A natural gas (NG=F) glut in the US has sent prices for the commodity tumbling to multi-decade lows, down 43% over the past year.

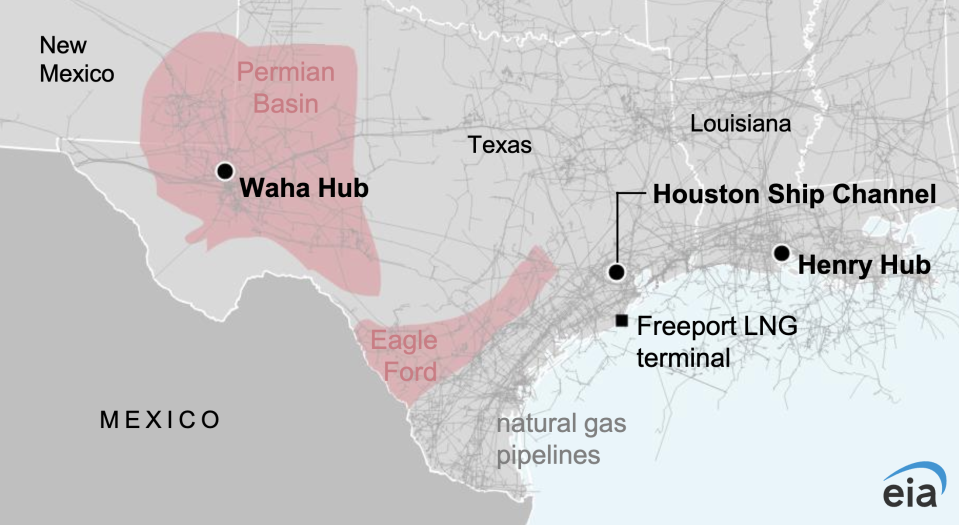

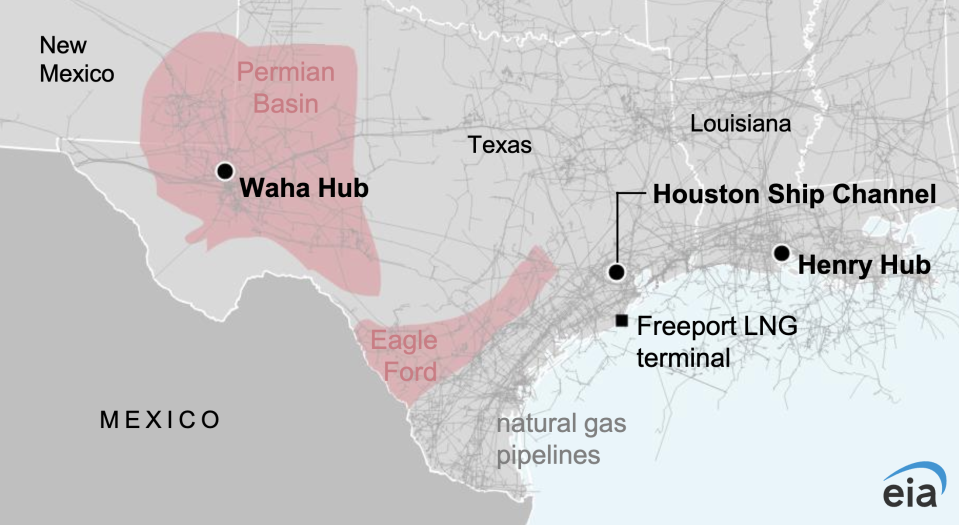

At West Texas’s key trading spot, the Waha Hub, prices have been negative for the majority of March and into April, according to government data released this week. That means producers have essentially paid someone to take it off their hands.

The phenomenon highlights a multiyear challenge plaguing the Permian Basin in West Texas: a lot of natural gas and not enough capacity to transport the commodity out of the area.

“The US domestic natural gas market has plenty of supply capacity and not enough takeaway capacity,” Ed Hirs, senior fellow at the University of Houston, told Yahoo Finance.

In recent years, prices at the Waha Hub have dipped into negative territory numerous times, falling below the US benchmark, the Henry Hub level.

Most natural gas production in the Permian Basin is a byproduct of crude oil production, often referred to as associated gas. As US oil output hit record highs last year, so did the supply of natural gas.

On Thursday, futures fell to trade below $1.80 per million British Thermal Units (BTUs) after Energy Information Administration (EIA) data showed stockpiles last week were about 38% above five-year averages.

A mild winter has exacerbated downward pressure on prices this year. The EIA expects natural gas inventories will “remain relatively high and natural gas spot prices to remain relatively low through 2025.”

The oversupply has already prompted producers to curtail output. Some energy analysts point to the risk of less oil production growth at a time when West Texas Intermediate (CL=F) has climbed 20% year to date.

“The lack of this pipeline takeaway capacity may limit Permian Basin oil production in 2024 since companies cannot simply burn off the associated gas into the atmosphere,” Andy Lipow, president of Lipow Oil Associates, told Yahoo Finance.

On Thursday, Goldman Sachs analysts said a drop in US oil output in January was due to extreme weather and shale producers’ inability to transport byproduct natural gas, among other factors.

“The transportation constraints sharply reduce the marginal price of natural gas in the Permian, which can reduce the incentives to produce oil and associated gas,” Yulia Zhestkova Grigsby and her team wrote.

The analysts estimate marginal revenues from associated gas per barrel of oil produced in the Permian have dropped to less than $2 per barrel in the first quarter of 2024, down from almost $20 per barrel in 2022.

This week, APA (APA), the holding company for hydrocarbon explorer Apache, revealed it curtailed natural gas production in the first quarter, mostly during the month of March in response to weak or negative Waha hub prices.

Several projects have been implemented to expand takeaway capacity in the Permian Basin, including the new Matterhorn Express Pipeline connecting West Texas and Southern New Mexico to Houston, which is slated to be completed by the end of 2024.

“They [the projects] will help, but they are not large enough to solve the problem by themselves,” said University of Houston’s Hirs.

“As the Permian field continues forward, the gas-oil ratio is increasing,” he said. “More takeaway capacity needs to be added.”

Analysts expect demand for natural gas to increase as energy consumption rises due to AI and the industrialization of green energy.

“The demand is much harder to change in the long term,” Vijay Marolia, chief investment officer at RP Capital, told Yahoo Finance. “Supply is going to go down in the future, and that will cause the price to go up.”

Ines Ferre is a senior business reporter for Yahoo Finance. Follow her on X at @ines_ferre.

Click here for in-depth analysis of the latest stock market news and events moving stock prices.

Read the latest financial and business news from Yahoo Finance