Donald Trump painted somewhat different pictures to different audiences Thursday of how he would cut taxes if he wins in November.

Before a closed-door gathering of CEOs, he talked up an idea to reduce the corporate tax rate to 20% from its current 21% level. The former president’s remarks were first reported by the New York Times and confirmed to Yahoo Finance.

But earlier that morning before an audience of House Republicans, according to attendees, Trump floated another idea: scrapping the entire US income tax system in favor of higher tariffs.

Perhaps not surprisingly, Trump doesn’t appear to have repeated his “all tariff” idea to the business executives. The reception if he had would undoubtedly have been cooler, with tariffs representing a tax that businesses pay when they import goods.

The two news-making ideas that Trump offered Thursday are not irreconcilable — he could pursue both if he is elected — but the sequence was emblematic of his overall approach to campaigning on fiscal issues.

He often tosses out seemingly spontaneous ideas favored by the audience in front of him. Where Trump is consistent is in having a keen focus on lower individual and corporate tax rates but a different approach to trade duties.

One attendee Thursday added that Trump offered support for different corporate tax rate levels in his remarks to CEOs. The former president focused on a 20% rate but also mentioned 15%, a number he has pushed for previously.

Trump liked the 20% level, according to the CEO, in part because it was a “round number.”

President Biden was also invited to address the CEOs this week but was traveling in Europe. He sent White House Chief of Staff Jeff Zients in his stead, who told the audience Biden had wanted to be there.

Taxes also came up in that conversation, according to a person familiar with the meeting, with Zients acknowledging a White House plan to potentially raise corporate taxes above 21% while also stressing the need to keep the US competitive while doing so.

Zients is a former business executive himself and often a Biden emissary to corporate America.

He made an overall case to the assembled business CEOs that Biden’s policies, from government support for infrastructure and specific sectors to a respect for international norms and global alliances, are more important to the economy’s well-being than a tax cut.

Help for corporate bottom lines

Trump’s corporate tax ideas drew praise from some conservative advocates, with some trying to cast a cut for America’s corporations as one that would help everyday citizens.

Grover Norquist, the president of Americans for Tax Reform, said in a statement that “workers, retirees, and households pay the corporate tax” and such a move “reduces the tax burden on the middle class and creates jobs and growth.”

It’s also a move that — if it comes to pass — would also have an economic impact.

Garrett Watson, a senior analyst and modeling manager at the DC-based Tax Foundation, told Yahoo Finance Friday that an adjustment to the corporate tax rate to 20% would increase GDP by about 0.1% — but could also further elevate the national debt if it’s not offset by spending cuts.

Such a move would cost about $114 billion over the coming decade, Watson said, but would help U.S. global competitiveness in terms of attracting corporate activity.

He added in a note that “corporate taxes are some of the more harmful types of revenue raisers for economic growth, so relying less on corporate taxes can be helpful to encourage greater long-run growth.”

But lower corporate taxes are something Trump has called for for years and he is unlikely to stop anytime soon.

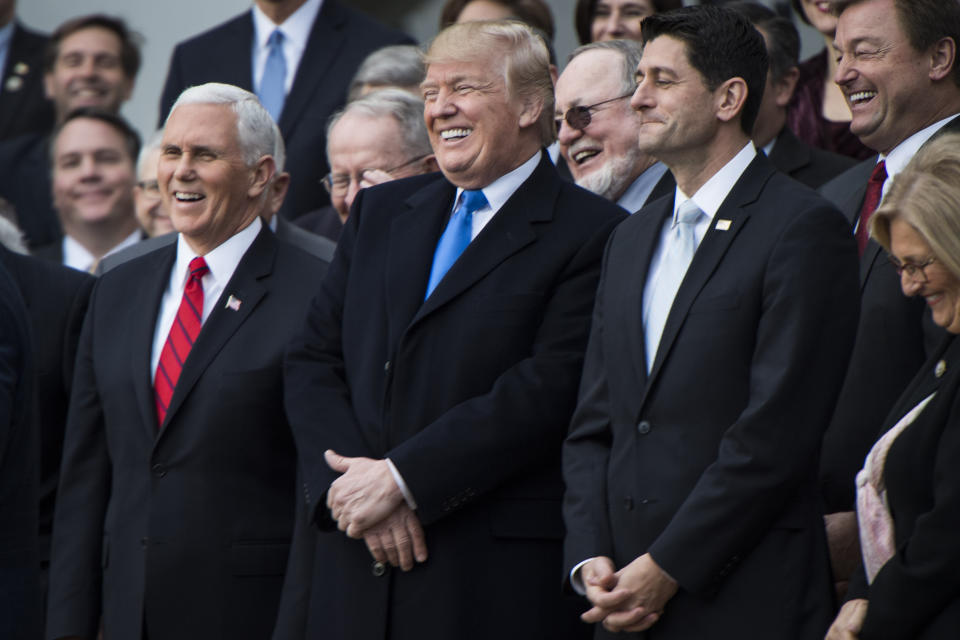

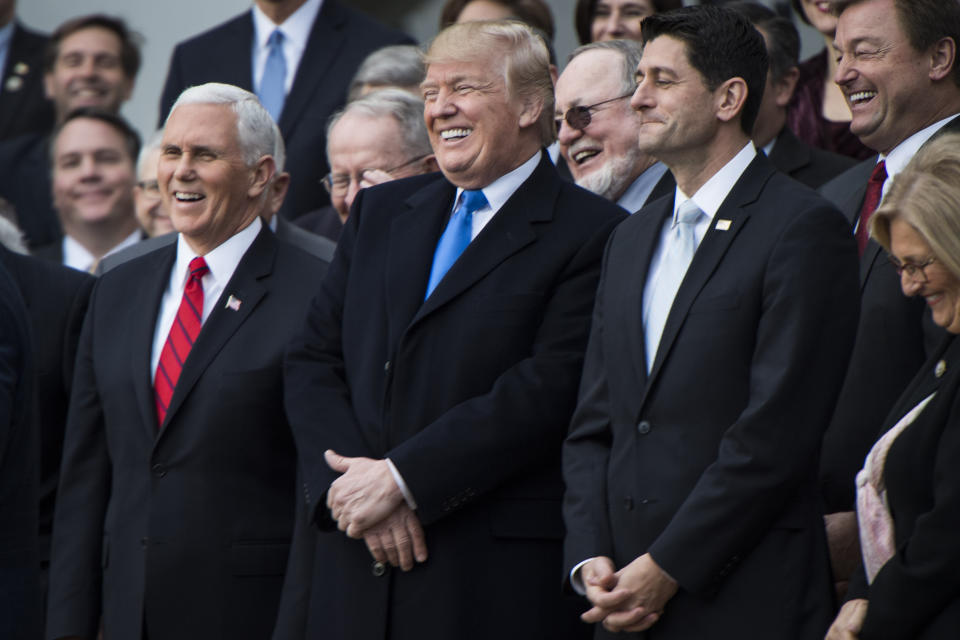

Back in 2017 the Trump-era tax cuts lowered the corporate tax rates from 35% to 21%. But during those negotiations Trump was a voice pushing for it to be even lower, to 15%.

And he has called for low rates in the years since.

In a 2023 NBC interview, Trump said of corporate rates “I’d like to lower them a little bit if we could” but declined to call for a 15% rate then, saying “it depends on where we are at the time.”

Trump has often touted his tax cuts generally when reaching out to wealthy potential donors.

One leaked video — which Democrats and the Biden campaign have often surfaced in the months since — appears to show Trump at a fundraiser at Mar-a-Lago last December talking to a well-heeled audience.

“You’re rich as hell” he said in the clip, and then added “we’re going to give you tax cuts.”

How the business world compartmentalizes Trump’s promises

Trump’s visit to Washington this week also put a spotlight on a corporate approach to the Republican that often focuses on highlighting the business-friendly parts of his agenda while downplaying others.

Trump appeared before the Business Roundtable, a group that represents CEOs in Washington and has made tax reform and lower rates a top priority for the year ahead.

In a gathering with reporters earlier in the week, Business Roundtable CEO Joshua Bolten downplayed Trump’s less business-friendly ideas such as his determination to impose a 10% tariff on US trading partners.

“We’re not looking at it as a package deal,” Bolten said. “We think that taxes ought to be low, and we think unjustified tariffs ought not be put into place.”

In a recent interview, a Northwestern University political scientist named Jason Seawright who co-authored a book on billionaires and politics offered a reason why business leaders might make this distinction.

He notes that last time Trump was in office, what actually occurred was a wave of tax cuts as well as higher tariffs.

But those trade tensions ultimately didn’t throw the economy too far off course.

“They think that they managed things very nicely last time and they think they can do it again,” Seawright said.

Ben Werschkul is Washington correspondent for Yahoo Finance.

Click here for politics news related to business and money

Read the latest financial and business news from Yahoo Finance