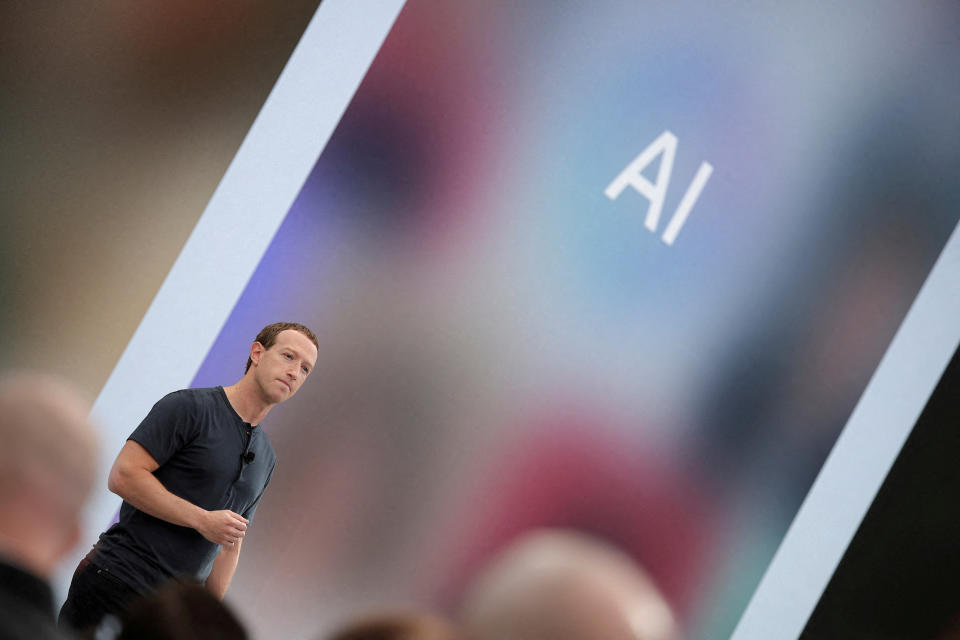

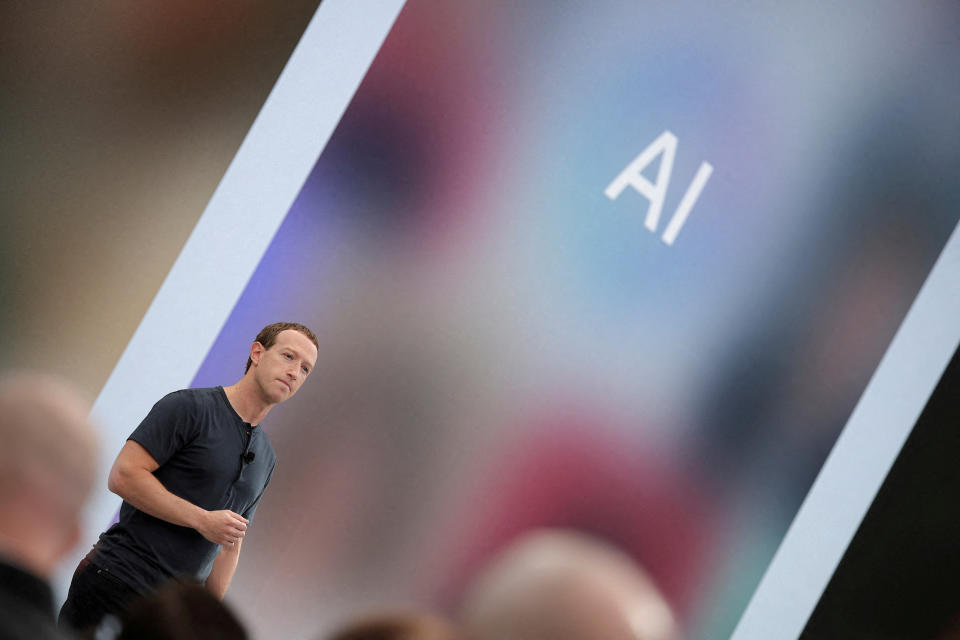

Meta stock (META) fell more than 10% on Thursday after CEO Mark Zuckerberg revealed that the social media company is pouring more cash into its AI efforts, spooking investors.

The CEO, however, tried to assuage investor concerns about the company’s spending during Wednesday’s earnings call, noting that Meta has made similar moves when transitioning to other new technologies in the past.

“We’ve historically seen a lot of volatility in our stock during this phase of our product playbook, where we’re investing in scaling a new product but aren’t yet monetizing it. We saw this with Reels, Stories, as Newsfeed transitioned to mobile, and more,” Zuckerberg said.

But he also admitted that it will likely take years before Meta turns a profit on its AI investments. In January, Zuckerberg announced via an Instagram post that Meta will purchase some 350,000 Nvidia H100 AI chips by the end of the year. While Nvidia doesn’t release the exact price of its data center chips, estimates indicate they cost anywhere between $20,000 and $40,000 apiece. That would put Meta’s estimated costs well into the billions of dollars.

Meta CFO Susan Li backed up Zuckerberg’s statements in her earnings note commentary, raising the company’s full-year total expenses estimate from a range of between $94 billion and $99 billion to between $96 billion and $99 billion due to higher infrastructure and legal costs. Li said that the company’s investments will also increase in the years ahead.

“While we are not providing guidance for years beyond 2024, we expect capital expenditures will continue to increase next year as we invest aggressively to support our ambitious AI research and product development efforts,” Li said.

While Wall Street’s early reaction to Zuckerberg’s comments may have turned off some investors, experts say the investments will likely pay off in the long run more than, say, the company’s metaverse play.

“There’s no doubt that Meta is all in on AI but to achieve its vision, the company must make big investments in infrastructure. Mark Zuckerberg’s ‘heads up’ was reminiscent of what he once said about the metaverse,” Forrester vice president and research director Mike Proulx said in a statement.

“That didn’t exactly go so well, but this is different than Meta’s metaverse gamble because AI has real and practical use cases now. The question remains whether Meta can contend in the AI race while maintaining a strong financial position,” he added.

William Blair analyst Ralph Schackart, meanwhile, said that while the timing and scale of Meta’s generative AI investments will be larger and longer than its prior build-outs, making moves now will put Meta in a more competitive position against rivals.

“We believe [Meta] is still exercising prudence in spending and ultimately will be one of the leaders in the AI race. However, this may take some time and further proof points to investors,” he wrote in an investor note.

Meta’s AI investments include two divisions, one dedicated to consumer users and the other focusing on advertisers. On the consumer front, there’s the company’s new Meta AI chatbot which answers users’ general knowledge questions. Then there’s Meta AI’s customer side, which allows advertisers to build out advertising campaigns on the company’s social platforms using AI.

All of the focus on Meta’s AI investments, however, overshadowed the fact that the company still beat analysts’ expectations on the top and bottom lines for the quarter, posting earnings per share (EPS) of $4.71 in the quarter on revenue of $36.46 billion. Analysts were anticipating EPS of $4.30 on revenue of $36.12 billion, according to analysts’ estimates compiled by Bloomberg.

The company did, however, say it anticipates Q2 revenue slightly off the midpoint of what Wall Street was expecting. Meta said it will see second quarter revenue between $36.5 billion and $39 billion; estimates called for $38.24 billion.

Email Daniel Howley at [email protected]. Follow him on Twitter at @DanielHowley.

For the latest earnings reports and analysis, earnings whispers and expectations, and company earnings news, click here.

Read the latest financial and business news from Yahoo Finance.