The tech industry had a wild first quarter. From Nvidia’s (NVDA) stock price continuing to rocket higher and higher to Google’s (GOOG, GOOGL) botched launch of its Gemini image generator and Apple’s antitrust battle, the first three months of the year were full of highs, lows, and, well, even lower lows.

The quarter was also full of surprises. Meta (META) announced its first dividend payment and a larger stock buyback program and Apple (AAPL), according to Bloomberg, decided to kill its long-gestating car program, putting an end to an effort that would have catapulted the company into the automotive industry.

Speaking of autos, EVs took it on the chin as sales fell off a cliff. And the Federal Trade Commission (FTC) and the European Union’s European Commission began sniffing around companies’ AI investments and more.

Oh, and did I mention Congress has revived efforts to ban TikTok in the US? Yes, it’s been a busy three months. And we still have nine more to go. These are the good, the bad, and the ugly stories of the first quarter of 2024.

The good

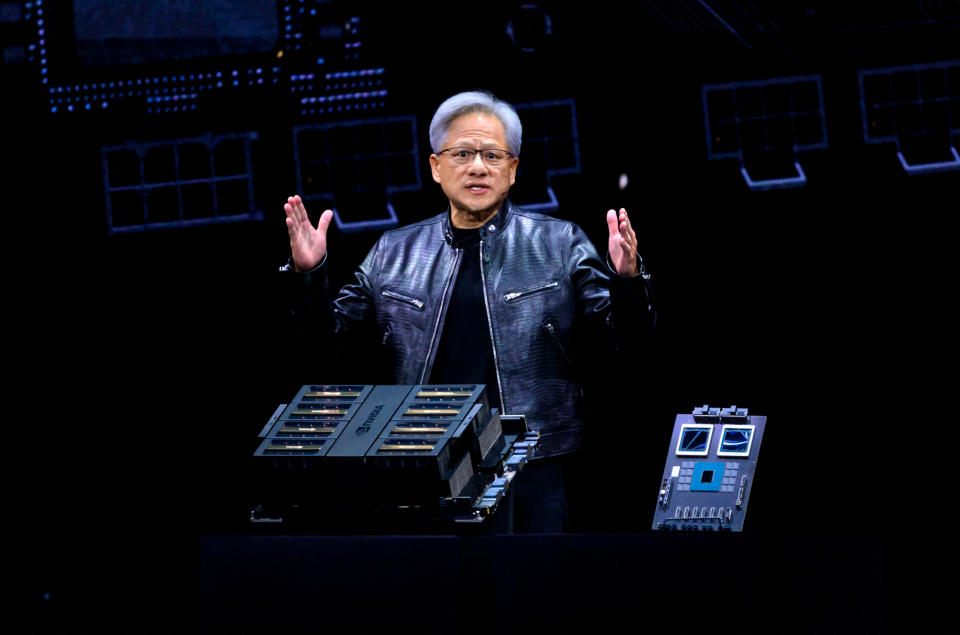

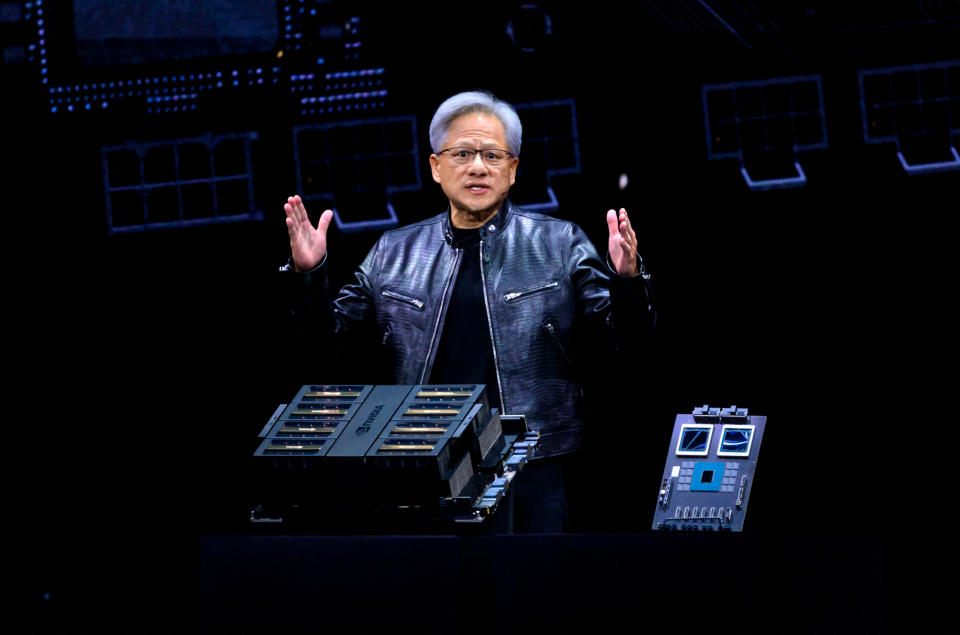

Let’s kick things off with the good news for the tech industry in the first quarter. First up is Nvidia, which continues to dominate the AI conversation. In February, the company announced another monster quarter, blowing past Wall Street’s expectations on revenue and earnings and beating out anticipated revenue for the current quarter.

Shares of Nvidia are up some 89% year to date and 226% over the last 12 months. And in March, the company debuted its new Blackwell AI processor architecture during its GTC conference, which felt more like a party than a developer event.

Also this quarter, Intel and the White House announced that the chipmaker is getting $8.5 billion in CHIPS Act funding to help build out its chip manufacturing and research and development facilities at plants across the US.

The cash from the CHIPS Act is meant to revitalize the US semiconductor industry, and with Intel starting to build chips for third-party companies like Microsoft, it should benefit handsomely from the funding.

Apple, meanwhile, made headlines for ending its electric car project. According to Bloomberg, the company is going to transition a number of employees who worked on the car to its AI division, at a time when Wall Street is looking for signs that the iPhone maker is taking the generative AI trend seriously. Killing the project also means that Apple will avoid what could have been a costly rollout amid a slowdown in electric vehicle sales in the US.

Finally, Meta announced during its first-quarter earnings report that it will begin paying a quarterly dividend of $0.50 per share and authorized an additional $50 billion for stock buybacks, sending shares of the company skyrocketing 38% year to date and 131% in the last 12 months.

The bad

Things weren’t all good for tech in the first quarter. Case in point, the FTC announced it is launching an inquiry into Alphabet, Amazon (AMZN), and Microsoft’s (MSFT) investments in generative AI firms including Anthropic and OpenAI. Alphabet and Amazon have both invested billions in Anthropic, while Microsoft has pumped billions into OpenAI.

The FTC says the move will “help the agency deepen enforcers understanding of the investments and partnerships formed between generative AI developers and cloud service providers.”

The upshot? The FTC is keeping its eye on Big Tech’s efforts to capture as much of the AI market as possible, and whether those companies are grabbing too much power.

It’s not just the FTC keeping its eyes on tech companies either. The European Union’s competition watchdog, the European Commission (EC), is looking into whether Apple, Google, and Meta are complying with the bloc’s Digital Markets Act (DMA).

The DMA is meant to force large tech companies to open up their services to prevent them from dominating specific markets. The EC isn’t so sure they’re playing ball though, and are looking into whether they’re complying or not.

The hits kept coming for Google during the quarter, after it botched the launch of its flagship generative AI-powered Gemini image generator. Users found the app produced images of multicultural Nazis among other things, forcing the company to pull the app.

Congress also got in on the action, looking to, yet again, take down TikTok, with the House passing legislation that would force parent company ByteDance to sell the social network or keep Apple and Google from offering it in their app stores. The Senate still has to take action on the measure, but First Amendment concerns could prevent any ban from sticking.

The ugly

Nothing is as bad as these stories though: Up top, the Department of Justice’s antitrust lawsuit against Apple. The DOJ claims Apple is boxing out competition and hurting developers, and ultimately consumers, by keeping a tight grip on its App Store and hardware.

According to the suit, Apple locks competitors out from being able to access features that would let them take on the Apple Wallet and Apple Watch. Apple refutes the claims, but the suit could take years to wrap up and may prove to be a distraction for its future.

Tesla (TSLA) CEO Elon Musk filed a lawsuit of his own against OpenAI, the company he co-founded, claiming that the AI firm has abandoned its original mission to create AI technologies that benefit humanity. Musk says that OpenAI is more focused on profits and is a subsidiary of Microsoft. OpenAI has fired back, refuting Musk’s claims and saying that he’s more or less upset that he missed the boat on the company’s explosive growth.

Finally, there’s the electric vehicle market. Sales of EVs are slowing in the US as subsidies for certain models dry up and sky-high interest rates are making it harder for consumers to purchase models. Then there’s lingering range anxiety about a car running out of power mid-drive. The general thinking is that EVs will eventually become the dominant type of vehicle on the road in the next decade or so, but for now, the jump in sales seen over the past few years is falling flat.

It’s still early in the year — heck, baseball season just started, though my Mets are already in the basement. That is to say, the good stories could flip and become bad or ugly and vice versa. On to Q2.

Email Daniel Howley at [email protected]. Follow him on Twitter at @DanielHowley.

Click here for the latest technology business news, reviews, and useful articles on tech and gadgets

Read the latest financial and business news from Yahoo Finance.

-100x65.png)