lower net income, the stock would yield 9% in FY25/26.

I believe the above yield, which considers negative factors (mainly the posterior write-off of the provisioned loan losses), is fair. I do not believe the stock is a Buy, though, given that future earnings power will still be determined by the terms of future financing, which are still unclear.

1H24 results

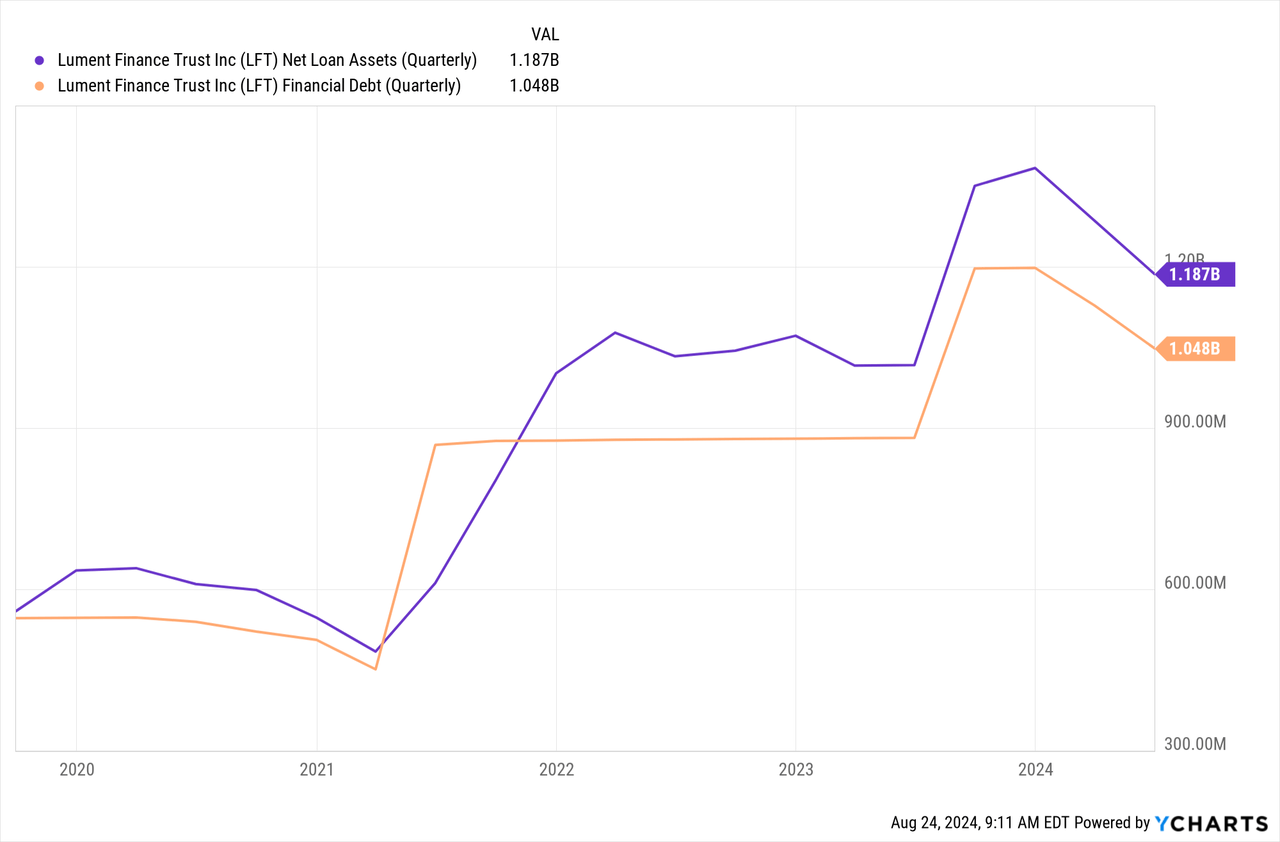

Larger book: Lument’s 1H24 results (including the 2Q24 results) were marked by an increase in the loan book size, vis a vis 1H23. This development was expected in my February article. It was caused by the company’s issuance of close to $320 million in debt and the investment of an additional $70 million in equity to purchase loans for close to $400 million from a base of about $1 billion.

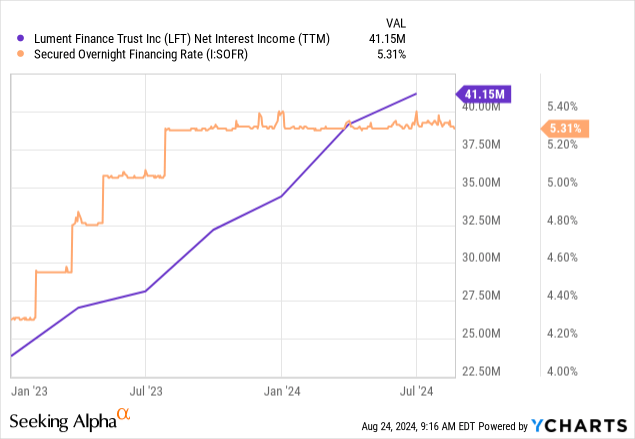

More net interest income: Although the effective spread in these additional loans was half the spread on the 2021/22 generated book (1 percentage point versus 2 percentage points), the increase still helped net interest income, which grew to $22.5 million from $11.75 million. The average SOFR in place for the period was about 1 percentage point higher in 1H24 compared to 1H23, explaining a small part of the improvement, too (as the equity-financed portion of the book benefits from higher SOFR).

Distress in the book: Most of Lument’s current book were generated before the rate hikes of 2022 (the book increase in 2023 was purchased below par). This means that the real estate developments working as collateral were generated during a period of low rates and excessive demand. This has led to episodes of distress as some of these loans mature. Lument’s book went from an average credit rating of 2.3 in 2Q22 (with barely any loans below a rating of 3), to a rating of 3.6 in 2Q24 (with 35% of loans below 3).

In particular, the 2Q24 period included five loans (two net new) in the defaulted category. The defaulted loans amount to $84 million in principal, but the company’s total loan loss provisions amount to only $9 million.

The above might sound worrying, and indeed, it is in part. Lument has so far recognized $4.3 million in charge-offs from an office building loan. On the other hand, the company could work through two defaulted loans from 2023, without losses to fair value. We will talk more about this below.

Future trends in interest income and defaults

CLO maturity: Lument receives the bulk of its financing from two CLOs, one created in 2021 (with a spread of 200bps over the company’s average book) and another one in 2023 (with a spread of 100bps over the company’s average book plus a one time 2% discount on par to purchased loans).

The main development in the company’s future earnings will be the maturity of the more profitable 2021 CLO, which has finished its reinvestment period. This is the cause behind the approximately $100 million quarterly decrease in the loan book size. The company’s management commented that they expect the rhythm of net repayments to continue at an $80 to $90 million level, with the possibility for more prepayments also considered.

Considering that Lument made 200 bps of spread on those loans and that 80% of them were debt-financed, the company would be losing about $5.6 million in net interest income per year in the next twelve months ($360 million in repayments, $288 million of which are debt-financed, with a spread of 200 bps). This assumes that the company reinvests the equity portion back into loans, which so far has not happened.

Future financing: In order to do business, Lument requires new financing; otherwise, its loan book will decrease significantly. The problem is that the CLO market has been dry. According to management during the 2Q24 call, only three deals have occurred in 2024 for managed vehicles. It will be extremely difficult to obtain close to $1 billion in financing to replace the 2021 CLO, and even more so to do it at low spreads.

Maturity and collateral risk: The company’s CLOs are term-matched to the loans, and most of them have maturities above two years (with extensions). This greatly reduces short-term maturity risk, as the company can extend the terms of the distressed borrowers. However, $31 million in loans maturing before the end of FY25 should probably be covered if defaulted. This could impact the company’s equity as it holds the most junior tranches of the CLOs.

Further, the majority of these loans were created before the rate hikes, and therefore, their LTVs of 60/70% (which are based on appraisal at loan origination) are probably overstated. This could also prove an equity risk.

Overall, though, I do not foresee a significant maturity or liquidity risk, even considering a mild continuation of the recession in place.

Valuation fair but not attractive

Lument currently offers a 13% earnings yield, including the $3.5 million in allowances generated in 1H24. This seems high and attractive, but we must consider the effect of the above dynamics.

On the net income side, it seems difficult for the company to recoup the 200 bps spread over the 2021 CLO with new financing in similar terms. From this factor alone, the company’s forward yield would decrease by 4.5% by 1H25, a process that would continue in 2H25 and FY25 or could even accelerate, depending on loan prepayments.

The decrease in interest rates helps increase liquidity in the CLO market but also damages the company’s yield on its $200 million equity-financed loans. Every percentage point of SOFR decrease implies $2 million less in yearly net interest income, or another 1.5% of yield lost.

The above does not consider the effects of operational and financial leverage, as the company has a relatively fixed expense structure and fixed finance costs in the form of preferred shares.

As an offset to these dynamics, if rates go down and the real estate market improves, the company might avoid writing off current provisions and generating new ones. If the company’s provisions were similar to those in 2023 ($2.5 million) instead of the current annualized rate of $7 million, that would represent a 3.5% boost to the yield. Overall, though, I believe this seems unlikely given that the motive for the rate decrease is a deterioration in the economy in the first place, an environment that is not conducive to a healthy real estate market.

From the yield perspective, therefore, I believe the company is trading at a fair valuation. Its current yield is high, but expected developments will probably lead to a substantial decrease in that yield in the year ahead. On the other hand, the yield on the relatively negative outlook described above is still reasonable, at about 9%.

The stock also trades at a discount to book ($130 million market cap versus $180 million in equity belonging to common). I believe this discount is also fair, given that the company holds $200 million in equity and junior tranches of CRE CLOs originated in 2021/22, which are at risk of impairment losses.

Overall, though, I think Lument’s valuation is pretty fair, offering a discount to the more negative scenarios. On the other hand, I do not see it as an opportunity, given that I do not see where the upside is. The company’s new financing will probably not hold the same terms as the 2021 CLO, difficulting a return to the current recurrent earnings yield. A generalized decrease in risk premiums could revalue the company’s equity for a given yield, leading to a share price appreciation. However, this is a one-time return source dependent on speculative factors.

I still believe Lument is a Hold at these prices for those reasons.