The Icahn Effect: How JetBlue’s Financial Turmoil Could Cost You Your Miles

JetBlue is looking for revenue anywhere it can find it. Not only are they struggling, and their business plan scuttled by back-to-back anti-trust rulings, but corporate raider Carl Icahn is breathing down their neck. He’s taken a 10% stake in the carrier, whose stock has cratered, and he controls two board seats. He could acquire more of the company.

That has had some readers worried about their miles. I don’t have inside knowledge about what the airline plans to do with their points, but there are two basic schools of thought here.

- Devaluations would hurt them more. They’re looking for additional revenue from their credit card. Only Delta has consistently been able to devalue their points without hurting their co-brand charge volume and revenue, and even Delta learned this past fall that there are limits to what the market will bear for program changes.

It would be silly to devalue their miles. JetBlue hasn’t realized the benefit of its frequent flyer program as much as competitor airlines. Their best opportunity is in leaning into that opportunity, rather than cutting it.

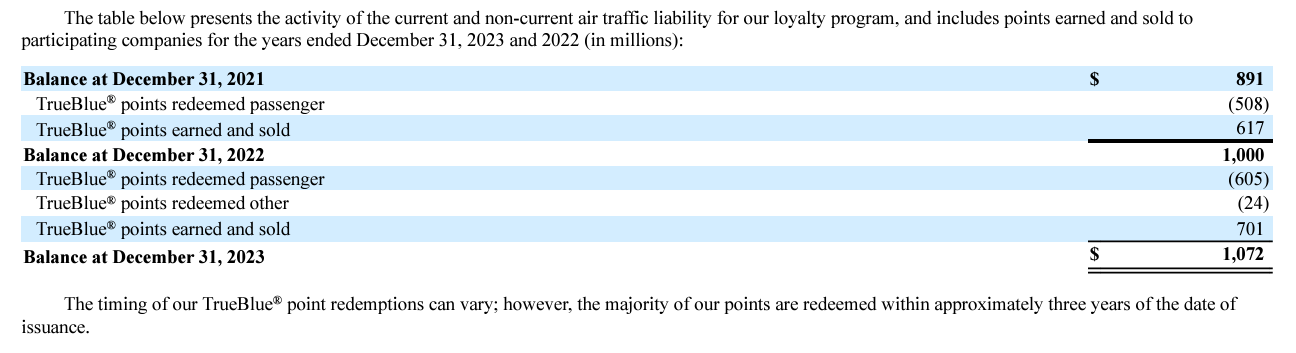

- Yet it’s a quick and easy cost-savings. If they are looking for cost cuts, one place on the balance sheet to look is the future travel liability of TrueBlue. Carl Icahn’s involvement is a bit of a wildcard – it’s a short term balance sheet maneuver rather than something that actually benefits the business.

Here’s JetBlue’s 2023 form 10-K filed with the SEC in February. There’s about a billion dollars in liability, and if they reduced that it would also mean a one-time recognition of revenue.

There’s no specific information about an impending devaluation, just a worry that Icahn’s involvement could lead to short-term cost cuts that harm the business in the long-term.

I’m not sure it matters either way, though. Your strategy should be the same. Your miles will (almost) never be worth more in the future than they are today. Saving points for some distant future – a travel IRA of sorts – is never a good idea.

There are occasional arbitrages. Points with America West Flight Fund arguably took on a new life when that airline acquired US Airways, opening up Star Alliance redemption opportunities. If Alaska Airlines succeeds in its acquisition of Hawaiian Airlines, and HawaiianMiles convert 1:1 into Mileage Plan, then the value of HawaiianMiles will go up.

Once those arbitrage opportunities come to fruition you are… best off redeeming, rather than saving for a future which will involve devaluation.

In general always best to redeem sooner than later – JetBlue points don’t seem likely to get more valuable, unless they wind up joining a global alliance.