Past performance

Over the past one-year period, amid weakness in stock markets, multi-asset funds as a category have delivered average returns of 9.2%. Within the category, certain multi-asset funds have delivered higher returns. The stock market benchmark Nifty 50 has fetched a little over 2.6% in the same period.

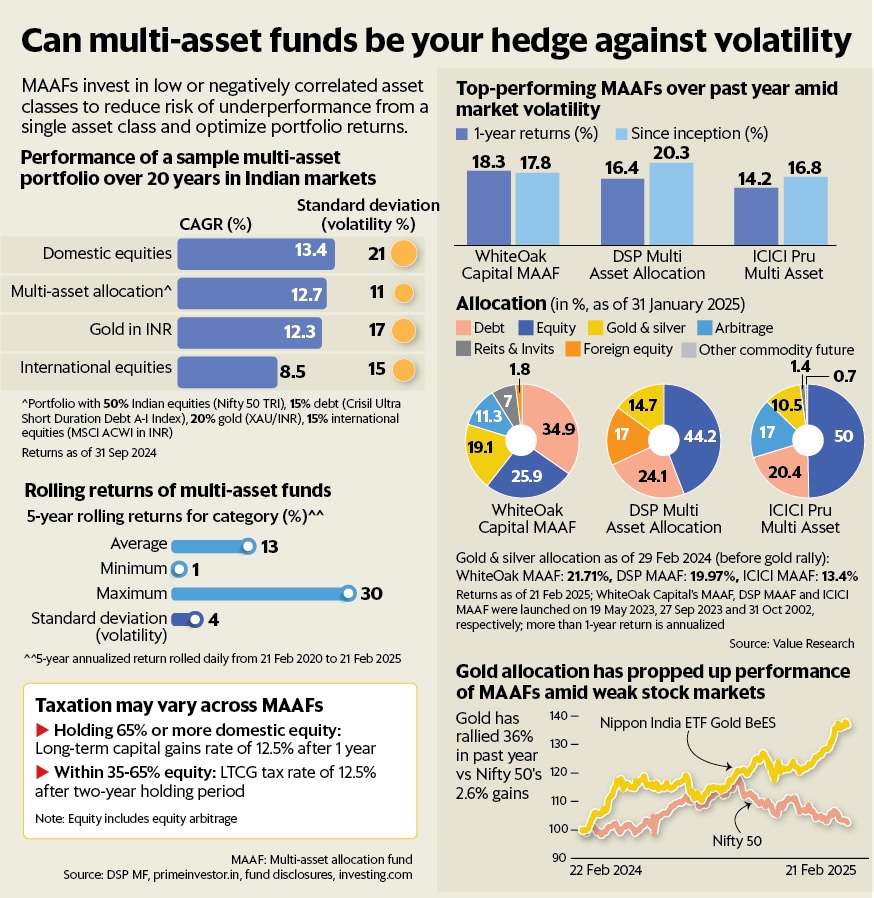

On a five-year rolling basis, multi-asset funds have delivered returns of 13% on an average between 21 February 2020 and 21 February 2025. Five-year rolling returns are simply five-year returns rolled daily between the above-mentioned dates. The same analysis shows that multi-asset funds have delivered a maximum of 30% five-year returns; the minimum is 1%. The funds showed a standard deviation (measures volatility) of 4% on an average.

An analysis done by WhiteOak Capital MF of three-year rolling returns between January 2001 and December 2024, showed that a 100% debt portfolio delivered annualized returns of 6.3% on an average, with standard deviation (volatility) of 3%; a sample of 75% debt-25% equity portfolio delivered 3-year rolling returns of 9.3%, with standard deviation of 2.9% and a 60% debt-20% equity-20% gold portfolio delivered returns of 10.2%, with standard deviation of 2.9%.

What about market crashes? An analysis by DSP MF showed that amid the covid-19 crisis in 2020, the Nifty TRI (total returns index) showed a maximum drawdown of 38%, while it was 18% for a multi-asset portfolio. TRI reflects index returns from price movement of the index stocks, as well as gains from the dividends paid by the companies.

As the regulations only require multi-asset funds to keep a minimum of 10% each in at least three asset classes, different multi-asset funds take different approaches to their asset allocation strategy.

Also read: Should PMS investors switch to focused funds after new tax changes?

Different strategies

“Equity and gold display a low and negative correlation which is great for diversification and reducing volatility of a portfolio that has material equity exposure. But for gold to be able to dampen the volatility of equity, it is important that gold and equity allocation is equitable and is allowed to be freely calibrated based on valuations. Our gold allocation range is 10-40% and equity allocation range is 15-45%. In the last six months, while equity has fallen sharply, equitable allocation to gold has done its job of dampening volatility and also added to returns amidst the stock market rout,” said Aashish Somaiyaa, CEO of WhiteOak Capital MF.

View Full Image

As of 31 January 2025, WhiteOak Capital Multi Asset Allocation Fund’s exposure to gold and silver stood at 19.1%. The exposure is largely gold-oriented, while the fund has some silver arbitrage position. Silver arbitrage entails buying silver in the cash (spot) market and selling its future contracts. The profit is generated through price mismatches.

Among other asset classes, WhiteOak Capital Multi Asset Allocation Fund has net equity allocation of 25.9%, equity arbitrage allocation of 11.3%, Reits (real estate investment trusts) and InvITs (infrastructure investment trusts) allocation of 7% and foreign equity allocation of 1.8%. It has debt allocation of 34.9%. The fund has delivered returns of 18.2% over the past one-year period. WhiteOak Capital MF is a new entrant in the ₹67 trillion mutual fund industry. Its multi-asset fund was launched on 19 May 2023.

DSP Multi Asset Allocation Fund’s exposure to gold stood at 11.96%, while exposure to silver stood at 2.77%. Among other asset classes, the fund has 44.18% equity exposure, 24.09% debt exposure and 17% foreign equities. Unlike other funds in the category, the fund doesn’t do equity arbitrage. The fund is fairly new as it was launched on 27 September 2023.

“Investors should not get carried away by returns of an asset class, whether it is gold or foreign equities. This time, foreign equities and gold have outperformed domestic equities. But that doesn’t necessarily mean it will always be the case. Gold in the past has seen decades of underperformance. At such points in time, equities would do well or fixed income will deliver returns. That’s how low-correlated asset classes complement each other in a diversified portfolio,” said Aparna Karnik, fund manager at DSP Mutual Fund. DSP Multi Asset Allocation Fund has delivered 15.9% returns over the past one-year period.

ICICI Prudential Multi-Asset Fund maintains a minimum 65% gross equity exposure, which makes it eligible for equity taxation. As of 31 January 2025, its net equity exposure stood at 50%, while equity arbitrage exposure was at 17%. Its gold and silver exposure stood at 10.5%, Reits and InvITs accounted for 1.4% exposure, while exposure to other commodities stood at 0.7%. Its debt exposure stood at 20.4%. The fund was launched on 31 October 2002.

Ihab Dalwai, senior fund manager at ICICI Mutual Fund, said that along with gold allocation, sticking to the fund’s core philosophy of counter-cyclical and non-consensus investing has further enhanced overall returns. The fund has delivered 14.5% returns in a one-year period. “Earlier, momentum stocks were doing well, but over the past six-odd months, quality-oriented counter-cyclical investing has done well,” Dalwai explains.

Nippon India Multi Asset Allocation Fund has delivered returns of 13.97% in one-year period. The fund’s target allocation is 50:20:15:15, with 50% to domestic equities, 20% to foreign equities, 15% to gold and other commodities and 15% to fixed income. “As and when any asset class meaningfully deviates from this target allocation due to price appreciation or decline, the fund is re-balanced and that asset class is brought back closer to the target allocation range,” explained Ashutosh Bhargava, fund manager and head-equity research, Nippon India Mutual Fund.

Nippon India Multi Asset Allocation Fund was launched on 28 August 2020.

As mentioned earlier, Securities and Exchange Board of India regulations require a minimum 10% allocation each to at least three asset classes, but Bhargava says keeping minimum 15% in one asset class offers wider diversification to investors.

Also read: Money Explainer: What Sebi’s proposal on passive hybrid funds means for your portfolio

Choosing the right MAAF

Different MAAFs (multi asset allocation fund) are suitable for different type of investors. For example, aggressive investors can go in for multi-asset funds with higher equity exposure compared to other asset classes.

Investors that want multi-asset funds that are slightly less aggressive can look for funds with lower allocation to equity.

Kavitha Menon, founder of Probitus Wealth, points out that not many investors actually capitalize on the opportunity to add equities when stock markets are crashing. “There are behavioural biases at play, which deter investors from doing that. However, in a fund like a multi-asset fund, re-balancing happens automatically whenever one asset class significantly declines or sees sharp rallies. And the re-balancing is not a tax event. If an investor does that through separate investments, selling any asset class for re-balancing of portfolio will be a tax event,” she says.

“It is not possible for investors to predict when a particular asset class will do well. But meaningful diversification will help an investor participate in at least one asset class that will do well in a given economic cycle,” Menon adds

“Investors should look for a multi-asset fund that behaves like one and not focus too much on how the fund’s asset allocation impacts its tax status,” says Kirtan Shah, founder and chief executive officer of Credence Wealth.

Also read: Smart-beta funds: How to pick and choose?

Tax treatment

Different multi-asset funds get different tax treatment. For example, multi-asset funds with 65% equity (including equity arbitrage) are treated as equity funds for taxation. So, these funds are eligible for long-term capital gains (LTCG) tax rate of 12.5% after one year of holding period. Short-term capital gains (STCG) in excess of ₹1.25 lakh are taxed at 20%.

For multi-asset funds, where the equity allocation is within 35-65% range, the LTCG tax rate of 12.5% can be availed after two years of holding period. STCG is taxed at slab rate of the investor.

Takeaways

Data suggests that multi-asset funds can reduce volatility through a portfolio of low or negatively-correlated asset classes. However, multi-asset funds can differ widely from each other in terms of their asset allocation. Some multi-asset funds keep higher equity exposure. Others could keep lower equity exposure and maintain a sizeable allocation to other asset classes. Before choosing one, check its allocation and how its allocation has changed in the past. Go with the fund that is within your risk-tolerance limits.