US stock futures pointed mostly upward Friday, but the indexes dipped off highs after a blowout January jobs report served as the last major data point in a jam-packed week of market-moving events.

Futures tied to the benchmark S&P 500 (^GSPC) rose 0.3%, while those on the blue-chip Dow Jones Industrial Average (^DJI) lagged, dipping below the flatline. The tech-heavy Nasdaq Composite (^IXIC) looked to lead gains, rising about 0.6%.

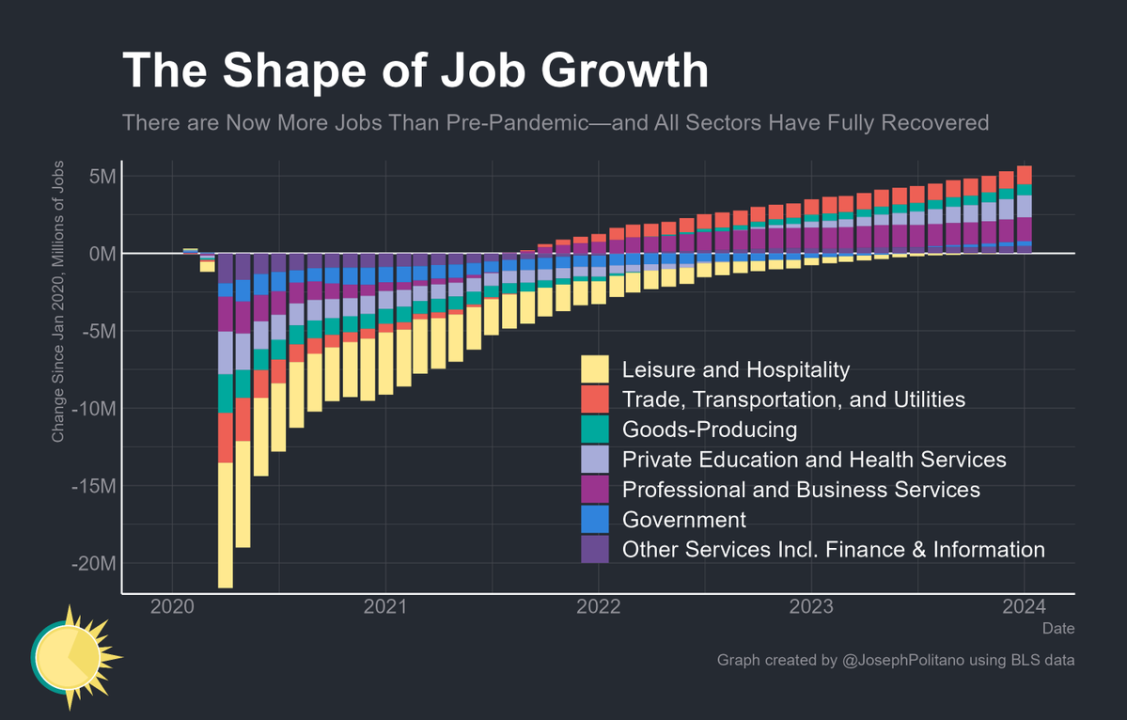

Investors are nearing the end of a momentous week. As Yahoo Finance’s Josh Schafer reports, Friday’s highlight was the jobs report, which blew past Wall Street expectations as the economy added 353,000 jobs in January. The unemployment rate was unchanged at 3.7%.

The labor market has remained resilient in the face of a rate-hiking campaign from the Federal Reserve, but other data this week had shown signs of softening. Though the Jerome Powell-sparked sell-off of just two days ago is almost a mere footnote by now, Friday’s jobs report could once again shift expectations on the Fed’s rate path, especially as Powell suggested that a strong labor market is actually a good sign.

Meanwhile, the S&P 500 and Nasdaq were still basking in the glow of strong earnings reports from tech giants Amazon (AMZN) and Meta (META) on Thursday. As Yahoo Finance’s Hamza Shaban writes, they delivered the goods where Microsoft (MSFT) and Alphabet (GOOGL, GOOG) had fallen short earlier in the week. Meta surged more than 17% in premarket trading, while Amazon popped nearly 7%.

Apple (AAPL) also looks to have disappointed, despite an earnings beat Thursday, because of warning signs about its China business. Apple fell as much as 3.5% before the market open.

Live3 updates