There are currently seven companies in the world with a market capitalization exceeding $1 trillion. Save for Saudi Aramco, they operate in the technology sector.

Warren Buffett’s investment conglomerate, Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B), is the eighth most valuable company in the world with a market cap of about $870 billion. Shares of Berkshire have risen about 29% during the past year — roughly in line with the S&P 500.

Let’s break down why Berkshire is such a strong business, and how the company could be next to join the exclusive club of trillion-dollar companies.

Slow and steady wins the race

Buffett’s investment style is pretty straightforward. He identifies businesses that generate steady growth, with a specific focus on profitability. Moreover, the Oracle of Omaha also tends to hold stocks for long periods of time — often decades.

This disciplined and patient approach allows Buffett to double down on his winners over time, and benefit from the power of compounding. More specifically, as his companies grow, they may implement stock buybacks or dividends. Both are ways that shareholders can enjoy outsized returns from top-quality businesses.

Although this is all great for Mr. Buffett, how does it benefit investors? Well, Buffett makes his investments primarily though Berkshire Hathaway. Since Berkshire is public, investors can gain exposure to the holding company for their investment portfolio.

A treasure trove of rock-solid businesses

Berkshire Hathaway holds companies across a variety of industries including technology, energy, financial services, consumer staples, and healthcare.

Some of Buffett’s most prominent holdings include Apple, American Express, Coca-Cola, Occidental Petroleum, Bank of America, and Chevron. Although many of these companies are best-in-breed brands in their respective industries, one thing that I find particularly unique about Berkshire is its position in a leading exchange-traded fund (ETF), the Vanguard S&P 500 ETF.

This is a pretty savvy move, in my opinion. Essentially, Buffett is complementing his individual stock picks with some exposure to the broader markets. In a way, it serves as a hedge and keeps any losses relatively insulated should one of his larger positions experience a decline.

What could fuel Berkshire Hathaway higher in 2024?

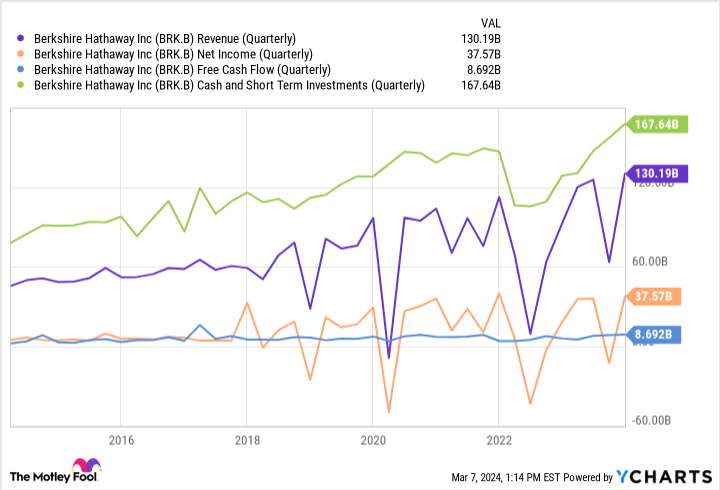

The chart below illustrates a number of important financial metrics. Investors can see that Berkshire has rebounded sharply from pandemic-induced drops a couple of years ago.

But what I find most important is the company’s rising cash pile. As of Dec. 31, Berkshire held $167 billion in cash and short-term investments on its balance sheet.

One of the ways Buffett has been able to accumulate so much cash is dividends. In fact, among his large portfolio of stocks, just six of them account for nearly $4.7 billion of dividend income per year. But with so much cash on hand, you might be wondering why Buffett isn’t aggressively buying new businesses at the moment.

My guess is that he is waiting to see how the Federal Reserve acts this year. Indeed, investors have been given some signs that interest rate cuts will come in 2024. But given inflation is still lingering higher than the Fed’s long-term target of 2%, Chairman Jerome Powell and his constituents have to act carefully — as there are pros and cons of cutting rates too soon, too late, and by what magnitude.

These variables will dramatically influence the broader macroeconomy and the capital markets. I would not be surprised to see Buffett make some intriguing moves this year, but it seems to me that he is exercising patience — par for the course for him.

As revenue and profit rises, Berkshire’s financial horsepower should continue to improve. While it’s unknown what moves Buffett will make, his long-term track record speaks for itself. Given Berkshire’s exposure to so many leading companies across diverse industries, coupled with the markets trading at record highs, I think the company will handily achieve the trillion-dollar milestone sooner than later. Now could be a unique opportunity to scoop up shares in one of the most respected and famous portfolios of all time.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 8, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. American Express is an advertising partner of The Ascent, a Motley Fool company. Adam Spatacco has positions in Apple. The Motley Fool has positions in and recommends Apple, Bank of America, Berkshire Hathaway, Chevron, and Vanguard S&P 500 ETF. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

Prediction: This Warren Buffett Stock Will Be the Next Trillion-Dollar Company was originally published by The Motley Fool