Energy mutual funds allow investors to diversify within the energy sector, thus reducing risk compared to selecting individual energy stocks. These funds offer several other benefits, such as higher liquidity and low minimum investment requirements. Today, we have focused on two energy mutual funds –FNARX and GAGEX – with over 10% upside potential projected by analysts in the next twelve months.

Let’s delve deeper.

Fidelity Select Portfolio Natural Resources Portfolio (FNARX)

The FNARX fund seeks to earn capital appreciation by investing 80% of its investors’ money in precious metals and in companies that own or develop natural resources. As of today’s date, FNARX has 38 holdings with total assets of $656.70 million. Moreover, the fund has generated returns of about 11% over the past six months.

On TipRanks, FNARX has a Moderate Buy consensus rating. This is based on the weighted average consensus rating of each stock held in the portfolio. Of the 38 stocks held, 30 have Buys, while eight stocks have a Hold rating. The analysts’ average price target on FNARX of $53.18 implies 12.22% upside potential from the current levels.

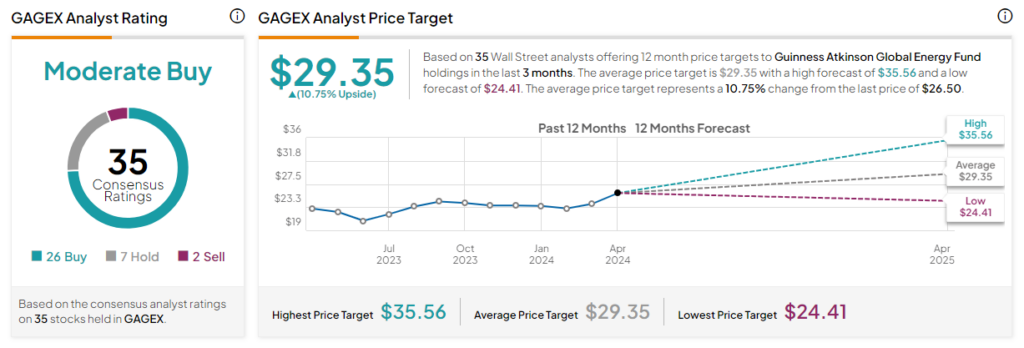

Guinness Atkinson Global Energy Fund (GAGEX)

The GAGEX fund focuses on long-term capital appreciation and follows the MSCI World Energy Index as its benchmark. This actively managed fund provides investors with exposure to both U.S. and non-U.S. companies that are principally involved in energy-related activities. As of today’s date, GAGEX has 35 holdings with total assets of $12.21 million. GAGEX has gained 7.3% over the past six months.

On TipRanks, GAGEX has a Moderate Buy consensus rating. This is based on 26 stocks with a Buy rating, seven stocks with a Hold rating, and two stocks with a Sell rating. The analysts’ average price target on GAGEX of $29.35 implies 10.75% upside potential from the current levels.

Concluding Thoughts

Investing in energy-focused mutual funds presents investors with a compelling opportunity to gain broad exposure to this crucial sector while simultaneously mitigating risk through diversification. However, a prudent approach necessitates in-depth research before investing.