(Bloomberg) — A stock selloff deepened in Asia, after fresh data redoubled concerns about China’s economy and as investors curbed wagers on Federal Reserve interest rate cuts.

Most Read from Bloomberg

Hong Kong shares led the declines, with the Hang Seng Index tanking nearly 4%. The CSI 300 mainland Chinese benchmark also fell 1.6%. The losses came after official figures showed while China reached its 2023 economic goal, the country’s housing slump has worsened and domestic demand remained listless.

A regional gauge dropped 1.7%, with Japanese equities reversing earlier gains. US and European stock futures also slid further, while short-dated Treasury yields and the dollar edged up.

“China’s nominal GDP growth in 2023 is lower than the real GDP growth, due to the deflationary pressure. Labor market is weak,” said Zhang Zhiwei, chief economist at Pinpoint Asset Management Co. “This suggests China is likely growing below its potential growth.”

The weaker tone in Asia came after the S&P 500 lost 0.4% on Tuesday and a selloff in Treasuries that pushed up 10-year yields by around 12 basis points. While the 10-year yields were steady Wednesday in Asia, their two-year counterparts rose a further 2 basis points.

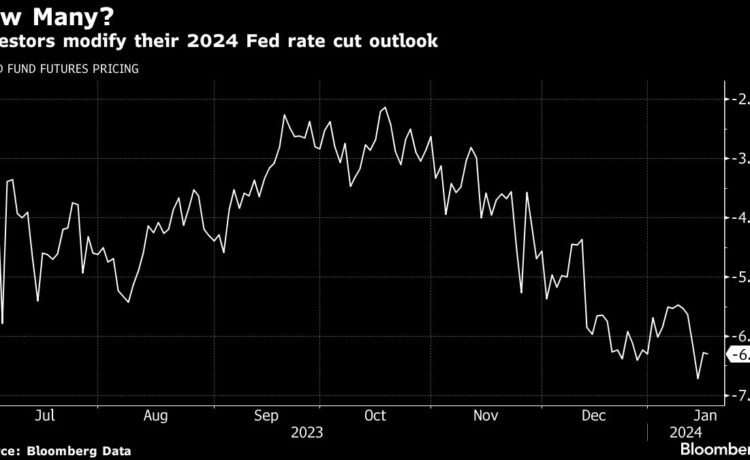

The moves followed comments from Fed Governor Christopher Waller, who urged caution but said a rate cut this year was possible if inflation edges lower toward the central bank’s target. When the time is right, rates should be lowered “methodically and carefully,” Waller said during a virtual event on Tuesday.

Reflecting a recalibration of Fed rate cut expectations, swaps market pricing for a rate cut in March inched lower to around 65% from 80% on Friday.

Mixed China Data

Data released earlier Wednesday showed China’s gross domestic product grew 5.2% last year, matching the rate that economists had expected and exceeding Beijing’s official target of “around 5%.” The latest figures for December continued to feed worries about the growth outlook: the decline in new-home prices accelerated last month, while retail sales grew slower than expected.

Meantime, a Chinese measure of economy-wide prices marked its longest slide since 1999.

“This is the deepest and longest deflation in China since the 1998 Asian financial crisis,” said Robin Xing, chief China economist at Morgan Stanley. “The longer deflation stays, the bigger policy stimulus is required.”

In commodities, oil declined as the drag from a stronger US dollar and broader risk-off tone offset concerns over escalating Middle East tensions, including continued attacks on ships in the Red Sea by Iran-backed Houthi rebels.

Earlier, the greenback staged its biggest rally in 10 months on the move in yields as expectations on rapid rate cuts by the Fed this year diminished.

In US earnings, Morgan Stanley slid amid a warning on lower margins in wealth, while Goldman Sachs Group Inc. rose as profit beat estimates. Boeing Co. sank on an analyst downgrade. Apple Inc. slipped as the US Supreme Court refused to consider its appeal in an antitrust suit challenging the App Store.

Elsewhere, gold was steady after a Tuesday decline of more than 1% to trade around $2,028 per ounce and Bitcoin was steady above $43,000.

Key events this week:

-

Eurozone CPI, Wednesday

-

US retail sales, industrial production, business inventories, Wednesday

-

Fed issues Beige Book survey of regional economic conditions, Wednesday

-

New York Fed President John Williams speaks, Wednesday

-

ECB President Christine Lagarde and ECB Governing Council members Klaas Knot and Boris Vujcic speak at Davos, Wednesday

-

US housing starts, initial jobless claims, Thursday

-

Republican presidential primary debate in New Hampshire, Thursday

-

ECB President Christine Lagarde participates in Davos panel discussion, Thursday

-

ECB publishes account of December policy meeting, Thursday

-

Atlanta Fed President Raphael Bostic speaks, Thursday

-

Canada retail sales, Friday

-

Japan CPI, tertiary index, Friday

-

US existing home sales, University of Michigan consumer sentiment, Friday

-

ECB President Christine Lagarde and IMF Managing Director Kristalina Georgieva speak in Davos, Friday

-

San Francisco Fed President Mary Daly speaks, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.5% as of 6:17 a.m. London time

-

Nikkei 225 futures (OSE) fell 0.4%

-

S&P/ASX 200 futures fell 0.1%

-

Hong Kong’s Hang Seng fell 3.7%

-

The Shanghai Composite fell 1.2%

-

Euro Stoxx 50 futures fell 1%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.2%

-

The euro fell 0.2% to $1.0858

-

The Japanese yen fell 0.4% to 147.77 per dollar

-

The offshore yuan was little changed at 7.2192 per dollar

Cryptocurrencies

-

Bitcoin fell 1.5% to $42,791.76

-

Ether fell 1.7% to $2,562.98

Bonds

-

The yield on 10-year Treasuries was little changed at 4.06%

-

Japan’s 10-year yield advanced 1.5 basis points to 0.605%

-

Australia’s 10-year yield advanced six basis points to 4.21%

Commodities

-

West Texas Intermediate crude fell 0.8% to $71.83 a barrel

-

Spot gold fell 0.5% to $2,018.33 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Iris Ouyang and James Mayger.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.