[Note: A version of this article was previously published on TKer.co.]

Stocks made new record highs, with the S&P 500 reaching a closing high of 4,958.61 and an intraday high of 4,975.29 on Friday. For the week, the S&P rose 1.4%. The index is now up 4% year to date and up 40% from its October 12, 2022 closing low of 3,577.03.

Various aspects of the markets and the economy can be worse and good, simultaneously. They can also be both better and bad.

That’s because “worse” and “better” are relative terms, and “good” and “bad” are absolute terms.

Kind of like when you’re starting to recover from the flu. Maybe you feel better. But that doesn’t mean you feel good.

In the markets and the economy, this can get confusing when you consider developments in the various metrics investors follow.

For instance, size is an absolute. And the relative terms used to describe size include “growing” and “shrinking.”

But the concept of growth can also be considered an absolute. And relative terms like “accelerating” and “decelerating” describe it.

Lately, a number of aspects of the economy can be described with relative and absolute terms that can seem contradictory, making it tricky to conclude how good or bad things really are.

Economic activity: Decelerating growth

The early phases of the economic recovery were characterized by hot growth fueled by massive tailwinds, including excess savings and robust business investment activity.

Over recent months, the economy has entered a phase where it is still growing, but that growth is decelerating a bit. The hot labor market has cooled, consumer finances have gone from unusually strong to more normal, and surging capex orders have leveled off at record levels.

None of this is to suggest the economy is looking bad. Rather, it’s gone from very hot to just pretty good.

Prices: Cooling inflation

The biggest economic story of the last three years has been inflation rates reaching their highest levels in four decades.

Since peaking in early 2022, inflation rates have been coming down.

However, recent developments in prices have confused those who mistakenly thought falling inflation meant falling prices.

In actuality, falling inflation only means that the pace at which prices are rising is slowing. That is to say: Prices are still rising.

The chart above reflects an inflation rate — a relative measure. The chart below reflects price level — an absolute measure.

For more on decelerating economic growth and cooling inflation, read: The bullish ‘goldilocks’ soft landing scenario that everyone wants

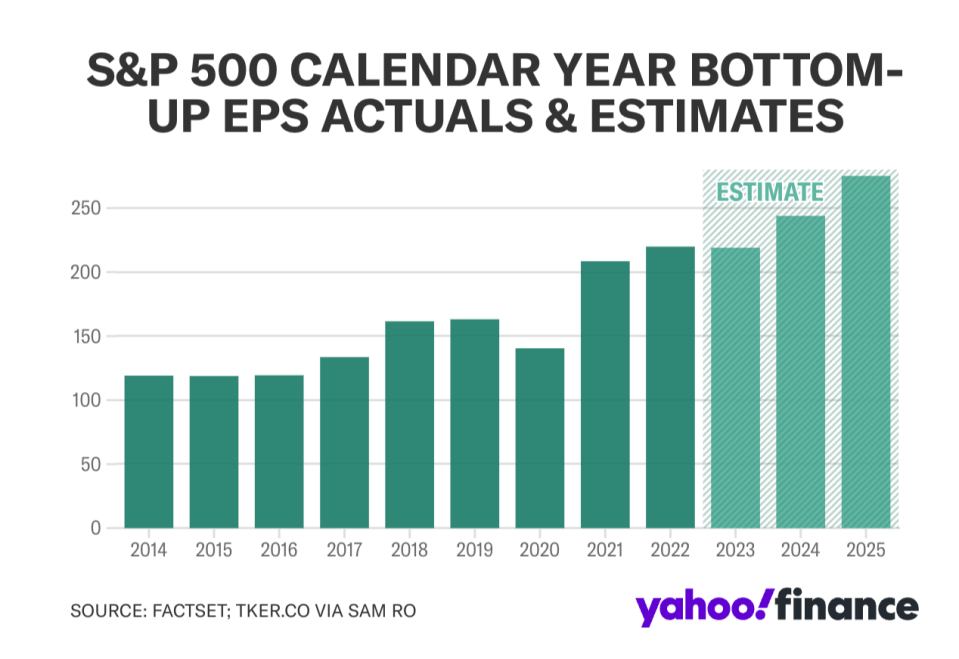

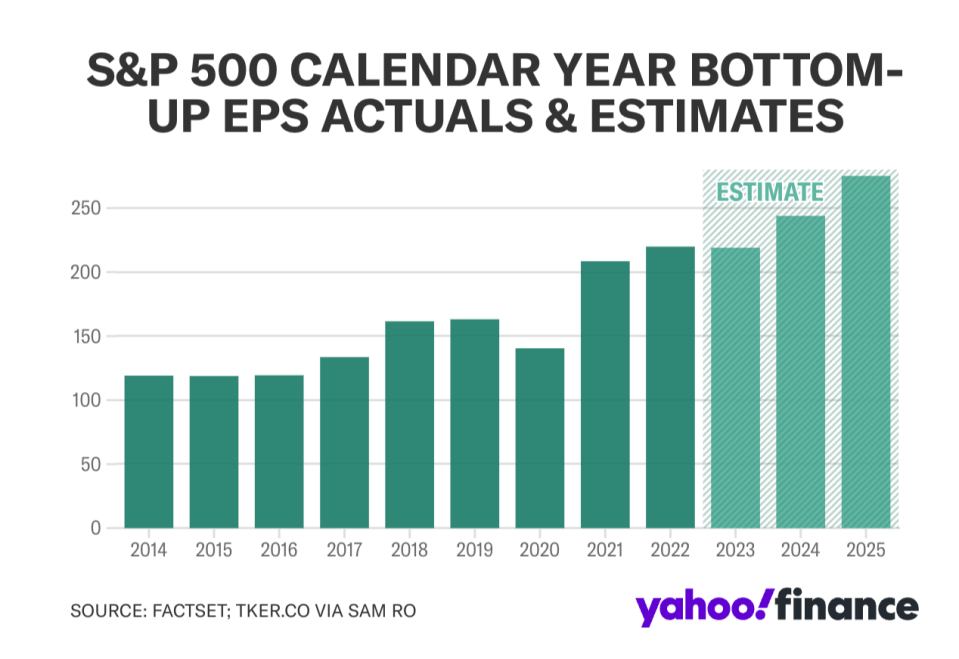

Earnings: Growing with beats and misses

In the stock market, a popular set of relative terms are “beat” and “miss.” They’re typically used in the context of a company’s quarterly earnings report — whether or not it comes in higher or lower than what analysts had forecast.

Unfortunately, whether a company beats or misses these expectations does not tell you much about the level or direction of earnings.

For example, a company can beat estimates by reporting a smaller-than-expected contraction in earnings. Similarly, it can miss estimates by reporting smaller-than-expected growth in earnings

Sure, there’s a case to be made that better-than-expected earnings are more good than they are bad.

Still, it’s that much better when earnings are growing instead of contracting, regardless of if those growing earnings are beating or missing expectations.

Fortunately — as this chart I shared with Yahoo Finance shows — earnings appear to be growing.

A VERY important observation about recessions

Nobody likes recessions, especially those whose jobs and incomes are affected.

But from a big-picture perspective, it’s important to remember that recessions describe the direction of the economy, not the level.

Consider the fact that the unemployment rate currently sits at 3.7%, a level that’s barely above 50-year lows. One respected recession indicator would envision such a scenario if the three-month average unemployment rate moved up to 4.0% in the near future. (This is according to the Sahm Rule, observed by the brilliant Claudia Sahm. Read how this works in her newsletter.)

In this case, the direction of unemployment would suggest that the economy is less good than where it once was.

But how bad is 4.0%?

The chart below tracks the unemployment rate over the past 50 years, with recession highlighted by the vertical gray bars. As you can see, there are historical examples of economic expansions during which the unemployment rate either never fell as low as 4.0% or spent very little time at or below 4.0%.

In other words, while a 4.0% unemployment rate might characterize a recession today, it also reflected economic boom times in the past.

Admittedly, it’s probably controversial to suggest that the next recession might not be that bad.

For now, all I’ll say is this is how recessions are defined, and this is what the historical data shows.

For more on how to think about the next recession, read: The glass-half-full view of what could be the next recession

Zooming out

The language we use can shape how we perceive the world.

So, it’s very important to understand what’s actually being said, especially when people are using relative terms.

As we’ve discussed, there are many ways the markets and the economy can be described as getting worse.

But does that mean things are actually bad?

Not necessarily.

Reviewing the macro crosscurrents

There were a few notable data points and macroeconomic developments from last week to consider:

Fed wants to be “confident” inflation is under control. On Wednesday, the Federal Reserve kept monetary policy tight, leaving its target for the federal funds rate unchanged at a range of 5.25% to 5.5%. This was widely expected.

With inflation rates having largely normalized and economic data showing signs of cooling, the big question is if and when the Fed will begin to cut rates.

As we’ve been reiterating in TKer’s weekly review of macro crosscurrents, the Fed has indicated it prefers to see inflation near target levels for a little while before it decides to employ less hawkish monetary policy.

The central bank reiterated this view in its new policy statement: “In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%.”

While it’s uncertain exactly when the Fed could start easing policy, Chair Powell indicated it was unlikely that policy would need to be any tighter. From his press conference: “We believe that our policy rate is likely at its peak for this tightening cycle and that, if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.”

For more on the outlook for monetary policy, read: Monetary policy: Tight for how long? and Whether or not the Fed cuts rates is not the right question

The labor market continues to add jobs. According to the BLS’s Employment Situation report released Friday, U.S. employers added 353,000 jobs in January. It was the 37th straight month of gains reaffirms an economy with robust demand for labor.

Total payroll employment is at a record 157.7 million jobs.

The unemployment rate — that is, the number of workers who identify as unemployed as a percentage of the civilian labor force — stood at 3.7% during the month. While it’s above its cycle low of 3.4%, it continues to hover near 50-year lows.

For more on the labor market, read: Labor market: How cool will it get?

Wage growth ticks higher. Average hourly earnings rose by 0.6% month-over-month in January, up slightly from the 0.4% pace in December. On a year-over-year basis, this metric is up 4.5%, a rate that’s generally been cooling but remains elevated.

It’s worth noting the BLS’s numbers may have been affected by seasonal distortions. From Bloomberg’s Matthew Boesler: “Bad weather probably reduced the reported length of the average workweek, in turn boosting the hourly earnings calculation… Mike McCall, an economist at the BLS, explained via email how a drop in hours in two sectors with lower-than-average hourly earnings — retail trade and leisure and hospitality — impacted the overall figure.”

The raises are getting smaller for job stayers and changers. From payroll processor ADP: “Pay gains continued to shrink in January. Year-over-year pay gains for job-stayers reached 5.2% in January, down from 5.4% in December. For job-changers, pay was up 7.2%, the smallest annual gain since May 2021.”

Key labor costs metrics are cooling. The employment cost index in the Q4 2023 was up 0.9% from the prior quarter, down from 1.1% rate in Q3. On a year-over-year basis, it was up 4.2% in Q4, down from the 4.3% rate in Q3

For more on why policymakers are watching wage growth, read: A key chart to watch as the Fed tightens monetary polic

Labor productivity is up. From the BLS: “Nonfarm business sector labor productivity increased 3.2% in the fourth quarter of 2023, the U.S. Bureau of Labor Statistics reported today, as output increased 3.7% and hours worked increased 0.4%.”

From Wells Fargo: “The improved trend in productivity alongside cooler growth in nominal compensation costs has led to a sharp reduction in inflationary pressures emanating from the jobs market.”

Job openings tick up. According to the BLS’s Job Openings and Labor Turnover Survey, employers had 9.03 million job openings in December. While this remains elevated above prepandemic levels, it’s down from the March 2022 high of 12.03 million.

While the December print reflected a month-over-month uptick, the trend still appears to be downward.

For more on how data can be noisy, read: The markets and the economy are ‘full-on Monet’

During the period, there were 6.27 million unemployed people — meaning there were 1.44 job openings per unemployed person. This continues to be one of the most obvious signs of excess demand for labor.

For more on job openings, read: Were there really twice as many job openings as unemployed people?

Layoffs remain depressed, hiring remains firm. Employers laid off 1.62 million people in December. While challenging for all those affected, this figure represents just 1.0% of total employment. This metric continues to trend below pre-pandemic levels.

Hiring activity continues to be much higher than layoff activity. During the month, employers hired 5.87 million people.

For more on why this metric matters, read: Watch hiring activity

Unemployment claims rise. Initial claims for unemployment benefits increased to 214,000 during the week ending January 20, up from 189,000 the week prior. This is the highest print since November 2022. This is above the September 2022 low of 182,000, but it continues to trend at levels historically associated with economic growth.

For more on the labor market, read: The hot but cooling labor market in 16 charts

Consumer confidence jumps. From the University of Michigan’s January Surveys of Consumers: “Consumer sentiment confirmed its early-month reading, surging 13% to reach its highest level since July 2021, reflecting improvements in the outlook for both inflation and personal incomes. January’s gain has been exceeded only five times since 1978, one of which was last month at an even larger increase of 14%. Consumers expressed gains in their views on their personal finances as well as the macroeconomy; the short-run business outlook soared 27%. After reserving judgment last fall about whether the slowdown in inflation would persist, consumers now feel assured that inflation will continue to soften.”

The Conference Board’s Consumer Confidence Index in January surged its highest level since December 2021. From the firm’s Dana Peterson: “January’s increase in consumer confidence likely reflected slower inflation, anticipation of lower interest rates ahead, and generally favorable employment conditions as companies continue to hoard labor. … The gain was seen across all age groups, but largest for consumers 55 and over. Likewise, confidence improved for all incomes groups except the very top; only households earning $125,000+ saw a slight dip.”

For more on improving sentiment, read: The economic vibes are healing

Meanwhile, “Consumers’ assessment of their Family’s Current Financial Situation was more positive in January.”

For more on consumer finances, read: People have money

Why consumers aren’t getting crushed by higher interest rates. From Apollo Global’s Torsten Slok: “Eighty-nine percent of US household debt is fixed rate (mortgage, student, and auto loans) and 11% is floating rate (credit cards, HELOC, and other types of debt). As a result, the transmission mechanism of monetary policy has been weak. Combined with significant excess savings during the pandemic, Fed hikes have had a limited impact on the consumer.”

Labor market confidence jumps. From The Conference Board’s December Consumer Confidence survey: “Consumers’ appraisal of the labor market was also more positive in January. 45.5% of consumers said jobs were ‘plentiful,’ up from 40.4% in December. 9.8% of consumers said jobs were ‘hard to get,’ down from 13.1%.”

Many economists monitor the spread between these two percentages (a.k.a., the labor market differential), and it’s been reflecting a cooling labor market.

For more on the labor market, read: The hot but cooling labor market in 16 charts

People are driving. Weekly EIA data through January 26 show gasoline demand is up from a year ago.

Gas prices tick up. From AAA: “The national average for a gallon of gas rose by a nickel since last week to $3.15. The upward trend is likely a combination of oil costs edging into the upper $70s per barrel and normal seasonal increases as winter eases and demand for gas creeps higher.”

For more on energy prices, read: The other side of the oil price story

Mortgage rates tick down. According to Freddie Mac, the average 30-year fixed-rate mortgage declined to 6.63% from 6.69% the week prior. From Freddie Mac: “Although affordability continues to impact homeownership, the combination of a solid economy, strong demographics and lower mortgage rates are setting the stage for a more robust housing market. Mortgage rates have been stable for nearly two months, but with continued deceleration in inflation, rates are expected to decline further.”

Home prices rise. According to the S&P CoreLogic Case-Shiller index, home prices rose 0.2% month-over-month in November.

For more on mortgages and home prices, read: Why home prices and rents are creating all sorts of confusion about inflation

There aren’t too many places to move into. Here’s the NAHB blog on Q4 2023 Census data: “The national rental vacancy rate stayed at 6.6%, and the homeowner vacancy rate inched up to 0.9% from 0.8%. The homeowner vacancy rate is still hovering near the lowest rate in the survey’s 67-year history (0.7%).”

🔨 Construction spending rises. Construction spending rose 0.9% to an annual rate of $2.096 trillion in December.

Manufacturing surveys improve. From S&P Global’s January Manufacturing PMI: “Manufacturers have started the year with a spring in their step. Business optimism about the year ahead has surged to its highest since early 2022 thanks to a jump in demand. New orders are rising at a pace not seen for over a year and a half, improving especially sharply for consumer goods as households benefit from signs of an easing in inflation and looser financial conditions. Factories are also showing signs of restocking, with some firms buying more inputs to support higher production in the coming months. Payroll numbers are also rising again as firms seek to build extra operating capacity, boding well for the upturn to gain further strength as we head through the first quarter.”

The ISM’s January Manufacturing PMI also improved, led by significant gains in new orders activity.

It’s worth remembering that soft data like the PMI surveys don’t necessarily reflect what’s actually going on in the economy.

For more on this, read: What businesses do > what businesses say

Near-term GDP growth estimates look good. The Atlanta Fed’s GDPNow model sees real GDP growth climbing at a 4.2% rate in Q1.

For more on economic growth, read: Economic growth: Slowdown, recession, or something else?

Putting it all together

We continue to get evidence that we are experiencing a bullish “Goldilocks” soft landing scenario where inflation cools to manageable levels without the economy having to sink into recession.

This comes as the Federal Reserve continues to employ very tight monetary policy in its ongoing effort to get inflation under control. While it’s true that the Fed has taken a less hawkish tone in 2023 and 2024 than in 2022, and that most economists agree that the final interest rate hike of the cycle has either already happened, inflation still has to stay cool for a little while before the central bank is comfortable with price stability.

So we should expect the central bank to keep monetary policy tight, which means we should be prepared for tight financial conditions (e.g., higher interest rates, tighter lending standards, and lower stock valuations) to linger. All this means monetary policy will be unfriendly to markets for the time being, and the risk the economy slips into a recession will be relatively elevated.

At the same time, we also know that stocks are discounting mechanisms — meaning that prices will have bottomed before the Fed signals a major dovish turn in monetary policy.

Also, it’s important to remember that while recession risks may be elevated, consumers are coming from a very strong financial position. Unemployed people are getting jobs, and those with jobs are getting raises.

Similarly, business finances are healthy as many corporations locked in low interest rates on their debt in recent years. Even as the threat of higher debt servicing costs looms, elevated profit margins give corporations room to absorb higher costs.

At this point, any downturn is unlikely to turn into economic calamity given that the financial health of consumers and businesses remains very strong.

And as always, long-term investors should remember that recessions and bear markets are just part of the deal when you enter the stock market with the aim of generating long-term returns. While markets have had a pretty rough couple of years, the long-run outlook for stocks remains positive.

[Note: A version of this article was previously published on TKer.co.]