A second major consulting group has quit working with Ohio’s controversy-ridden retired teachers’ pension fund, another blow to the already chaotic system.

Anxiety is high at the State Teachers Retirement System (STRS).

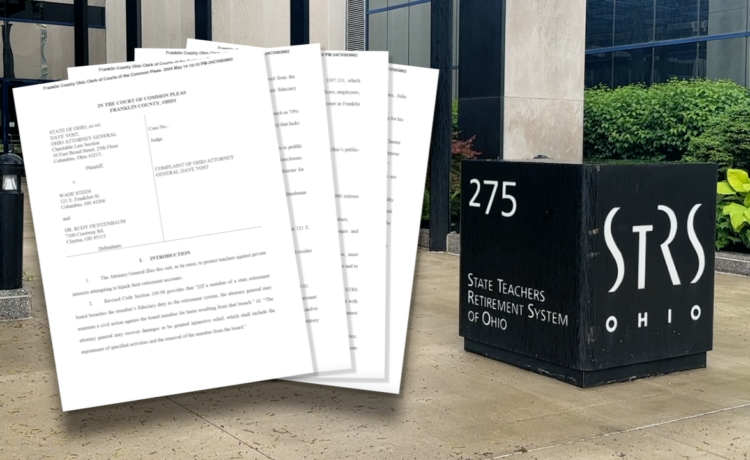

STRS is embroiled in controversy. In summary, there has been constant fighting, two board resignations and allegations of both a public corruption scheme and mishandling of funds.

This all stems from a debate on how STRS should invest money — through the current system of actively managed funds versus an index fund. Active funds try to outperform the stock market, have more advisors, and typically cost more. Index funds perform with the stock market, are seen as more passive, and typically cost less.

In short, “reformers” want to switch to index funding, while “status quo” individuals want to keep actively managing the funds. Recent elections have allowed the “reform-minded” members to have a majority of the board.

McLagan, a data and analytics company, had been providing compensation advice and research to STRS.

“While we appreciate the opportunity to provide STRS with compensation advisory services under a new SOW, we are unable to assist at this time with the request for the July 19, 2024 Board meeting,” McLagan said in a July 10 email we obtained.

A special board meeting had been scheduled to go over compensation on July 19.

“McLagan has partnered with STRS for over 20 years and we will continue to support STRS with respect to past deliverables if there are any questions with respect to McLagan’s work,” the exit letter states.

Although the company did not provide any reasoning, it should be noted that they specifically consulted on performance-based incentives (PBIs). In June, the STRS board blocked staff from getting these PBIs, which can be referred to as bonuses.

The termination letter surprised some STRS staff members who reached out to us.

“STRS Ohio was notified earlier this week that McLagan would be unable to provide the compensation consulting services requested by the pension system at this time. The Board still plans to discuss investment staff compensation at the next board meeting,” STRS spokesperson Dan Minnich said in a statement.

Back in May, consulting giant Aon, and owner of McLagan, also pulled out of STRS. They provided board governance advice and services, meaning they and McLagan had two separate agreements in different divisions of STRS.

“This is deeply concerning for the entire pension system as a whole,” former STRS Chief Actuary Brian Grinnell said.

Grinnell resigned in May after working at the pension fund for a decade.

“It’s concerning when the board has seen not one, but now two consultants terminate voluntarily because they don’t want to, presumably, be associated with this board or this system and the controversy that’s going on right now,” he said.

Eliminating bonuses could slash the income for STRS staff by half, which in turn could cause talented people to leave, he warned. If too many people leave, there won’t be anyone to actually make money for the teachers.

Retired educator Robin Rayfield says reducing the staff would actually help the educators. He is the executive director of the Ohio Retirement for Teachers Association (ORTA), full of reformers.

Retirees like him have helped to elect board members who want a change, people whose main focus is providing a full cost-of-living adjustment (COLA).

“We need to be doing indexed investing, not have a massive investment staff,” Rayfield said. “We’d get better returns and we’d have far less expenditures.”

Many retired teachers say it isn’t fair that they have a restricted COLA, especially when the board approved $10 million in bonuses for staff last year.

“If we can’t get a cost of living, why should all these people working in STRS get these huge bonuses?” retired Columbus teacher Sharon Parker said. “How are they able to afford that?”

The COLAs were suspended for more than 150,000 retired Ohio teachers for five years starting in 2017. In 2012, the qualifying retirement number was moved from 30 years to 35 years. Last year, this was changed to 34.

The STRS building is in the heart of downtown Columbus — with a waterfall outside of it. It used to have a child care center for kids of employees but that was closed after educators fought against it. Some of the current benefits include an on-site fitness center, outdoor balcony, and lunchroom with kitchen appliances.

“There are many teachers in Ohio that are in poverty, yet we have investors and staff members that are getting big salaries and $10 million in bonuses,” Parma schools teacher Terry Caskey said.

The average income for STRS investment staff members was roughly $230,300.

Ten million is nothing in comparison to the billions needed to restore the COLA, Grinnell argued.

“The system simply doesn’t have the assets in order to do that in a sustainable way right now — unless they get an outside infusion of many billions of dollars,” he said. That’s not something that can happen in the short term.”

Case Western Reserve business law professor Eric Chaffee said both views have merit.

“Eliminating all that lavishness might allow for teachers to receive more in terms of the cost-of-living adjustments,” Chaffee said. “But at the same time, it might compromise the long-term future of STRS.”

He is doubtful that cutting the PBIs will actually do anything substantial for the teachers, but he sees it as more of a move for optics.

“It’s very symbolic,” Chaffee said. “People are concerned here that ultimately, these bonuses are being issued when there are all sorts of questions being raised about STRS.”

Symbolism isn’t helpful when educators’ pension and staff’s income are on the line, Grinnell said.

“The disappointing thing is that it seems like there’s a faction of the board that is working to actively undermine the staff, undermine trust in the staff and is not working in a productive manner to strengthen the system and to reassure people and to get them the benefits that they deserve,” he added.

QED

As someone whose job was handling risk management, Grinnell is appalled by the board leadership’s interest in investment firm QED Systematic Solutions.

In May, Attorney General Dave Yost filed a lawsuit to remove two members of STRS, stating they are participating in a contract steering “scheme” that could directly benefit them. Yost started the investigation after documents prepared by STRS employees alleged that Wade Steen and Chair Rudy Fichtenbaum have been doing the bidding of private QED.

Yost started investigating after STRS employees gave documents to Gov. Mike DeWine’s office. The office believes “numerous whistleblowers” wrote the 14-page memo, also including about a dozen other documents in an attempt to verify their allegations.

Steen and Fichtenbaum “seek to steer” as much as 70% of current STRS assets, which is $65 billion, to a “shell company” that has “backdoor ties” to the members, Yost argued.

The AG states that the pair should be removed because they broke their fiduciary duties of care, loyalty and trust when “colluding” with QED.

QED was started by former Deputy Treasurer Seth Metcalf and Jonathan (JD) Tremmel. Metcalf worked under Josh Mandel in multiple capacities, including as general counsel.

Click here to learn more about the lawsuit.

Despite the reformers denying it, we obtained a now-archived video meeting proving Yost’s claim that Fichtenbaum and Steen were promoting a $65 billion partnership with an investment firm that lacks “legitimacy.”

“My father always told me if something sounds too good to be true, it probably is not true,” he said. “And in this case, there are a ton of red flags around this so-called investment opportunity.”

Despite having no clients and no track record — QED tried to convince STRS members to partner with them, according to the STRS staff’s memo. QED was not registered as a broker-dealer or investment adviser. The men also didn’t own the technology to “facilitate the strategy,” the documents say.

“It is grossly inappropriate for the board to be involved at that level of decision-making around investment opportunities,” Grinnell said.

We asked Steen back in May if he still wanted to use QED, even though other people can do the same job and haven’t been involved in controversy.

“Now, I’m not even advising QED or anyone — what I’m advising is we need to look at index funding,” Steen responded. “We really need to take a look at that that would dramatically reduce our costs.”

Educators believe that this is a sham investigation by Yost.

“Now we have a supermajority and now we can get all the information we need that they’ve been covering up or not being transparent about,” Caskey said.

DeWine is covering up for his Wall Street friends, she and other reformers added — but she is also concerned that this is a corruption scheme.

Caskey doesn’t trust DeWine at all and believes the whole investigation into STRS board members and their relationship with QED is a “ruse.”

DeWine’s spokesperson, Dan Tierney, denied all of her allegations and said they were “absolutely ludicrous.”

Meanwhile, the lawsuit between Yost and Steen and Fichtenbaum is heating up.

“If Defendants appear outraged and aggressive, they are,” the joint filing by the reformers’ attorneys states. “Both men have volunteered countless hours to have the satisfaction of seeing that the fund is properly managed which they were on the cusp of doing when the Attorney General filed his lawsuit.”

Interestingly, QED doesn’t seem to be done. In a joint filing by the pair — they defend their support of the firm.

“Mr. Tremmel, one of the QED founders, has a sterling track record, having successfully managed a $1 billion plus fund at the age of nineteen (19) and having an unparalleled 5-year track record of 5-star investment management performance results,” the filing says.

Later, the pair criticized Yost, DeWine and the STRS staff who provided documents to the executives.

Future

The lawmakers have joined the governor and AG in trying to prevent the reformers from getting control of the board.

Several ideas were proposed during the Ohio Retirement Study Council meeting on Monday and after an interview with us.

Lawmakers have proposed removing the elected members from the STRS board and combining all the pension funds into one.

This is anti-democratic, Rayfield said.

“We would be diametrically, adamantly opposed to any changes that reduce or eliminate teacher input into their pension,” he said.

Grinnell only wants to do the best for the teachers, which means relying on insight from investment experts.

“Before making changes, before making commitments that you may not be able to keep — you need to carefully consider your basis for doing so,” he said. “You need to make good decisions and good decisions are based on reality, not grievances, or grudges or falsehoods.”

To ask questions or provide comments about STRS, please email [email protected] with the subject line “STRS COMMENT.”

Follow WEWS statehouse reporter Morgan Trau on X and Facebook.