(Bloomberg) — China discovered that officials allowed cash raised from special bonds or funds from the central government budget to be invested in subpar or halted projects, raising questions about the effectiveness of current fiscal measures in bolstering economic recovery.

Most Read from Bloomberg

Almost 28 billion yuan ($3.9 billion) of bond funds involving 522 projects were untapped or used for purposes other than what they were approved for as of the end of 2023, the National Audit Office said in a statement released Tuesday.

Progress was also slow in the 721 projects identified by the National Development and Reform Commission for central budget investment, leaving over 41 billion yuan unused. Some projects even received more government or special bond funds than their planned total investment, it added.

The report — a rare revelation of government fund misuse — highlights the difficulties Beijing faces in effectively implementing fiscal stimulus. Officials struggle to find quality projects, which have focused on infrastructure construction so far, to put government funds to use.

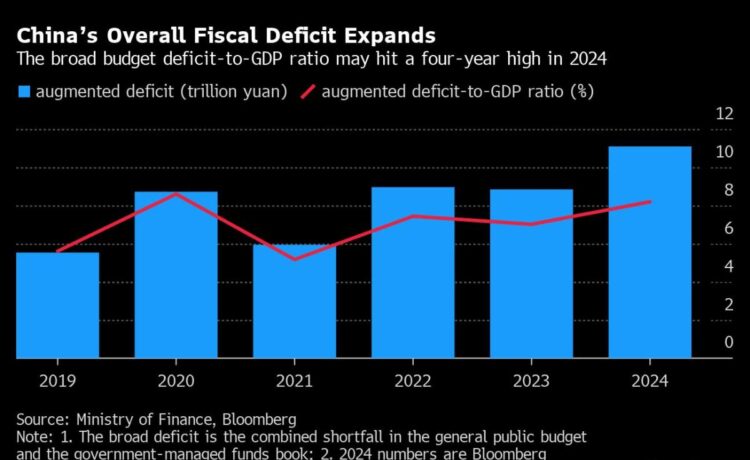

Improper funding rollout could hurt China’s economic growth prospects, especially as households and businesses hesitate to spend amid a property downturn, and as its companies start to face more trade barriers from the US and Europe.

“Implementation of proactive fiscal policies went awry,” the office said in its annual report to legislators on the auditing of the country’s 2023 budget execution and other fiscal income and spending. “Some special bond projects failed to play the role of driving investment,” it added, noting that they rarely attracted private capital.

The slow use of funds means the government is paying interest on bonds that don’t generate investment returns, increasing the risks for future debt repayment and giving Beijing more reasons to be cautious about aggressive loosening.

In a sign of the shortage of qualified programs, the NDRC included over 280 projects lacking feasibility study approval or equity capital requirements in a preliminary list for special bond usage, the NAO said. The Ministry of Finance also added more than 500 problematic or suspended projects to its bond project reserve.

“It’s just harder and harder to get qualified projects with years of over-investment,” said Michelle Lam, an economist for greater China at Societe Generale SA. “I don’t expect extra bond issuance compared to what’s announced in the March budget, but the government needs to focus on the implementation.”

Beijing should take on more borrowing and spending responsibilities from local governments and find effective ways to use government bond funds for productive investments and social welfare spending to boost consumption, she said.

The government is expected to broaden the sectors eligible to receive special local bond funds. The Ministry of Natural Resources is studying a plan that would enable local governments to use funds from these bonds to repurchase undeveloped land, the Economic Observer reported this week.

Speculation grew last week that China might ease regulations to permit provinces to issue new special bonds for repaying old debts, sparked by Henan’s announcement of such a plan. However, Henan later revised its language to maintain ambiguity about the funds’ intended use.

The national audit office discovered that some local authorities continued to borrow in violation of rules. State-owned enterprises in 24 regions were found to be holding on to 37 billion yuan from such funds as of the end of last year, mainly to cover maturing debts and employee salaries.

–With assistance from Helen Sun.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.