In the opening months of 2024, large-company growth stock funds have continued their run, ranking among the best-performing categories this year.

While growth stocks have stumbled in recent weeks as higher-than-expected inflation readings led investors to push back their expectations for Federal Reserve rate cuts, the group has been led by gains in technology stocks, especially those seen to benefit from the artificial intelligence boom.

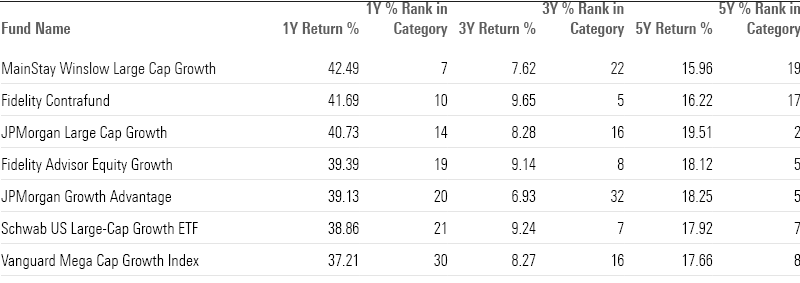

The best large-growth funds over the last one-, three-, and five-year periods include offerings from Fidelity Investments, Vanguard, JPMorgan, and Schwab. Only two index funds made the cut.

- MainStay Winslow Large Cap Growth MLRSX

- Fidelity Contrafund FCNKX

- JPMorgan Large Cap Growth JLGMX

- Fidelity Advisor Equity Growth FZAFX

- JPMorgan Growth Advantage JGVVX

- Schwab US Large Cap Growth ETF SCHG

- Vanguard Mega Cap Growth Index VMGAX

Large-Growth Fund Performance

Recent returns from large-growth funds have beaten those of the overall stock market. The average large-growth fund has gained just shy of 8% in 2024, outstripping the 5.35% rise in the Morningstar US Market Index.

Over the longer term, the group has a mixed picture. Thanks to the 2022 bear market, which hit growth stock funds particularly hard, the category’s average annual return of 4.43% over the last three years lags the market’s 5.06%. But the average large-growth fund has risen 13.52% per year over the last five years, while the US Market Index has been up 11.12% per year.

What Are Large-Growth Stock Funds?

Stocks in the top 70% of the capitalization of the US equity market are defined as large-cap. Large-growth portfolios focus on companies in rapidly expanding industries. The categorization is based on fast growth (high growth rates for earnings, sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields). Large-growth portfolios invest primarily in big US companies projected to grow faster than other large-cap stocks.

Screening for the Best-Performing Large-Growth Funds

We screened for funds that ranked in the top 33% of the Large Growth Morningstar Category using their lowest share classes over the past one-, three-, and five-year periods. We then filtered for funds with Morningstar medalist ratings of Gold, Silver, or Bronze. We then selected funds with asset bases greater than $100,000 and an analyst coverage threshold of 90% or greater. Because the screen was created with the lowest-cost share class for each fund, some may be listed with share classes not accessible to individual investors outside of retirement plans. The individual investor versions of these funds may carry higher fees.

Among the funds that passed the screen, the actively managed $14.4 billion MainStay Winslow Large Cap Growth posted the best returns over the last 12 months, with a 42.49% gain. In the year to date, the fund is up 10.17%, while over the past three years, it has climbed an average of 7.62% per year, compared with the category’s average 4.38% gain.

Fidelity Contrafund trails just behind, rising 41.69% over the last 12 months and outperforming the average fund in the category, which rose 31.79%. The $135.9 billion fund has gained 15.63% this year, while the average fund in its category is up 7.97%. Over the past three years, the fund has climbed an average of 9.65% per year.

The two index funds that made the list are Schwab US Large-Cap Growth ETF and Vanguard Mega Cap Growth Index. Over the past year, the Vanguard Mega Cap Growth Index rose 37.21%. The $19.1 billion fund has climbed 7.67% this year, just behind the category average. Over the past three years, the fund is up 8.27%. Meanwhile, the $26.3 billion Schwab US Large-Cap Growth ETF is up 38.86% over the past year, 8.8% in the year to date, and 9.24% over the past three years.

The Eight Best-Performing Large-Growth Stock Funds

Here are closer looks at these funds from Morningstar analysts.

MainStay Winslow Large Cap Growth

- Ticker: MLRSX

- Morningstar Medalist Rating: Bronze

“The team categorizes stocks as consistent, dynamic, or cyclical growers. The managers adjust the bucket weightings based on relative valuations, with each tending to have 25%-40% of assets at a given time. Consistent growers such as Microsoft MSFT demonstrate robust earnings growth and can better weather economic downturns; dynamic growers such as Nvidia NVDA have clear competitive advantages and over 10% revenue growth; and cyclical growers such as Apple AAPL are selected for their potential earnings growth in the next two years, depending on economic forecasts.”

—Andrew Redden, analyst

Fidelity Contrafund

- Ticker: FCNKX

- Morningstar Medalist Rating: Silver

“Manager Will Danoff looks for best-of-breed companies with competitive advantages, improving earnings potential, and capable leadership. He is particularly fond of founder-led firms. So it is unsurprising to see him express high conviction in Meta, which this portfolio has held since before its 2012 debut as a public company, then called Facebook.

“The portfolio has become increasingly defined by the stock. Through its outperformance, the stock reached over 12% of assets as of year-end 2023. That’s a huge position size relative to the stock’s 2%-4% share of relevant large-blend and large-growth indexes; it topped the Meta stakes of all other U.S.-sold funds aside from sector funds; and it marked the strategy’s largest stake since at least the turn of the century.

“Danoff has successfully steered this diversified strategy through multiple market cycles, including recent ones. The fund’s roughly 13% annualized return over the past decade beat the S&P 500 (the fund’s broad-market prospectus benchmark) and ranked among the best-performing third of funds in either the large-blend or large-growth Morningstar Categories. It’s a particularly impressive feat given the strategy’s colossal asset base of more than $200 billion across all accounts, which has long limited its flexibility.”

—Robby Greengold, strategist

JPMorgan Large Cap Growth

- Ticker: JLGMX

- Morningstar Medalist Rating: Bronze

“Manager Giri Devulapally and his team aim to find big long-term winners while minimizing downside risk. They seek companies with competitive advantages, margin expansion opportunities, and large addressable markets. Devulapally believes the biggest winners are often expensive. Even so, he closely monitors each stock’s relative price tag and will trim it if its valuation looks stretched relative to its history. To minimize risk, he often sizes initial positions modestly and will bolster the position if the stock goes up or cut losses upon a decline”

—Andrew Redden, analyst

Fidelity Advisor Equity Growth

- Ticker: FZAFX

- Morningstar Medalist Rating: Bronze

“As of March 2023, in the Russell 1000 Growth Index, Apple and Microsoft constituted a massive 24% weighting. That month, the fund had a near-market weight in Microsoft but a much lower stake in Apple, so the pair had a 14% weighting in total. That made room for favored non-US stocks: Universal Music Group, Reliance Industries, and Taiwan Semiconductor TSM are top-20 picks that together held 5% of assets.

The fund similarly is a little lighter in the heaviest sectors in the growth indexes. As of March, the Russell 3000 Growth prospectus benchmark had a 40% weighting in technology stocks and 14% in consumer discretionary fare. Meanwhile, the fund devoted 33% and 11%, respectively, to those areas. It overweighted the healthcare sector, a key growth area, as well as industrials—a less-traditional area for growth investors.”

—Todd Trubey, senior analyst

JPMorgan Growth Advantage

- Ticker: JGVVX

- Morningstar Medalist Rating: Silver

“This is an all-cap portfolio, but it has leaned more heavily on large caps in recent years. As of June 2023, large- and mega-cap stocks took up about 80% of assets versus around 50% a decade earlier. Asset growth at this strategy and JPMorgan Small Cap Growth likely has played a role in a shift away from small caps, although the closing of the small-cap fund in 2021 helps preserve this fund’s ability to own some of the same stocks, even if at modest weightings. The portfolio still owns more mid-cap stocks than the Russell 3000 Growth Index prospectus benchmark. At the end of June 2023, its 20% mid-cap stake was roughly twice that of the benchmark.

“Key active bets versus the benchmark include underweightings in the largest companies such as Apple AAPL and Microsoft MSFT. Parton has preferred smaller companies perceived to have greater upside potential.”

—Adam Sabban, senior analyst

Schwab US Large Cap Growth ETF

- Ticker: SCHG

- Morningstar Medalist Rating: Silver

“This low-turnover portfolio is dominated by growth names with sound financial footing that are leaders in their industry, imparting a slight quality tilt. Names like Apple and Microsoft make up the top spots in the portfolio. The fund’s profitability—proxied by its return on invested capital—has averaged 1 percentage point higher than its average peer over the trailing five years through April 2023.

“Most of the fund’s sector exposures have hewed close to its average peer. The fund’s sector allocations do not deviate by more than 4 percentage points except for its exposure to tech stocks, which was 9 percentage points higher than the category average as of April 2023. It made up some of the difference by underweighting industrial stocks by 3 percentage points.”

—Mo’ath Almahasneh, associate analyst

Vanguard Mega Cap Growth Index

- Ticker: VMGAX

- Morningstar Medalist Rating: Silver

“The fund tracks the CRSP U.S. Mega Cap Growth Index, which captures the growth-oriented side of the mega-cap market. Growth stocks tend to have high valuations because of investor sentiment around their superior growth prospects. While growth stocks constitute much of the fund, value and blend stocks are also present, which should steady the fund when its growth holdings can’t meet their lofty expectations.

“The index’s narrow scope heightens firm-specific risk exposure and pronounced sector biases compared with its average peer in the large-growth category. As of May 2023, the fund’s top 10 holdings made up three-fifths of its portfolio, with Apple (16%) and Microsoft (15%) accounting for 31% by themselves. Certain sector concentrations are inherent to the large-growth category, but they are even more pronounced here. Technology stocks are given greater emphasis thanks to their recent relative strength.”

—Zachary Evens, analyst