Many popular index funds aren’t behaving the same way they did five years ago.

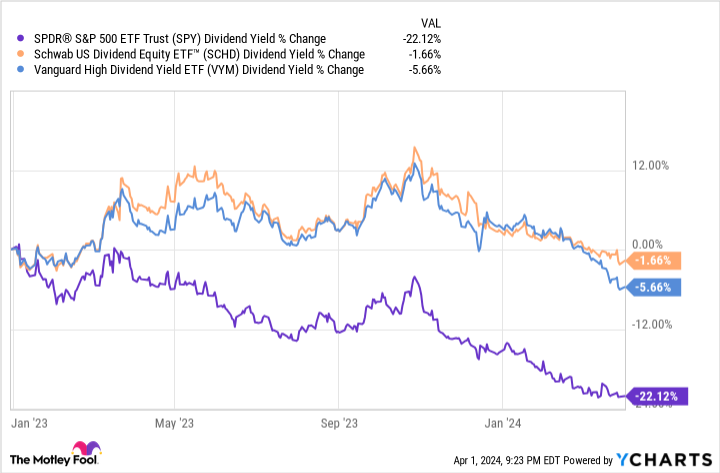

Index investing isn’t always as straightforward as you might think. Stock indexes evolve over time, and that can have meaningful impacts on long-term passive strategies. The chart below illustrates an important shift that will influence many people’s retirement investments. Don’t let this catch you sleeping — stay diligent and keep your portfolio primed for optimal performance.

You might need to look elsewhere for dividend yield

Index funds play a major role in most people’s investment plans, even investors who maintain an active strategy with a portion of their holdings. Retirees often diversify to dilute company risk, and S&P 500 ETFs, like the SPDR S&P 500 ETF Trust (SPY 1.04%), are some of the most popular and efficient tools to accomplish that.

Image source: Getty Images.

Index funds aren’t generating as much dividend income as they used to. This is a big deal for some retirees and investors approaching retirement whose focus is shifting away from growth to income.

SPY Dividend Yield data by YCharts

There’s a strong chance that your overall investment portfolio will perform differently moving forward. Assuming that your allocation was perfectly suited to your goals one year ago, you might need to make adjustments to keep things optimized.

A major market trend is behind this shift

The S&P 500 has gained nearly 40% since the start of 2023. Investors have been anticipating interest rate cuts from the Federal Reserve as inflation cools. Many people have been eager to buy high-quality stocks so that they don’t miss out on the bull market.

The start of the artificial intelligence boom coincided with that eagerness, helping to fuel exceptionally strong performance for a small number of dominant tech stocks. The “Magnificent Seven” have catalyzed market indexes as they left other stocks behind. These companies have above-average growth rates, relatively exciting future prospects, and most of them have enhanced cash flows by controlling costs. Investors are justifiably optimistic about those factors. This optimism has translated to surging valuation ratios, compounding the returns delivered by improved fundamentals and sending the stocks even higher.

That’s all good news for investors, especially for anyone who holds mutual funds or ETFs that track major indexes. Your retirement account most likely delivered impressive gains over the past 15 months. However, there’s an important underlying dynamic that could necessitate action from many investors.

Index funds are behaving differently now

The exceptional performance of a handful of similar stocks has altered the balance and weighting of the S&P 500. The tech sector now makes up 21% of the S&P, and these stocks don’t really behave the same way that large caps have in the past. The S&P 500 dividend yield is below 1.3%, having been around 2% for most of the decade preceding the COVID-19 pandemic.

SPY Dividend Yield data by YCharts

Index funds were never really optimized for dividend income, but large-cap stocks are often mature businesses. They frequently have modest growth prospects, so they return cash to shareholders via dividends rather than investing for rapid expansion. Large-cap dividend stocks often exhibit cheaper valuation ratios and lower volatility as a result.

The Magnificent Seven aren’t as volatile as small-cap growth stocks, but they also aren’t traditional value stocks. They generally bear low dividend yields — or none at all. They attract relatively expensive valuations commensurate with their impressive growth rates. This can lead to extra volatility during bear markets.

What you can do to address the situation

As always, it’s a good idea to review your portfolio annually to confirm that it’s aligned with your investment goals and risk tolerance. If everything still looks good after the market’s big shift, then you don’t need to take meaningful action.

If your dividend yield is falling short of your income needs, it might be time to reallocate. The gains from an S&P 500 index fund might allow you to purchase more shares of a reputable high-yield ETF like the Schwab US Equity Dividend ETF (SCHD 0.36%) or the Vanguard High Dividend Yield ETF (VYM 0.50%). These funds might not deliver as much growth, but they can kick off bigger cash flows, likely with less volatility.

Before diving into this strategy, be sure to review sector concentrations in these popular dividend ETFs. They have relatively high exposure to financial and energy stocks, so don’t utilize these vehicles if you’re uncomfortable with that weighting.

Ryan Downie has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vanguard Whitehall Funds-Vanguard High Dividend Yield ETF. The Motley Fool has a disclosure policy.