-

Net Income: Reported at $308 million, falling significantly short of the estimated $763.29 million.

-

Earnings Per Share (EPS): Achieved $1.10, well below the analyst estimate of $2.95.

-

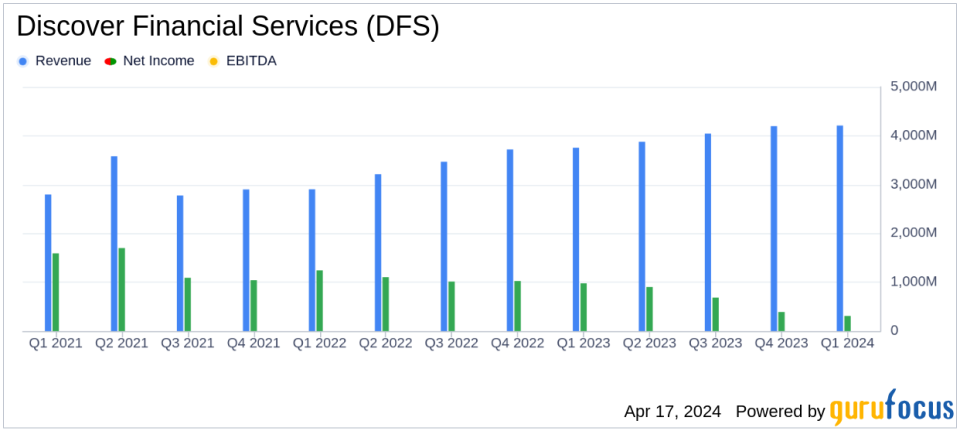

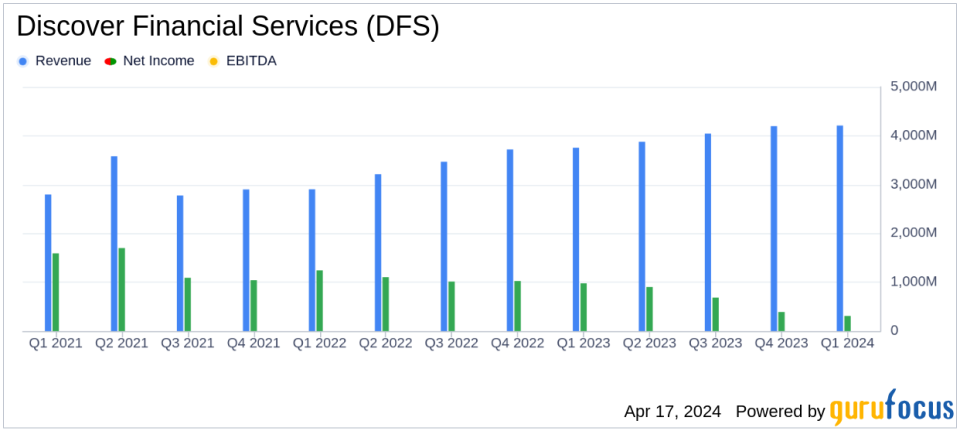

Revenue: Totalled $4,210 million, slightly surpassing the forecast of $4,073.95 million.

-

Total Loans: Grew by 12% year-over-year to $126.6 billion.

-

Net Charge-Off Rate: Increased sharply to 4.92%, indicating rising credit losses.

On April 17, 2024, Discover Financial Services (NYSE:DFS) released its 8-K filing, revealing a challenging first quarter. The company, a prominent player in the U.S. financial services sector, reported a net income of $308 million or $1.10 per diluted share, a stark decline from $968 million or $3.55 per diluted share in the same quarter the previous year.

Discover Financial Services operates through two main segments: direct banking and payment services. The company issues credit and debit cards and offers other banking products like personal and student loans, while also managing the Discover, Pulse, and Diners Club networks.

Analysis of Q1 Performance

The first quarter saw a 12% increase in total loans, ending at $126.6 billion. Despite this growth, the company faced a substantial rise in the total net charge-off rate to 4.92%, up from 2.72% year-over-year, reflecting higher credit losses. This increase is particularly noted in the credit card segment, where the net charge-off rate surged to 5.66%.

Revenue net of interest expense grew by 13% to $4,210 million, slightly above analyst expectations. However, this was overshadowed by elevated expenses, including a significant $799 million increase in the card misclassification remediation reserve, contributing to a 68% rise in total operating expenses.

Michael Shepherd, Discovers Interim CEO, commented on the quarter’s results, highlighting the dual impact of robust loan growth and margin expansion against the backdrop of rising delinquencies and heightened expenses. Shepherd remains optimistic about the company’s merger with Capital One, expected to enhance their banking and payments platform.

“Our first quarter results showed good loan growth, net interest margin expansion, and stabilizing delinquencies, while expenses were elevated due to our action to advance the resolution of our card misclassification issue,” said Michael Shepherd, Discovers Interim CEO and President.

The Payment Services segment reported a pretax income increase to $82 million, driven by higher PULSE revenue and improved performance in the Diners Club and Network Partners volumes.

Despite the financial challenges, Discover declared a quarterly dividend of $0.70 per share, maintaining its commitment to shareholder returns.

The detailed financials and future outlook will be further discussed in the upcoming earnings call, scheduled for April 18, 2024. Interested parties can access the call through Discover’s investor relations website.

As Discover navigates through these turbulent times, particularly with the impending merger with Capital One, investors and stakeholders will be closely monitoring the company’s strategic maneuvers to mitigate risks and leverage growth opportunities in the competitive financial services landscape.

Explore the complete 8-K earnings release (here) from Discover Financial Services for further details.

This article first appeared on GuruFocus.