Olivier Le Moal

Investment Thesis

Runway Growth Finance (NASDAQ:RWAY) is a business development company headquartered in Chicago, Illinois. In this thesis, I will analyze its dividend yield at current price levels and its consistency. I will also be analyzing its third-quarter results and its future growth prospects. I believe that RWAY has managed to build a quality loan portfolio with negligible credit losses and high-interest income. It is a great investment opportunity for investors looking for a quality finance company with a high dividend yield, and hence, I assign a Buy rating for RWAY stock.

Company Overview

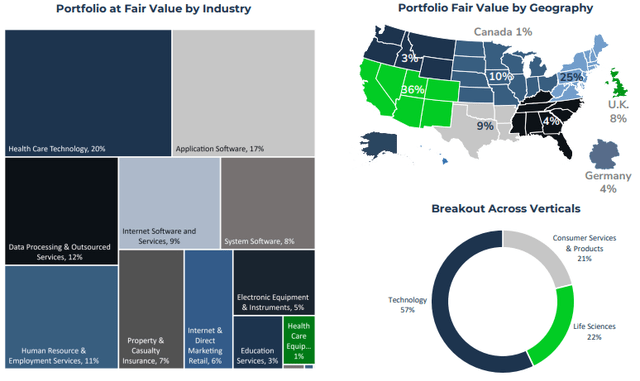

RWAY is a finance company focused on providing flexible capital solutions to late-stage and growth companies seeking an alternative to raising equity. It directs its investments toward companies operating in diverse sectors, including technology, life sciences, healthcare, information services, business services, and select consumer services and products. The company adopts a deliberate approach by providing senior secured loans ranging from $5 million to $75 million.

12.6% Dividend Yield

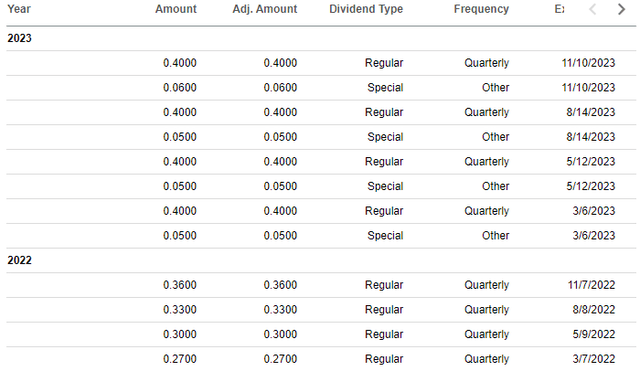

RWAY announced a $0.40 quarterly dividend with an ex-dividend date of 11 November 2023. This brings the annualized dividend yield to 12.60% at the current share price of $12.68 and a forward annual dividend payout of $1.60. However, this $1.60 dividend payout doesn’t include a cumulative special dividend of $0.21, which takes the FY23 forward dividend yield to 14.3%. The dividend payout has consistently been increasing over the last two years, with quarterly dividend payout increasing from $0.27 in March 2022 to $0.40 in November 2023, reflecting a significant increase of 48%. For Q3 FY23, the dividend payout/ EPS stood at 74%, with a Q3 dividend payout of $0.40 and an EPS of $0.54, which shows that there is still reasonable room for dividend payout growth. If we include the special dividend for Q3 of $0.06, the payout ratio comes out to be 85%. I believe, with the strong financial performance of RWAY, the dividend payout has strong growth potential in the coming quarter, and investors looking for a safe dividend income should not miss this opportunity.

Investor Presentation RWAY

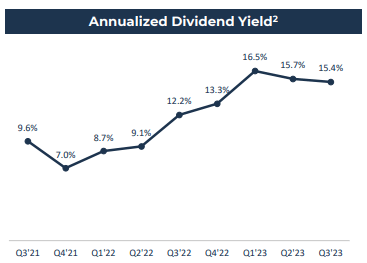

This chart represents the increase in annualized dividend yield over the last nine quarters. I would like to highlight that the growth in dividends is not a result of a stock price decline but an increase in the dividend payout, which is a very positive sign. The stock price has witnessed a YTD increase of 7.5%, and still, the dividend yield has consistently been over 15% for the last three quarters.

Q3 FY2023 Result

RWAY reported a solid third quarter, beating the market revenue and EPS estimates by 8.4% and 15.5%, respectively. The company has managed to provide quality secured loans to a diversified client base. As per my analysis, 99% of its loans are secured loans with first lien on agreements. This means that almost all loans are backed by an asset, and RWAY has the first right to recover money in case of default or dissolution of any client. The results of such a safe investment are visible in the credit loss percentage that the company reported, with a $0 credit loss in FY23 and just a 0.12% net credit loss on the total investment since its inception. At a time when banks and finance companies across industries are taking a hit, and defaults are rising, it is quite impressive that RWAY managed to keep this risk in control.

It reported a total investment income of $43.8 million, up a solid 62% compared to $27 million in the same quarter last year. As per my analysis, the interest income primarily drove the total income. The company is consistently increasing its loan portfolio, driving the income further up. The interest income for the quarter stood at $35.5 million, up 40% compared to $25.4 million in the corresponding quarter last year. The net investment income for the quarter, equivalent to the net profit for the company, stood at $22 million, up a significant 52% compared to $14.5 million in the same quarter last year. 100% of its loans have a floating interest rate, which helped the company in passing on the increased interest rates to the clients. The EPS was reported at $0.54, compared to $0.36 in Q3 FY22. The company managed to increase its revenues as well as profit margins while not compromising the asset quality, which is the main reason behind my bullish view of RWAY.

Now, let us have a look at its balance sheet. The company ended the quarter with a net core leverage ratio of 0.8x. With a total loan portfolio amounting to $1011 million and cash and cash equivalent of $15 million, against 441 million in debt payable. The company is targeting the FY23 net leverage ratio to be in the range of 0.8x-1.1x. I think it has a healthy balance sheet with significant room to raise funds in the future to expand its loan portfolio without putting much stress on the balance sheet.

Overall, it posted solid results, outperforming on multiple parameters, including loan portfolio growth and increased profits. During October and November this year, it added six new investments in the form of loans and equity warrants totaling $72 million. This clearly reflects that the company is maintaining its growth rate and expanding its loan portfolio, providing income visibility for the rest of FY23 and FY24. The management has not provided any guidance for FY23. The market expects the Q4 investment income to be in the range of $45 million to $47.5 million. I believe the company should be able to achieve these targets given the new loans it added during Q3 and Q4.

Valuation

RWAY is currently trading at a share price of $12.68, a YTD increase of 7.5%. It has a market cap of $514 million. It is trading at a forward non-GAAP P/E multiple of 6.4x with an FY23 EPS estimate of $1.98. Comparing this to the sector P/E of 10.5x, I believe it is trading at a significantly cheaper valuation. RWAY provides a safe investment opportunity in the financial sector and could trade at a higher P/E multiple in the coming months. I think investors should not miss this opportunity to invest in a high dividend-yielding company with growing earnings.

Conclusion

RWAY is on a significant growth trajectory with an expanding loan portfolio and increased earnings. The management is strategically investing in secured loans so as to keep the credit losses significantly lower than the industry standards. The company pays $1.60 in normal annual dividends, reflecting a dividend yield of 12.6% at a current share price of $12.68. Considering all these factors, I assign a Buy rating for RWAY.