Small caps have been all the rage amid the Fed pivot.

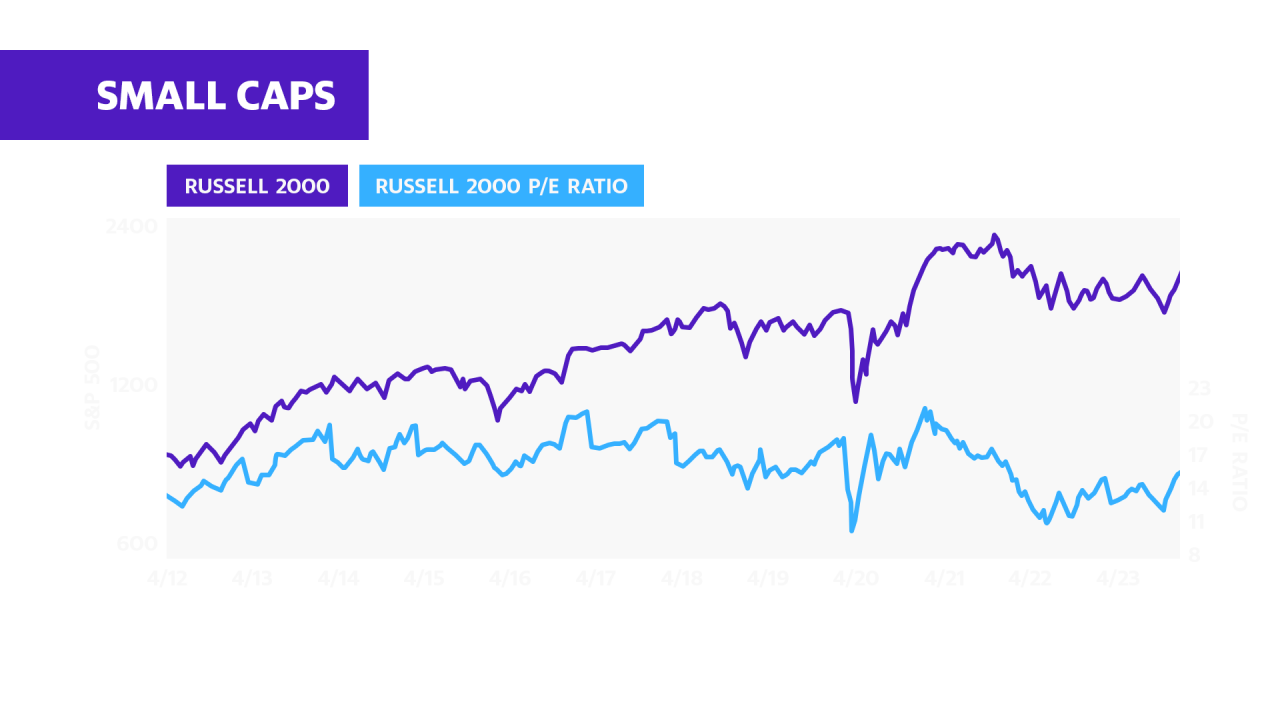

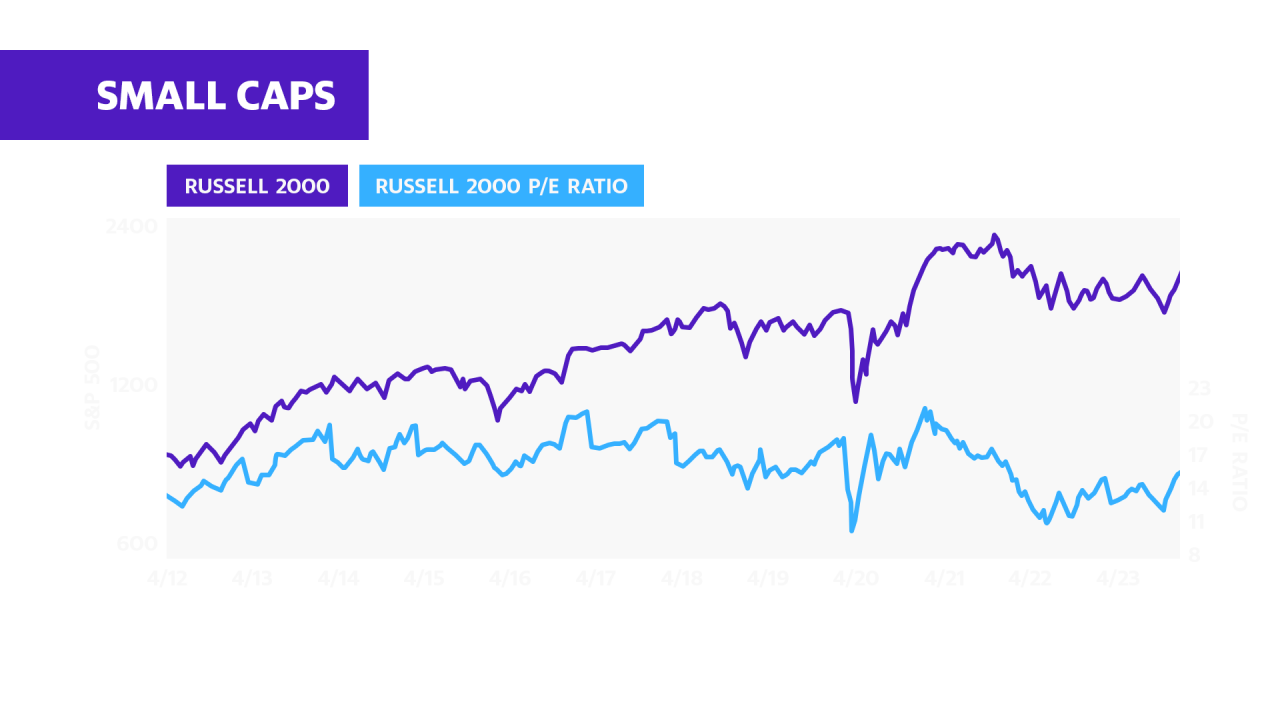

Since the Federal Reserve held interest rates steady on Nov. 1, the Russell 2000 (^RUT) has soared more than 20%. The commonly referenced index is used to encapsulate small-cap companies, which many had sold over the past year and a half over fears that higher interest rates would squeeze the companies.

But as investors have become increasingly confident that the Federal Reserve is closer to cutting interest rates than it is to raising them again, investors have snatched up interest rate sensitive sectors.

Small caps have become a favorite among that group, as many strategists have highlighted that indexes like the Russell 2000 are trading at a cheap valuation compared to the historical standard.

However, when asked further about small caps most strategists note they aren’t talking directly about the Russell 2000, per se.

Charles Schwab chief investment strategist Liz Ann Sonders highlighted to Yahoo Finance Live that the Russell 2000 doesn’t use a profitability filter. She estimated that 40% of the companies in the index aren’t profitable and 31% of the stocks are “zombie companies,” meaning they’re not turning profitable and are barely surviving.

“I’m not recommending the index,” Sonders said. “But if you’re looking for an index as a source for ideas, inherently, you have a higher quality index with the S&P 600 (^SP600) because of that profitability filter.”

Matt Stucky, a senior portfolio strategist at Northwestern Mutual Wealth Management, has been “overweight small caps.” But, he too sees a key difference in what exactly that means. He prefers to also go fishing in the S&P 600.

“That’s not abnormal for smaller companies that are growing to scale, but with our assessment, we think overweighting factors like profitability makes sense.”

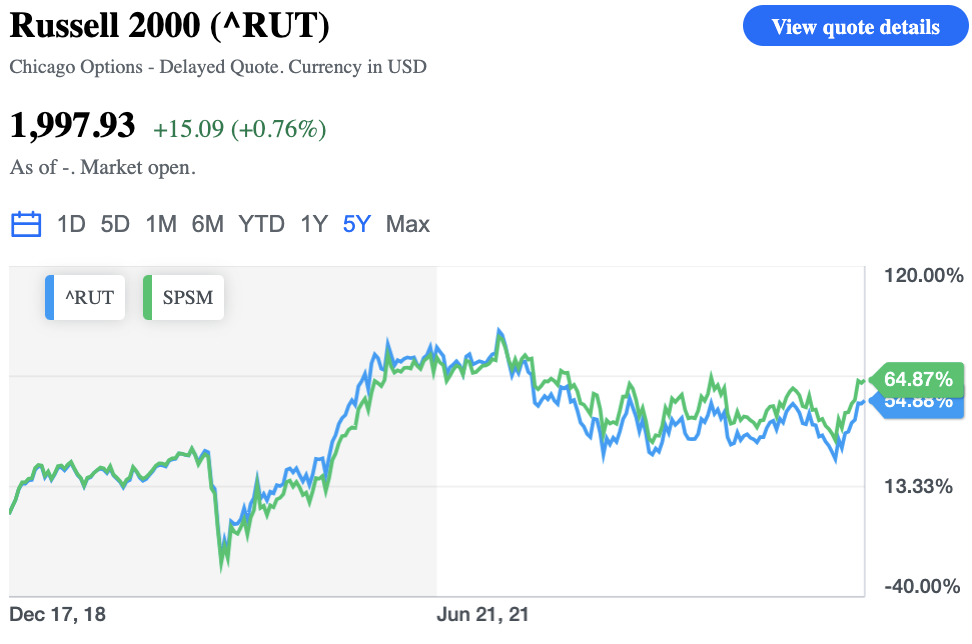

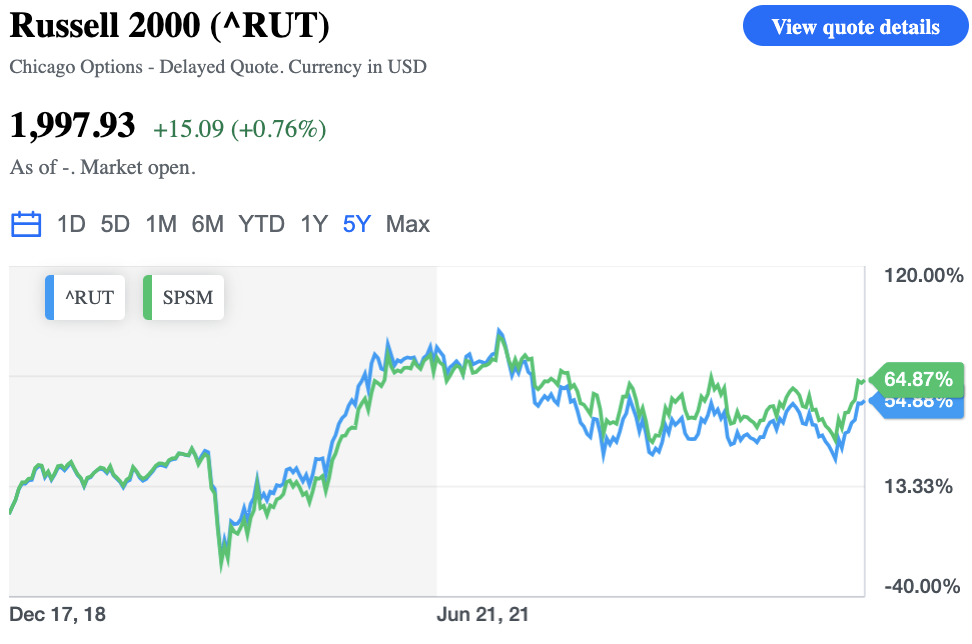

Over the last month, the returns in the two indexes are roughly the same. However, tracking back five years, the value-focused S&P 600 has outperformed, growing about 65% compared to the Russell 2000’s 55% return.