(Adds details from investor conference throughout, updates shares)

By Manya Saini

April 29 (Reuters) – Fulton Financial’s shares jumped on Monday after U.S. regulators brokered its takeover of Philadelphia-based Republic First Bank which failed following months of problems.

Republic First Bank, which had conducted business as Republic Bank and had $6 billion in assets, is the first U.S. bank to fail this year, underscoring how some regional lenders continue to struggle a year after three regional banks failed.

The Pennsylvania state regulator closed Republic Bank on Friday and appointed the Federal Deposit Insurance Corporation as receiver, which sold the bank to Fulton for an undisclosed price.

Fulton acquired $4 billion of the bank’s deposits and $2.9 billion in loans. The combined company now expects to have $32.8 billion in total assets and Fulton expects the deal will double its presence in the Philadelphia market.

“We anticipate improving the risk profile of the company with improved liquidity, internal capital generation, profitability and earnings,” Fulton’s CEO Curtis Myers said in an investor conference on Monday.

Fulton’s management said it expects to receive roughly $1 billion from the FDIC as part of the transaction terms. Its stock was last up 8% in afternoon trading

Republic Bank, which had been targeted by multiple activist investors since 2021, had struggled amid elevated interest rates, which had depressed the value of securities on its balance sheet and hurt its commercial real estate portfolio that accounts for about 45% of its loan book.

Its shares were delisted from the Nasdaq in August and had since been trading over the counter.

The bank cut jobs in May 2023 to reduce costs and exited its mortgage origination business, and in September announced it was entering into a $35 million capital infusion deal with an activist investor group led by veteran businessman George Norcross. But that deal fell through in February.

Regulators had reportedly been discussing a sale of the bank before the deal was signed.

INDUSTRY STRESS

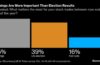

Investors have been worried about the health of regional lenders since Silicon Valley Bank, First Republic and Signature Bank collapsed in early 2023 following depositor runs, although the market took Friday’s news in its stride.

The KBW regional banking index was last down marginally in early afternoon trading.

“There is always the danger that some bank somewhere unwittingly – or wittingly – takes too much of what turns out to be the wrong risk at the wrong time, while the rise of internet banking does make it so much easier for deposits, and any bad news, to move so much more quickly,” said Russ Mould, investment director at AJ Bell.

“The key to maintaining confidence is to keep depositors whole.”

Fulton also launched an offering of its common stock and said it intends to use the proceeds for general corporate purposes, including supporting “new opportunities” from the acquisition.

It intends to sell roughly 16.7 million shares priced at $15 apiece to raise about $250 million. Myers said the deal was not contingent on the bank raising capital.

“Capital raise was not required, the OCC (Office of the Comptroller of the Currency) approved our bid based on bank level capital as is, not even the holding company,” he added.

Fulton disclosed office loans – a sector in stress as buildings run empty post-pandemic – accounted for roughly $200 million of Republic Bank’s total loan book.

The FDIC took some losses on Republic Bank’s securities, which were then transferred to Fulton at fair value, executives said.

Analysts at Jefferies said they expect the integration to be smooth and boost the bank’s liquidity, even though this is the largest deal Fulton has undertaken post the global financial crisis.

Through previous close, it had a market capitalization of $2.53 billion.

The FDIC estimated the cost to the Deposit Insurance Fund related to the failure of Republic Bank would be $667 million.

(Reporting by Manya Saini in Bengaluru; Editing by Krishna Chandra Eluri)