PM Images

Thesis

As we have said it numerous times before, 2024 is the year of bonds, when interest rates will be moving lower on the back of an expected Fed cut. When rates are moving lower, a retail investor should be focused on purchasing bonds, with a general focus on duration-driven ones such as Treasuries, Agency MBS and highly rated private label MBS.

The Angel Oak Income ETF (NYSEARCA:CARY) is a fairly new bond exchange-traded fund, having IPO-ed in 2022. As per its literature, the ETF:

seeks the best risk-adjusted opportunities in fixed income that offer the potential for both stable income and price appreciation. The team employs a top-down approach to identify relative value opportunities and a bottom-up credit selection process to select individual issues. The primary focus of Fund assets will be within residential mortgage-backed securities, asset-backed securities, commercial mortgage-backed securities and collateralized loan obligations. The managers will invest opportunistically across a wide range of credits and issuer types based on relative value within structured credit.

In this article, we are going to start our coverage of CARY and analyze its holdings and articulate why we believe the name is a ‘Buy’ in today’s macro environment.

Fund holdings

The ETF has a very interesting nomenclature, with ‘carry’ in finance signifying the return of an asset:

The carry of an asset is the return obtained from holding it (if positive), or the cost of holding it (if negative)

The fund has a positive carry, and is actually set up as a dividend tool with some capital appreciation potential:

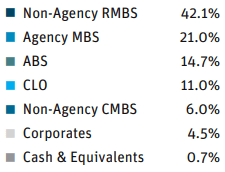

Assets (Fund Fact Sheet)

Non-Agency RMBS bonds represent 42% of the fund, followed by Agency MBS at 21% and ABS bonds at 14.7%. MBS paper thus represents over 60% of the fund, and is the largest exposure through both government protected MBS bonds as well as private label RMBS.

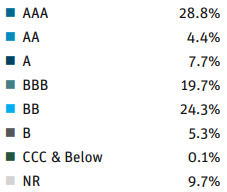

From a credit rating perspective, the ETF is overweight investment grade names:

Ratings (Fund Fact Sheet)

AAA bonds are roughly 29% of the holdings, representing a very large bar-belled allocation, while sub investment grade securities represent only 30% of the fund holdings.

MBS bonds are currently attractive given their long duration. As interest rates moved higher, mortgage rates followed suit, which has resulted in a very low level of re-financings and prepayments. Low prepayment levels have resulted in a high duration for all mortgages. When the Fed will lower rates and mortgage rates will move lower, we will get more activity in the housing market, which in turn will result in increased mortgage pre-payments and thus a lowering in the weighted average life of MBS bonds. A lower weighted average life results in higher prices all else equal.

Performance and Risk

The name falls in the same category as the JPMorgan Income ETF (JPIE) which we covered here, and the PIMCO Multisector Bond Active ETF (PYLD) which we covered here:

In the past year, the three names have had a similar total return, with all the funds posting above 10% net figures. What is notable is that CARY is the least volatile from the cohort, as noticed from its shallow October 2023 drawdown when compared to its peers.

When measuring its analytics on a 1-year time-frame, we find the fund having a 3% standard deviation and an annualized volatility of 3.5%.

Yield considerations and analytics

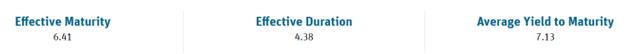

The fund has a 6.4% 30-day SEC yield, but a 7.13% yield to maturity on its assets:

The vehicle is running a 4.3 years effective duration, which puts it squarely in the intermediate duration funds bucket. The rest of the fund analytics are as follows:

- AUM: $0.2 bil.

- Sharpe Ratio: n/a (3Y).

- Std. Deviation: 3% (1Y).

- Yield: 6.4%

- Premium/Discount to NAV: -0.25%

- Z-Stat: n/a

- Leverage Ratio: 0%

- Composition: Fixed Income Multi Asset

- Duration: 4.3 yrs

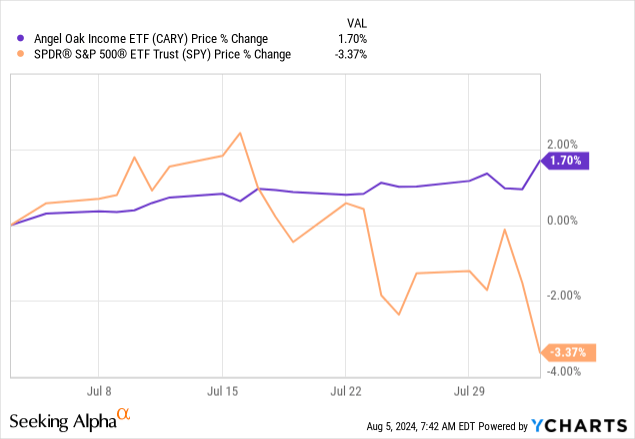

CARY is set to benefit from Fed cuts via a shift lower in the yield curve and thus a NAV gain based on its duration. We have already seen some of this move in the past week:

As stocks have sold off, CARY has moved higher on lower yields in its duration bucket. Given its composition, interest rates are the main total return driver here, and the fund will only be hampered by a very significant spike in credit spreads.

Risk factors

The fund’s main risk factor is represented by interest rates. When rates move higher, the fund loses money, while lower rates help the name via both duration as well as CPR (constant prepayment rate) on its MBS holdings. Therefore, the name is attractive via an asymmetric set-up, where it is set to have a double benefit when rates move lower, while only a single factor negative in a higher rates case. We believe peak rates are behind us, and with the Fed set to cut in September 2024, the fund is set to gain.

A secondary risk factor for the name is represented by liquidity. Outside of the Agency MBS bucket, the rest of the securitized holdings can become illiquid in a market crash, with wide bid/ask spreads and an inability to liquidate names at fair value. While in the past year, the name experienced a very low volatility and drawdown, it can all change in ‘rough seas’ and a violent risk-off scenario. As I am writing these lines on Monday, August 5, 2024, the market is set to open on a much lower level, with a VIX spike above 50 and a Japanese equity market down -10% for the day. Risk does come at you fast, and black swan events do occur. Expect the name to be impacted by underlying holdings liquidity issues in markets like what we are experiencing today.

Conclusion

CARY is a fixed income exchange-traded fund from the Angel Oak platform. The vehicle invests in Agency MBS and private label MBS bonds, which make up over 60% of the fund holdings. With a 4.3 years duration, the name falls in the intermediate duration bucket, and is set to benefit as the Fed starts cutting rates. The ETF will also experience a positive NAV effect as pre-payment rates move up as mortgage rates decrease. The fund’s main risk factor is represented by rates, with credit spreads as a secondary factor. The name is up over 10% in the past year on a total return basis, and we expect a similar performance in the next 12 months as interest rates move lower and pre-payment rates rise from historic lows.