When is the next Fed rate cut?

The federal funds rate impacts savers and borrowers alike. Policymakers’ actions influence the yield you earn on cash products and the interest you pay when you borrow.

A Fed rate cut means lower yields on cash products, which limits how much you can earn on safe money. On the other hand, borrowers — especially those paying variable rates on products like credit cards and home equity lines of credit (Helocs) — get a bit of a break when rates drop. Debt becomes less expensive, and it’s easier (and faster) to pay off what you owe.

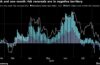

Toward the end of 2024, the Fed projected the possibility of two rate cuts in 2025. However, experts are increasingly skeptical that the Fed will reduce rates dramatically. According to the CME FedWatch tool, which measures sentiment regarding rate changes, there’s a 54.9% probability that the Fed will lower the rate by 25 basis points at the June meeting.

Typically, the Fed would increase rates in times of inflation, but the unemployment rate is also ticking slightly higher. The Fed is tasked with managing inflation and encouraging an economically healthy level of employment, and current conditions potentially put these two missions at odds.

“The Fed’s job has become increasingly complex in recent months because the economy and policy are moving in opposite directions,” says Kevin L. Matthews II, a former financial advisor and founder of the financial education firm Building Bread. “Tariffs will cause inflation, and the sporadic suspensions we have seen with Canada and Mexico will make planning more difficult. Trying to fight inflation and a slowing economy means that you’re fighting against stagflation, one of the worst scenarios to be in.”

JPMorgan estimates a 40% risk of recession in 2025, recently revising its earlier expectations. If the United States does enter a recession, the Fed could cut rates, regardless of the employment picture, to improve activity.

How to prepare your finances for what comes next

It’s impossible to accurately predict the markets or when the next recession will arrive, but there are steps you can take to position your finances, whether the Fed cuts rates or decides to hold steady in 2025.

Pay down debt

Experts often recommend reducing your debt — especially high-interest and variable debt — to improve your overall financial stability. With rates unlikely to fall dramatically, and the Fed likely to hold steady until at least the June meeting, consider aggressively tackling your high-interest debt.

The more you pay on your principal, the less interest you accumulate on your remaining balance, allowing you to get rid of your debt faster. Even if we don’t end up in a recession during 2025, paying down debt could put you in a better position to take advantage of opportunities when they arise.

Build your emergency fund

If a recession arrives in 2025, an emergency fund can help you weather the storm. Even if there isn’t a recession, you never know when a personal financial crisis will arise.

Concerns about layoffs in 2025 are rising, especially as the federal government continues to reduce its workforce. Even if your job isn’t at risk, you never know when the need for car repairs or appliance replacement will strike.

Consider using a high-yield savings account for your emergency fund. You’re more likely to earn a higher interest rate while keeping your principal safe and accessible. While you might not receive the same yield as you would with a certificate of deposit (CD), liquidity and access are usually more important attributes of an emergency fund held in the best high-yield savings accounts.

Lock in cash savings yields with short-term CDs

While the Fed isn’t likely to cut its benchmark rate anytime soon, you might consider looking for ways to maximize the yield on the cash portion of your portfolio. CD rates are likely to remain somewhat elevated for a few months.

Currently, six-month CDs and one-year CDs offer the highest yields among cash savings products. If you have the ability to commit your cash to six or 12 months, you might be able to maximize your yield. Historically, long-term CDs offer better yields, but that isn’t the case right now. As a result, using short-term CDs to maximize current yields also allows you to maintain the flexibility to roll your money into longer-term CDs when conditions potentially change in the future.

Don’t panic about the stock market

The stock market has been a roller coaster ride in recent weeks, and it might be tempting to sell.

“History has shown that staying focused on the long term, especially if you have decades before retirement, is usually your best move,” Matthews says. “Sometimes, it is best to avoid the day-to-day headlines and make sure your investing strategy is boring, which usually means dollar-cost averaging, index funds, and a few blue-chip stocks.”

The S&P 500 has yet to lose in any 20-year period, so if you have a long-term portfolio strategy, you might be better off sticking to it long-term. For example, those who stayed in the market during drops between 2008 and 2010 are still in a significantly better position than they would have been if they had sold.

Rather than selling, consider staying the course or — if you have the available cash to deploy — buying stocks while they’re on sale.