Key Takeaways

- Target-date mutual funds continue to garner net inflows despite the growing popularity of target-date collective investment trusts. In 2023, target-date mutual funds raked in $32.6 billion, largely in line with 2022 when they amassed about $32.3 billion.

- American Funds Target Date Retirement, the only all-active-based series to crack the top 10 in flows, took in the most cash for the second year in a row. Investors’ net contributions hit $21.2 billion, roughly two thirds of all net target-date mutual fund flows.

- Fidelity Freedom Index and Vanguard Target Retirement series rounded out the top three.

- Target-date series with index funds as their underlying building blocks continued to dominate, making up six of the top 10 spots.

- Target-date mutual fund flows only tell part of the story. CITs play a major role in target-date assets and flows, though they are voluntarily reported, and usually on a lag compared with more regulated mutual funds. So, year-end CIT data for the target-date universe is not yet available.

2023 Net Flows

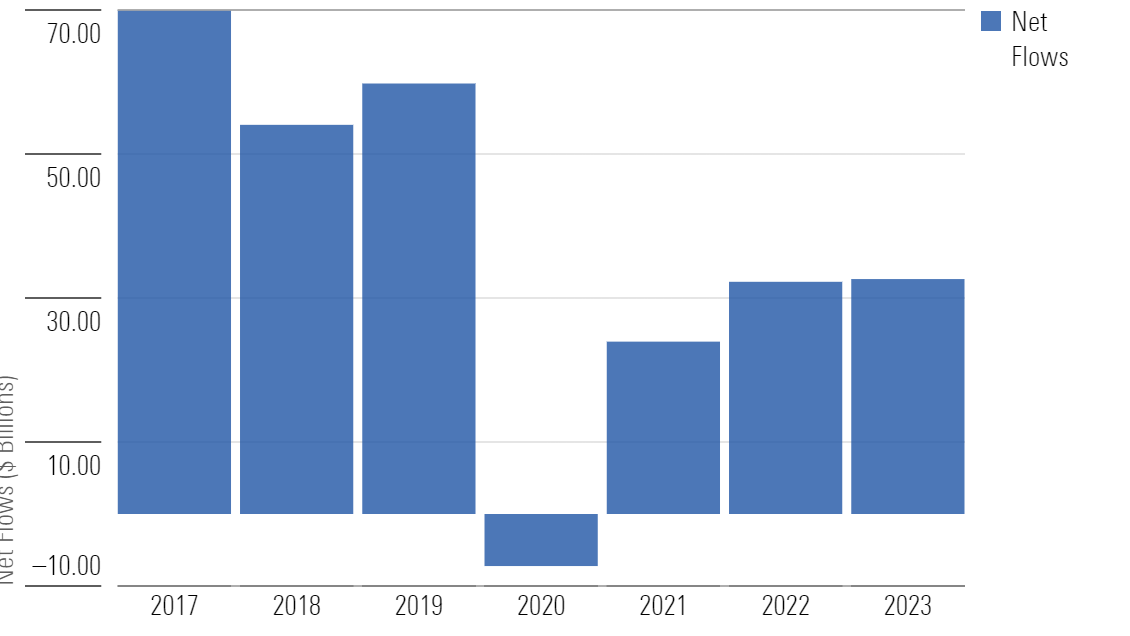

Target-date mutual funds raked in $32.6 billion during 2023, in line with the previous year’s haul. Despite a budding trend of stability, the numbers fall behind peak years such as 2017, when net contributions totaled $69.9 billion. Exhibit 1 illustrates the annual net flows into target-date mutual funds since 2017.

Net contributions to target-date mutual funds don’t paint the whole picture. Collective investment trusts have been making waves, taking in most of the net inflows since at least 2019. In fact, in 2022 CITs accounted for 79% of target-date strategies’ total flows and totaled 47% of assets. A large push toward lower costs has aided their success. CITs voluntarily report their assets and flows, typically on a lag, so year-end data is not yet available.

Big Players Maintain Their Popularity

The American Funds Target Date Retirement series secured its place at the top of the mutual fund target-date flows list for the second year in a row. Net inflows amounted to $21.2 billion, a 33% increase from 2022. It remains the only active-based target-date series to hit the top 10 yet again. The series stands apart in a space in which index-based series have largely claimed the throne. American Funds Target Date Retirement earns a Morningstar Medalist Rating of Gold for its cheapest share classes, differentiating itself through its balance of the firm’s renowned bottom-up security selection and its increasingly impressive asset-allocation research. Exhibit 2 outlines the remaining nine series.

Gold-rated Fidelity Freedom Index sits comfortably in the second slot with $15.6 billion in net flows, about $1.2 billion more than in 2022. Its strong team, which had its People rating upgraded to High from Above Average in 2023, straightforward portfolio construction, and low costs drive its appeal. The series isn’t the only success story for the firm. Silver-rated Fidelity Freedom Blend secured the seventh spot, bringing in a net $2 billion for the year. Its sustainability-focused series also experienced $19 million in net inflows after being launched in May 2023. But its flagship series—Fidelity Freedom—experienced about $9.6 billion in net outflows, the most of any target-date mutual fund series in 2023. It earned this dubious distinction in 2022 as well.

Silver-rated Vanguard Target Retirement secured the third spot with $9.5 billion in net flows. In 2020, the series experienced a large shift in flows to the firm’s CIT offering, which mirrors this series. 2022 marked the first year the CIT series had more assets than the mutual fund version. Despite the shift, the series continues to garner more flows than most target-date funds.

Underlying Influence

Target-date funds’ underlying building blocks can vary by series. As plan providers place a higher emphasis on costs, index-based series, or those that primarily rely on underlying index funds, have attracted more cash. In 2023, six of the top 10 series utilized index funds as their foundation. Together they amassed nearly $38.4 billion in net new contributions.

Blend (or hybrid) target-date strategies, those that have a notable allocation to both active and passive underlying funds, have been on the rise. Their appeal largely resides in their ability to provide some exposure to active management but also include passive exposure in more efficient asset classes to keep costs lower. Three blend series round out the top 10. Collectively they garnered $4.2 billion in net flows, a slight uptick from the blend series in the top 10 in 2022, which raked in about $4.0 billion. Fidelity Freedom Blend and Pimco RealPath Blend remained on the top-10 list, while JPMorgan SmartRetirement Blend broke through in 2023. The latter series raked in nearly a billion dollars after two years of outflows.