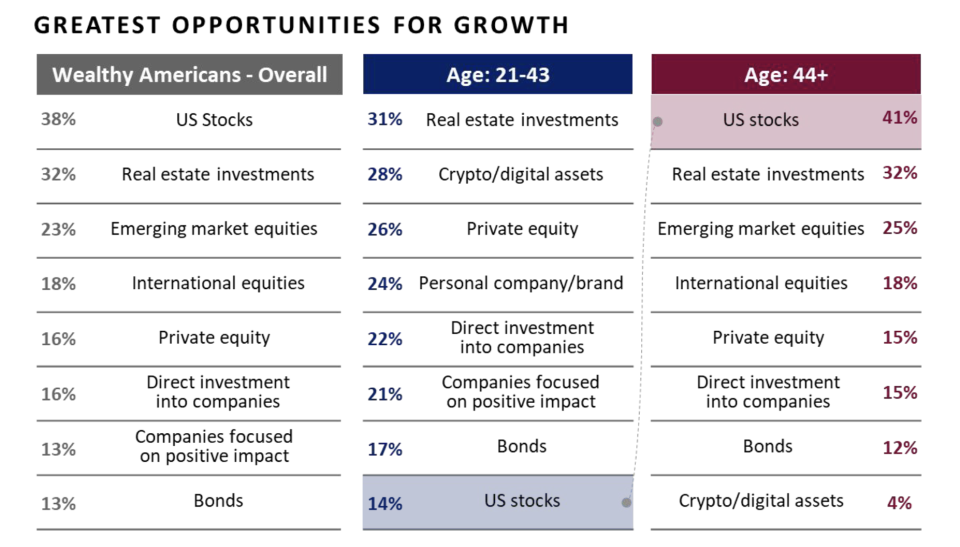

Bank of America Private Bank’s biennial survey of wealthy Americans revealed a generational divide in the perceived greatest opportunities for asset investment and growth.

“What we found was some stark differences in approaches to investing and mindset toward overall investing,” Michael Pelzar, head of investments at Bank of America Private Bank, told Yahoo Finance.

Market research company Escalent surveyed 1,007 high-net-worth Americans on behalf of Bank of America Private Bank. The respondents, who were divided into a younger cohort (ages 21 to 43) and an older cohort (44 and older), had a minimum of $3 million in investable assets apart from their primary residence.

Here’s what Bank of America discovered about the younger investors surveyed:

-

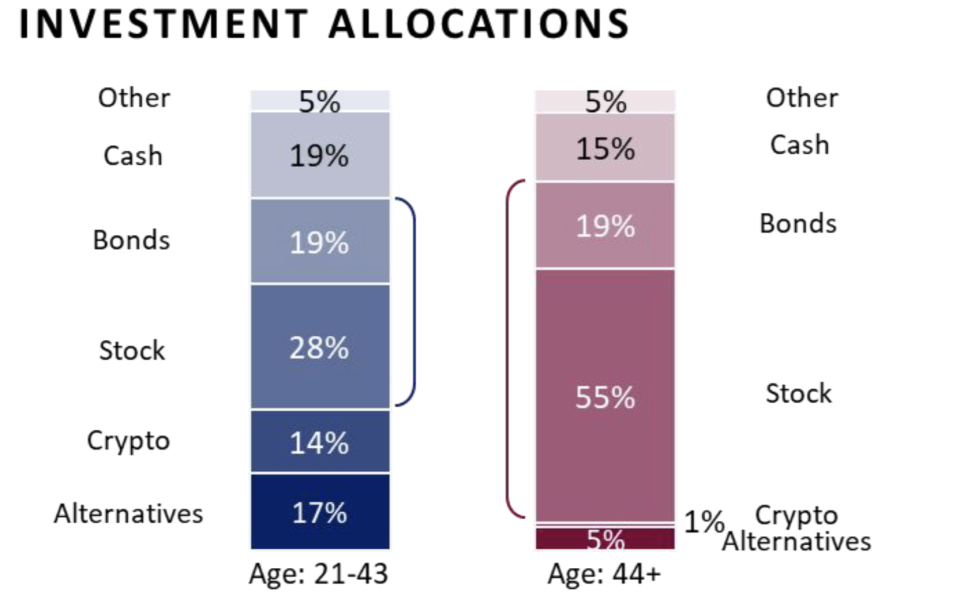

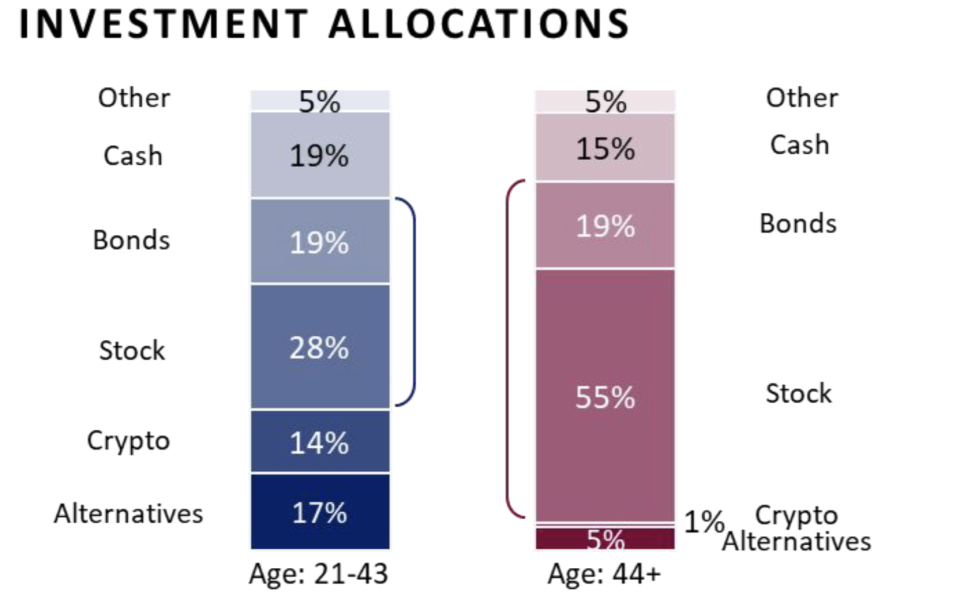

47% of the younger cohort’s portfolios are invested in stocks and bonds. That’s much lower than the older cohort (74%).

-

More younger investors are invested in alternative assets than older investors, and almost all of the younger cohort (93%) said they plan to allocate more to alternatives in the next few years.

-

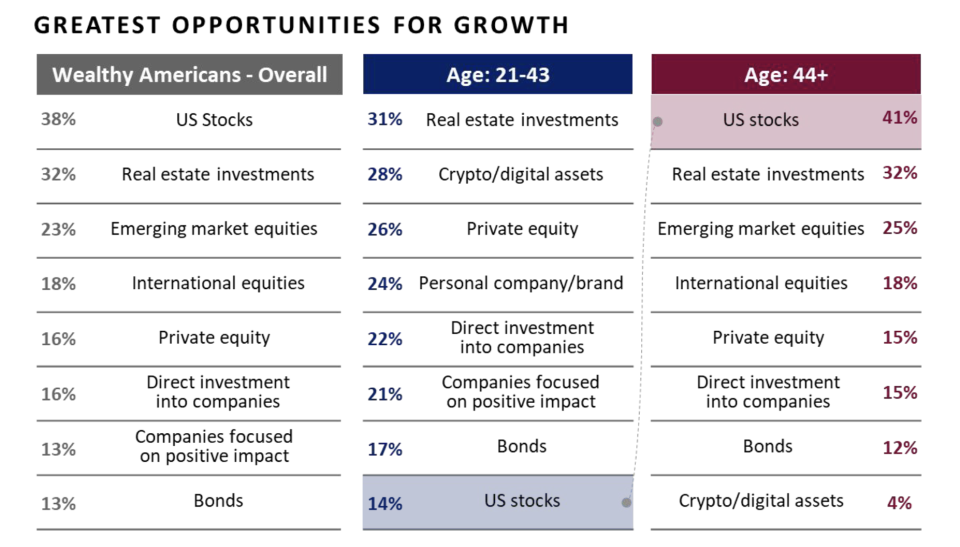

Nearly half (49%) of the young cohort own cryptocurrencies, and 38% expressed some interest. Behind real estate, this cohort ranked crypto as the top area for opportunity.

-

45% of the younger cohort own physical gold as an asset, and another 45% said they are interested in owning it.

Differences in financial outlooks drove the disparities in investment allocations and where investors perceive opportunities to be.

Notably, over 70% of younger wealthy investors no longer think it’s possible to achieve above-average investment returns by investing exclusively in a mix of stocks and bonds. In contrast, only 28% of older investors share that view.

Younger investors’ skepticism over traditional investments comes as the stock market has ripped higher in 2024. As Myles Udland wrote this week, the S&P 500 (^GSPC) is up 42% since the beginning of 2023, pacing an annualized rate of return near 26%, or almost three times the average 10% yearly return of the index over time.

However, Pelzar saw this difference in viewpoint as “somewhat understandable,” citing the turbulence the younger generation has experienced in their investing lives.

“The younger generation has seen in their investing lives two market crashes … and then over the course of the last few years, they’ve seen an increasing correlation between stocks and bonds,” Pelzar said. “And so that’s really colored their thinking around how they need to allocate assets in order to generate the returns they look for.”

The survey revealed that the younger cohort focused their asset allocation on alternatives, and many expressed plans to allocate even more to these investments in the next few years.

Pelzar said this projected increase is “largely reflective” of the younger cohort’s thoughts on the growth opportunities in the market. Because some of the alternative asset classes are less liquid, Pelzar said this implies that the younger generation is taking a longer-term view.

“You see a much different profile between those two different cohorts, and I think that indicates lessons learned or things we need to be thinking about in terms of the investment landscape going forward,” he said.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance