A recent report by PYMNTS Intelligence has shed light on a growing trend among consumers — they are tipping less this year.

The “Tipping Over: Consumers Reducing Spending and Avoiding Tips” report, the 17th installment in the PYMNTS “Consumer Inflation Sentiment” series, draws on insights from a survey of over 2,000 U.S. consumers to better understand their views on tipping and analyze the link between their sentiments on inflation.

According to the study’s findings, inflationary pressures and increasing costs of goods and services have prompted this shift in consumer behavior, which coincides with evolving tipping norms and the increasing adoption of this practice by establishments.

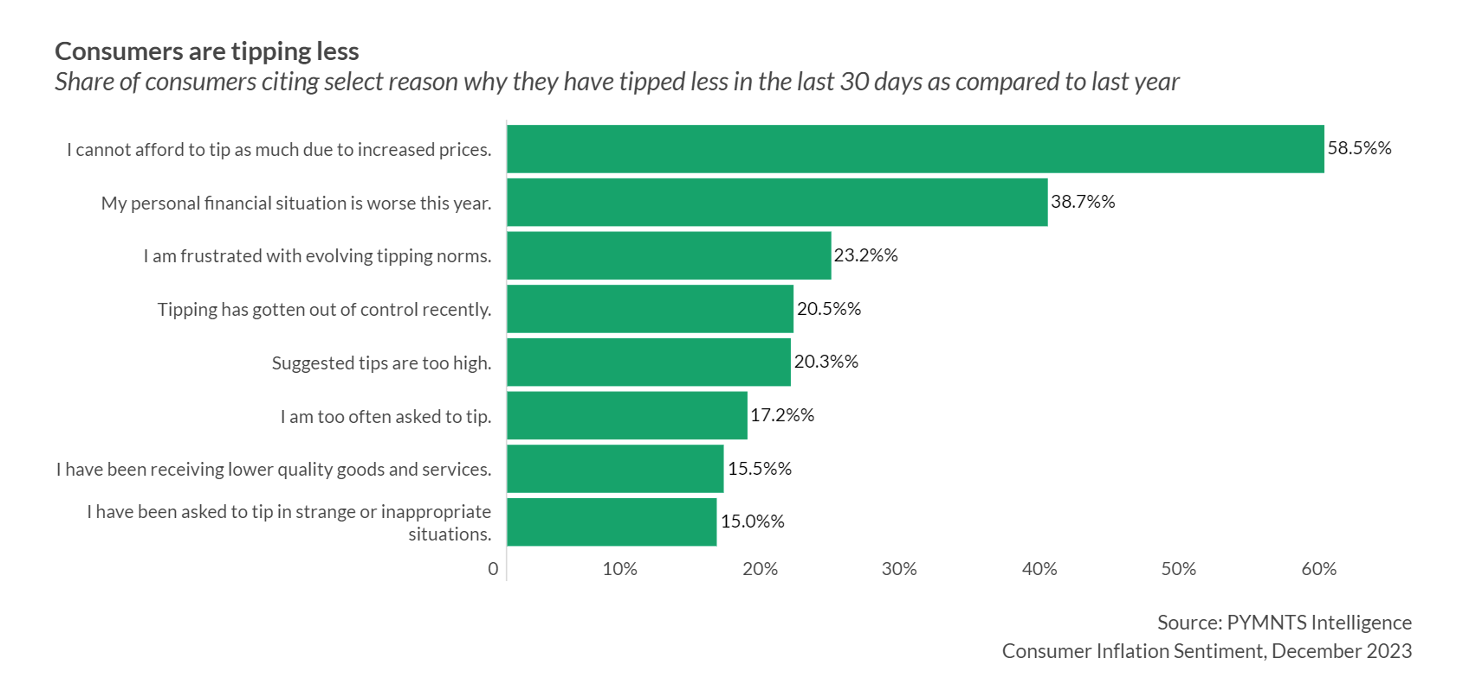

Overall, 15% of consumers are leaving smaller tips this year, tipping approximately $19 less per month compared to the previous year. The majority of these consumers (59%) attribute their reduced tipping to increased prices that make it harder for them to afford larger tips.

Another 39% of consumers link their reduced tipping over the past month to declining personal finances, while 23% cite frustration with evolving tipping norms. Moreover, 15% mention a decline in the quality of goods and services as the cause for tipping less, with a comparable percentage pointing to strange or inappropriate situations where tipping is expected as the reason for their decreased gratuities.

Among the sectors most affected by reduced tipping is the dining industry, with 60% of consumers who have cut back on spending due to tipping reducing their expenditure on food from table-service restaurants. Additionally, 49% have reduced their spending on food from quick-service restaurants (QSRs) that now encourage tipping. This negative response from consumers is expected to extend to other sectors where tipping is customary and constitutes a significant portion of the overall cost.

Drilling down into the data shows that nearly 30% of consumers feel that tipping has become excessive, leading 17% of them to cut back on their spending. Among the different age groups, Generation Z and millennials are the most likely to reduce their spending due to the high cost of tipping, with 27% and 23% respectively. In contrast, only 13% of Generation X and 12% of baby boomers and seniors have taken similar measures.

Pressure Points

While many consumers are opting to spend less due to the high cost of tipping, nearly two-fifths of those who purchased select products or services felt prompted to tip more often. This demand for tips has spread across various sectors, including fast-food establishments, personal grooming services, dine-in restaurants and even grocery stores.

Further data analysis shows that consumers whose wages have managed to keep up with inflation are more likely to leave larger tips this year. Nearly half of consumers in this group have chosen to share their wealth by increasing the amount and frequency of their tipping. Philanthropic sentiment and social pressure were cited as driving factors for this choice. However, only 18% of consumers have seen their wages keep up with inflation, making this a relatively small subset of the population.

In summary, tipping has become a source of frustration as inflation continues to erode consumers’ purchasing power and more establishments that traditionally did not request tips are now doing so. This has led to a decreased frequency in dining out and reduced spending on goods and services, even those not directly impacted by tipping.

Merchants and retailers should take note of these trends. As the study notes, “if tipping has reached a tipping point — and just 18% of consumers’ wages continue to keep pace with inflation — these trending spending cutbacks could become more widespread,” resulting in significant implications for the overall economy.