US stocks retreated on Tuesday, with investors still focused on the path of interest rates after a lackluster start to earnings season that kicked off with big bank results.

Dow Jones Industrial Average (^DJI) dropped 0.4%, while S&P 500 (^GSPC) shed 0.5%. The tech-heavy Nasdaq (^IXIC) fell roughly 0.5%.

All three major indexes closed Friday with weekly wins, and investors are looking to quarterly results from the financial sector and upcoming retail data to keep the momentum going, after a bumpy start to 2024.

Goldman Sachs (GS) shared opened slightly higher after the bank reported a fourth quarter earnings jump of 51% year-over-year. Goldman Sachs said its full-year net income of $8.52 billion for 2023 was down 24% as dealmaking slowed across the industry.

Morgan Stanley (MS) shares dipped more than 3% despite a fourth quarter revenue beat. The bank’s profit was impacted by a one time charge of $535 million.

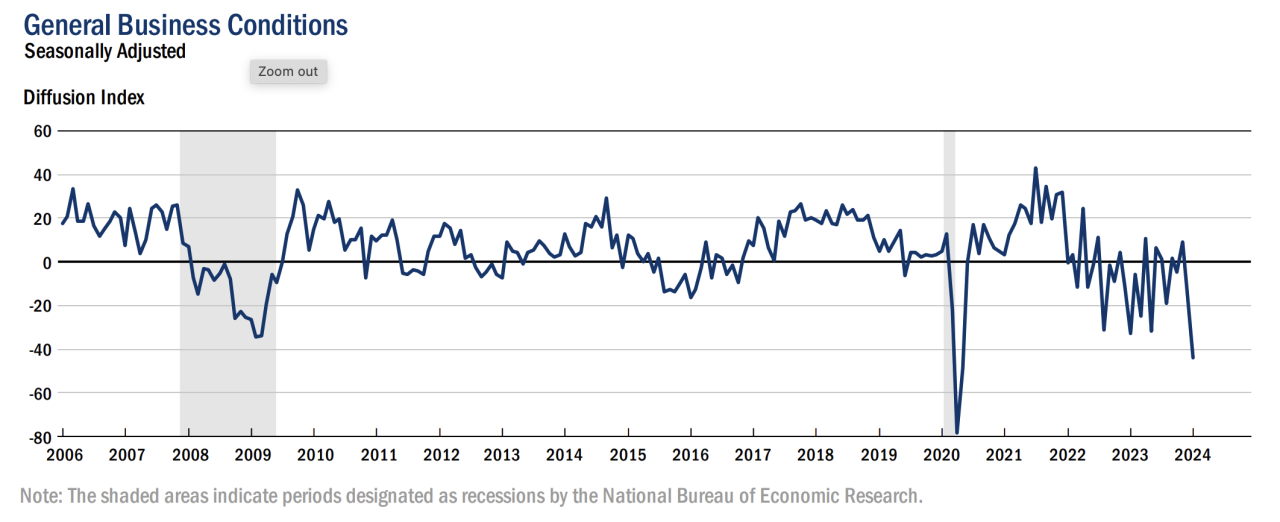

The New York Federal Reserve’s Empire State Manufacturing Survey released on Tuesday morning showed activity plunged to its lowest level since May 2020 this month.

Investors are counting down to Wednesday’s retail sales report, as they track each release that could influence the Federal Reserve’s data-driven policy thinking. Last week’s surprise cooling in US wholesale inflation nudged up hopes for an interest-rate cut in March.

Focus will likely turn to Fed Governor Chris Waller’s comments due later Tuesday for more clues after Atlanta Fed chief Raphael Bostic and a top IMF official warned it’s too early to declare victory on inflation.

In corporates, Tesla (TSLA) shares recovered from earlier losses after its CEO Elon Musk said that unless he has roughly 25% voting control at the EV maker, he’d prefer to build artificial intelligence and robotics products elsewhere.

Live3 updates

Click here for in-depth analysis of the latest stock market news and events moving stock prices.

Read the latest financial and business news from Yahoo Finance