In 2024, troubled multifamily properties are primed to cause a significant increase in heartburn. The lion’s share of the struggles loom for value-add investors who took out floating-rate loans over the last few years but whose projects are falling well short of financial projections. In many cases, the investors overpaid for the assets, counting on continued robust rent growth and historically low interest rates to fuel returns.

But the benchmark Secured Overnight Financing Rate spiked from near zero to around 5.3 percent over the last two years. Higher property taxes and construction and insurance costs, along with a surge in new supply and more modest rent growth, have further compounded difficulties.

“There are going to be a lot of eyes on the multifamily sector this year, with people wondering how much pain we’re going to see when maturity dates come up,” said Stephen Buschbom, a research director with Trepp. “But lenders have a lot of flexibility on how they can rework these loans, so the level of distress will be very case-dependent.”

These warning signs related to troubled problem loans contrast with some modestly encouraging signs that have emerged early this year about the larger debt market. NMHC’s latest Quarterly Survey of Apartment Market Conditions, released in January, shows that finance is one of the few areas of the industry where sentiment is trending upward. Forty-five percent of respondents said that debt was more available—up from zero percent in the October survey, and the first improvement in 10 quarters.

Another 35 percent said that borrowing conditions are unchanged and 14 percent called it a worse time to find debt than the previous quarter. In a statement, NMHC Senior Director of Research Chris Bruen attributed the improved sentiment to the decline in 10-year Treasury yield and the likelihood that Federal Reserve will cut interest rates several times this year.

Kick the can

Potential distress in the apartment sector approached $70 billion at the end of the third quarter last year, or about 2.6 percent of the market, with high concentrations in Brooklyn and Houston, according to MSCI. Another key indicator, current multifamily distress, totaled about $9 billion worth of assets.

Among other signs of unease, in August value-add investor Tides Equities and its lender, MF1, extended maturities and modified roughly $645 million in loans, according to The Real Deal. That followed earlier reports that Tides had told its investors that cash shortages would likely require a capital call from limited partners.

Other borrowers are following a similar path. In some cases, like that of MF1 and Tides, a lender’s exposure is so large that it has little choice but to work with a borrower, Buschbom observed. To secure extensions, he added, borrowers will have to take further steps, which may include purchasing rate caps for 1.5 to 2.5 percent of the loan balance and depositing fresh cash into interest reserve accounts.

Revere Capital has seen some stress in its portfolio, reported Jeff Salladin, the private debt fund’s managing director of real estate. But it is more along the lines of tighter-than-expected debt service coverage ratios rather than missed loan payments. “If borrowers come to us and we like the work they’ve done, we can absolutely work with them to get across the finish line,” Salladin noted. “That’s what we do, and we think we’ll be fine in those assets.”

Revere is also seeing opportunities to refinance troubled assets that might carry mezzanine debt along with a senior loan, but it is generally shying away from those situations, he reported. “For obvious reasons we don’t want to take on something difficult now,” Salladin said, “especially if the property is not generating enough income to support the loan.”

Negative Indicators

While multifamily delinquencies ticked up in 2023, they remained well below the rate for other property types save industrial, according to Trepp. Still, multifamily collateral loan obligations, which typically comprise short-term floating-rate debt to fund value-add deals, paint a worrisome picture, Buschbom said. Still, some loan performance metrics paint a worrisome picture.

Comparing financial performance projections at stabilization to current performance in CLOs issued by a value-add multifamily syndicator, Trepp recently found a sizable gap between anticipated and actual metrics of occupancy, rents and debt service coverage.

The monthly median rental rate of properties with an expected stabilization date before mid-July 2024 was $1,013 compared to a projected $1,365, for example, while the median debt service coverage of 1.01 was half of the expected rate. Property metrics for stabilization dates after mid-July 2024 showed similar issues—debt service coverage, for example, averaged less than 1.0.

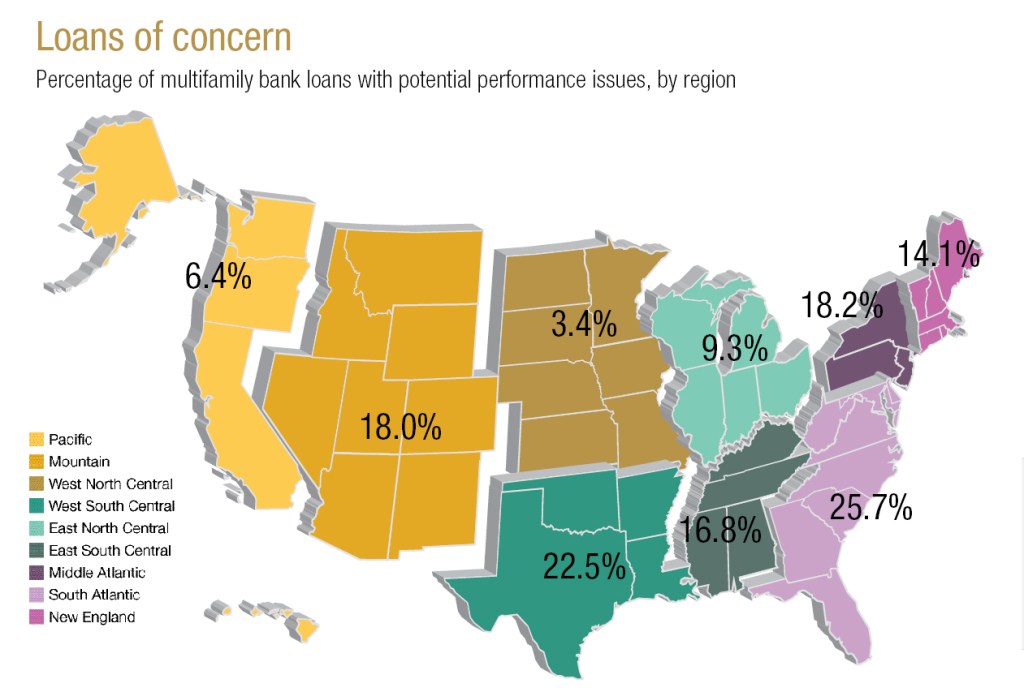

Additionally, certain regions are at greater risk of multifamily defaults, as measured by criticized bank loans, which are characterized by such concerns as leverage, liquidity or debt service coverage. Some 25.7 percent of multifamily bank loans in the South Atlantic region are classified as criticized—the highest of any region—while 22.5 percent are criticized across Texas, Oklahoma, Arkansas and Louisiana, Trepp reported. A criticized loan range of 5 to 15 percent represents a more stable environment, Buschbom observed.

“In cases where banks have any sort of evidence that they’ll receive something less than the full principal back, regulators have been pretty diligent about banks writing loans down,” he said. “Potentially, this is the new canary in the coal mine.”

Rescue Capital Ready

Amid write-downs, pressure will mount on banks to offload the troubled loans, according to Buschbom. In anticipation of those events, “rescue capital” funds that want to recapitalize struggling multifamily projects have emerged over the last several months.

Much like the bid-ask spread that has stymied investment sales, however, a lender-initiated standoff is largely preventing the injection of fresh funding, reported Eric Brody, co-founder of Anax Real Estate Partners. The venture is looking to plow preferred equity into incomplete multifamily projects in the $10 million to $250 million range.

The risks associated with recapitalizing deals require caution, Brody said. Surprises from shoddy construction as well as increasing construction and insurance costs, can eat into projected returns, especially if investors fail to secure a big enough discount when acquiring the original loan, he noted.

In one instance, Anax was competing to recapitalize a nearly complete multifamily project with ground-floor retail. But after a lengthy pause in construction, the commercial tenants walked away from the project, tanking its value and leaving the lender with the remedy of foreclosing on the loan. “The perception of banks today is that the value of an asset is 100 percent of the outstanding loan balance, whether the project is half-built or just started, but the market is saying that investors need a discount on the loan to take over a project to account for the new financial realities,” Brody contended. “There is a game of chicken being played right now, and who flinches first—lenders, or investors bringing new equity into the space—will unfold in the first and second quarters this year.”

Read the February 2024 issue of MHN.