C and S funds spearhead TSP’s negative returns for February

In February, the Fixed Income Index Investment F fund posted the highest return at 2.20%.

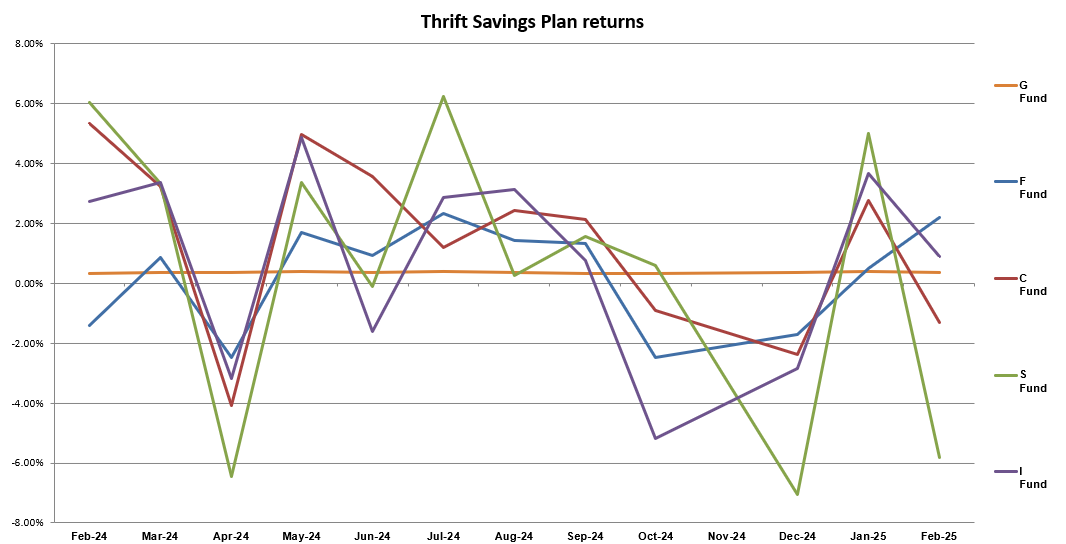

After a strong start in January, the Thrift Savings Plan saw month-over-month declines across all funds in February, with the Common Stock Index C fund and the Small Cap Stock Index Investment S fund posting the highest negative returns.

The S fund posted the largest negative return with -5.80%, while the C fund followed up with -1.30% return in February.

The rest of TSP funds achieved positive returns last month though almost all were lower compared to January. The Fixed Income Index Investment F fund posted the highest return at 2.20%.

Despite losing ground in February, the C fund still leads with the highest return of all TSP funds over the last 12 months with a total of 18.36%.

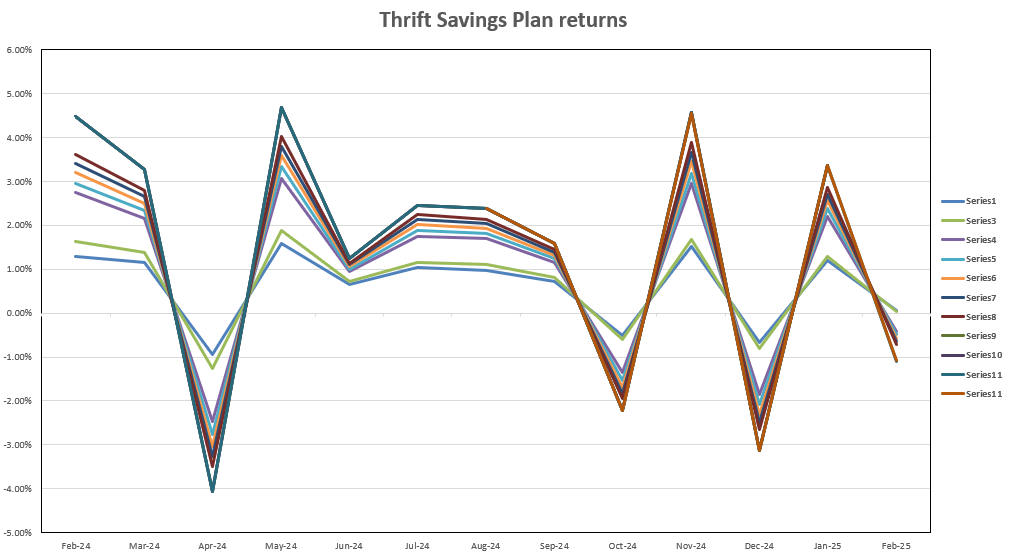

Only two Lifecycle funds posted positive returns in February, yet were still lower than what they earned in January. The L income posted the highest return at 0.07% and the L2025 was next with 0.04%. The L 2055, L 2060 and L 2065 all saw a negative return rate of -1.10%, with a 12-month return of 13.25%. The L 2070 fund also posted a negative return at -1.09% in February, and has no 12-month return data since the FTIRB created it in July 2024.

| Thrift Savings Plan — February 2025 Returns | |||

|---|---|---|---|

| Fund | February 2025 | Year-to-Date | Last 12 Months |

| G fund | 0.36% | 0.75% | 4.49% |

| F fund | 2.20% | 2.73% | 5.79% |

| C fund | -1.30% | 1.44% | 18.36% |

| S fund | -5.80% | -1.10% | 11.76% |

| I fund | 0.91% | 4.63% | 6.42% |

| L Income | 0.07% | 1.27% | 6.96% |

| L 2025 | 0.04% | 1.32% | 7.54% |

| L 2030 | -0.42% | 1.78% | 10.03% |

| L 2035 | -0.49% | 1.88% | 10.55% |

| L 2040 | -0.57% | 1.97% | 11.05% |

| L 2045 | -0.64% | 2.05% | 11.48% |

| L 2050 | -0.72% | 2.11% | 11.90% |

| L 2055 | -1.11% | 2.22% | 13.25% |

| L 2060 | -1.11% | 2.22% | 13.25% |

| L 2065 | -1.10% | 2.22% | 2.23% |

| L 2070 | -1.09% | 2.23% | N/A |

Copyright

© 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.