Although the US Federal Reserve only sees one interest rate cut in the second half of 2024, investors opted during the third week of June to focus on recent data showing labor markets easing and price growth moderating. US equity indexes tested fresh record highs and the yields on 10-year Treasuries fell to their lowest level since late March.

Against this backdrop, flows into US Equity Funds climbed to a 14-week high and US Bond Funds took in fresh money for the 27th week running while redemptions from US Money Market Funds hit a level last seen in mid-April. Of the total flows into US Equity Funds, over a third was attributable to flows into a single US Technology ETF ahead of a quarterly rebalancing that will see Nvidia displace Apple as the second-largest index component after Microsoft.

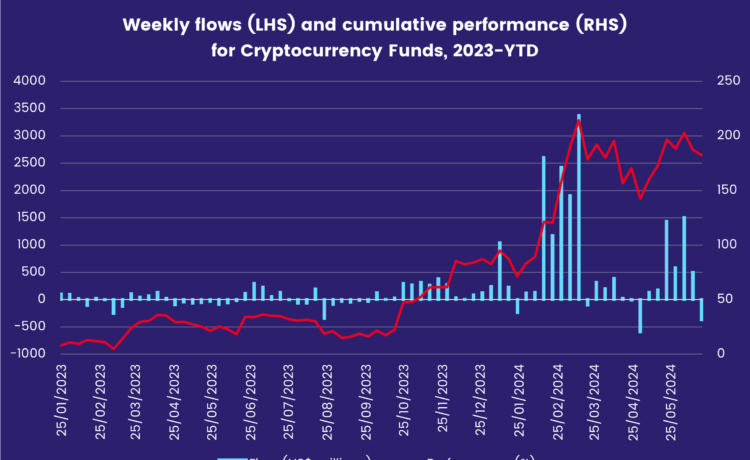

While US-oriented investors were willing to back that latest data and put money to work, there was a noticeable drop in risk appetite elsewhere. Cryptocurrency Funds recorded their second largest outflow year-to-date, Emerging Markets Bond Funds posted consecutive weekly outflows for the first time since early May, Europe Equity Funds experienced net redemptions for the 21st week so far this year and outflows from Frontier Markets Equity Funds climbed to a 26-week high.

Overall, a net $6.3 billion flowed into all EPFR-tracked Bond Funds during the week ending June 19 while Equity Funds absorbed $25.5 billion. Investors pulled $204 million from Alternative Funds, $2.9 billion from Balanced Funds and $15.7 billion from Money Market Funds.

At the asset class and single country fund level, Total Return Funds posted consecutive outflows for the first time since mid-4Q23, High Yield Bond Funds saw an eight-week inflow streak come to an end and Convertible Bond Funds posted their first inflow since early April. Sweden Bond Funds chalked up their largest inflow since mid-3Q22, redemptions from Japan Money Market Funds hit a 12-week high and Romania Equity Funds added to a 32-week run with their biggest inflow since the second week of 2019.

Emerging Markets Equity Funds

China and India-mandated funds again drove the headline number for all EPFR-tracked Emerging Markets Equity Funds during the third week of June, as investors continued to weigh the outlook for global trade in light of US and EU tariffs on Chinese-made electric vehicles and other green technology exports.

Retail share classes and EM Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates experienced net redemptions, as did three of the four major regional groups and Frontier Markets Equity Funds.

Domestically domiciled China Equity Funds attracted fresh money as the latest data for another historically popular asset class, property, is still losing value despite official efforts to prop up the sector. Three of the top 10 funds ranked by inflows for the week are technology focused. Meanwhile, China State Owned Enterprise (SOE) Funds posted their seventh straight outflow.

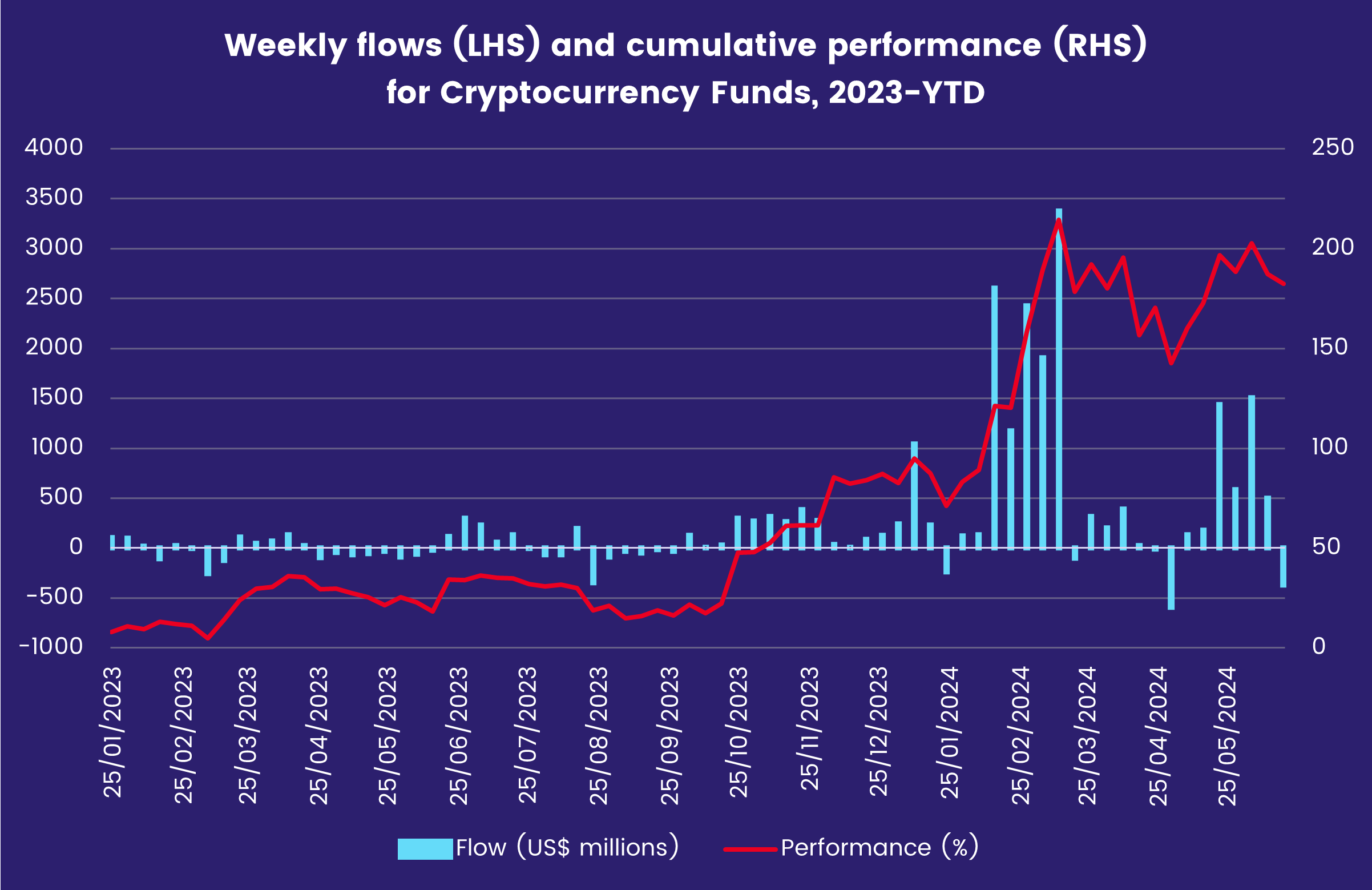

Although holdings of Chinese stocks by Global Emerging Markets (GEM) Equity Funds have fallen over the past four years, they still have over $225 billion worth in their portfolios. China Share Class Allocations data shows that Hong Kong share classes – Red Chips, H Shares and P Chips – still account for the biggest share of the group’s overall exposure.

Among the other Asia ex-Japan Country Fund groups, India Equity Funds absorbed fresh money for the 66th consecutive week and Taiwan (POC) Equity Funds for the 11th time over the past 12 weeks. But funds dedicated to countries with significant global supply chain stories have not fared so well. During the latest week, redemptions from Vietnam Equity Funds hit a 12-week high and Thailand Equity Funds experienced net redemptions for the 23rd straight week.

South Africa Equity Funds posted their biggest inflow since early 4Q23 after the African National Congress cobbled together a unity government that does not include the more extreme parties. But uncertainty about the direction of oil prices saw Saudi Arabia Equity Funds extend their longest outflow streak in over six months.

Developed Markets Equity Funds

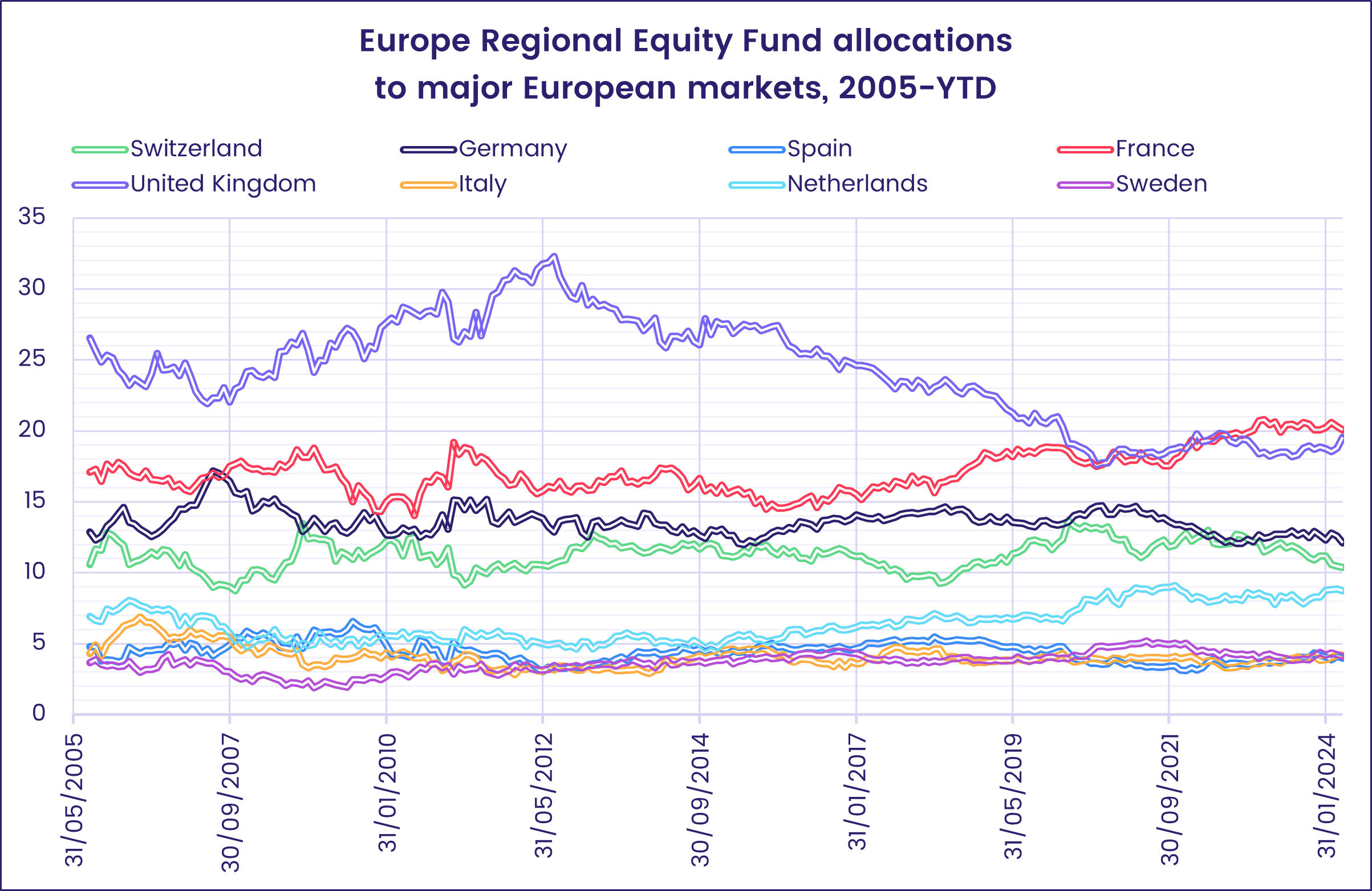

With impending elections in France and the UK weighing on their appetite for exposure to Europe, investors again steered the bulk of the fresh money they committed to EPFR-tracked Developed Markets Equity Funds during the week ending June 19 to US and Global Equity Funds.

The third week of June did see flows into Pacific Regional Equity Funds rebound to a 29-week high, Japan Equity Funds snap their five-week redemption streak and Canada Equity Funds post their biggest inflow in nearly six months.

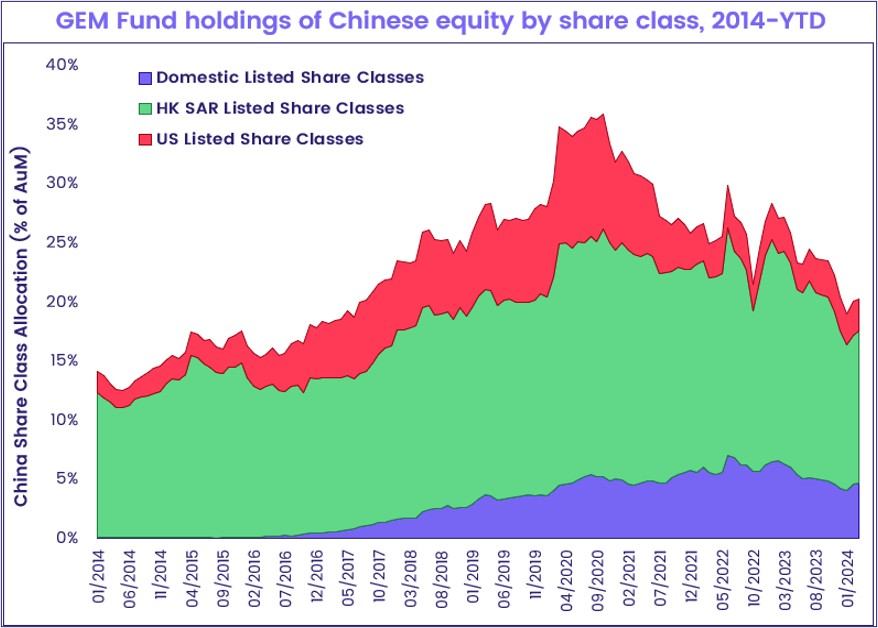

Europe Equity Funds racked up their 48th outflow during the past year as investors penciled in a Labour government with a bullet-proof majority in the UK and struggled to get a fix on the outcome of France’s snap election. Redemptions from France Equity Funds edged up to a four-week high, but the failure of populist Marine Le Pen and the National Rally Party she heads to translate strong poll numbers into power during the two previous elections has muted the response to predictions of fiscal chaos this summer in the Eurozone’s second-largest economy.

Elsewhere, Italy Equity Funds posted their second biggest outflow of the year so far as the country joined France, Belgium, Hungary, Malta, Slovakia and Poland on the list of countries facing the European Commission’s excessive deficit procedure. On the other hand, flows into Spain, Finland, Netherlands and Norway Equity Funds hit 20, 22, 83 and 230-week highs, respectively.

Although, at the fund level, those with large and mega cap mandates figured prominently among the biggest money magnets, US Mid Cap Equity Funds claimed the biggest share of the over $20 billion that flowed to all US Equity Funds during the third week of June. The headline number for both US Mid and Small Cap Equity Funds was the biggest since mid-March. Coming in, as those numbers typically do, ahead of the second “quadruple witching” Friday of the year when various financial contracts expire means there is a good chance that flows will reverse next week.

Japan Equity Funds recorded their first collective inflow since early May as commitments to retail share classes jumped to a seven-week high and leveraged funds pulled in nearly $400 million. At its June policy meeting, the Bank of Japan kept interest rates on hold, but has since signaled further tightening in July.

Global sector, Industry and Precious Metals Funds

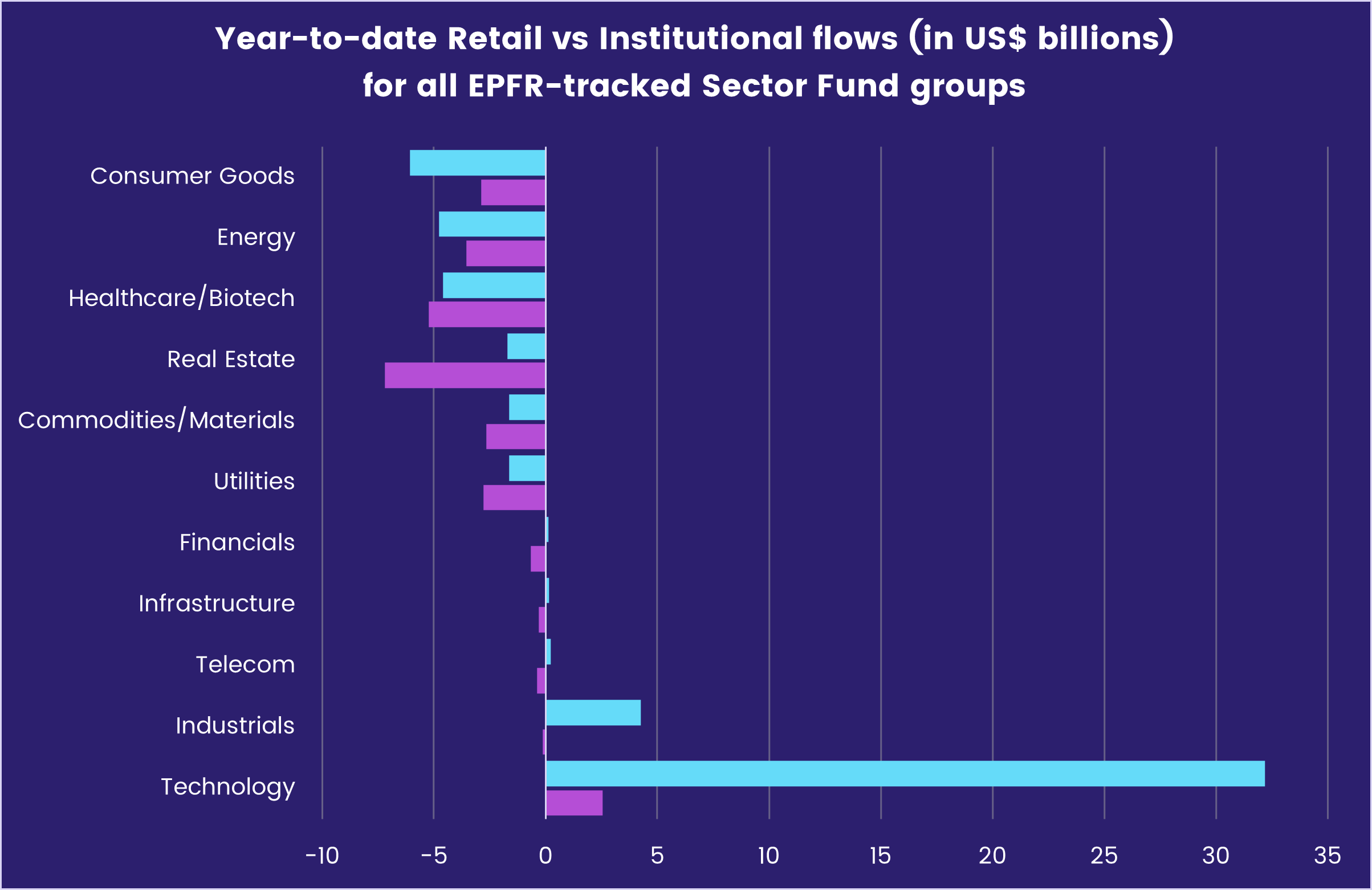

For the third straight week, at least seven of the 11 EPFR-tracked Sector Fund groups reported inflows. Those ranged from $99 million for Real Estate Sector Funds to a record-high of $8.7 billion for Technology Sector Funds. But in many cases, a single ETF or index fund accounted for the group’s headline number.

The bulk of the exceptional inflows for Technology Sector Funds, topping their previous weekly record of $8.5 billion set in mid-2Q23, came in a single day – June 18 – and went to a single fund, the Technology Select SPDR Fund whose underlying index rebalances during the coming week.

Telecoms Sector Funds posted a 14-week high inflow that more than offset the redemptions of the past three weeks. Again, a single US-dedicated SPDR fund underpinned the headline number with over $650 million flowing into it. Though the group has seen seven weeks of outflows since the second quarter started, net inflows over the past 12 weeks stand at over $700 million.

Flows for Real Estate Sector Funds have teetered between positive and negative territory over the past five weeks, but ended this week with a three-month high inflow. Europe ex-UK regional mandated funds pulled in over $150 million – the largest inflow in a year – and China and Japan Real Estate Sector Funds absorbed a combined $100 million, outweighing the redemptions from Europe Regional and Global RE Funds.

Investors again largely resisted the allure of precious metals funds. Physical Gold Funds racked up their biggest outflow in six weeks while Physical Silver Funds posted a second consecutive week of inflows. On the equity side, Gold Mining Funds barely eked out an inflow while Silver Mining Funds snapped a six-week streak of inflows. For metals tied to the electric vehicle industry, flows into Copper Mining Funds remained in positive territory for a 14th straight week while Lithium and Battery Funds posted their eighth outflow of the past nine weeks.

Bond and other Fixed Income Funds

As the dust settled on the latest round of central bank policy meetings, fixed income investors allocated their money based on the assumption that US rates may stay where they are into the fourth quarter, European rates will drift lower when the data allows and the Bank of Japan will take another step towards tightening policy in the third quarter.

During the week ending June 19, US, Europe and Global Bond Funds extended their current inflow streaks – albeit with totals at the lower end of their recent ranges – while Asia Pacific and Emerging Markets Bond Funds experienced net redemptions. At the asset class level, both High Yield and Bank Loan Bond Funds posted their first outflows since mid-April. In the case of the latter group, it was also their biggest outflow since early October.

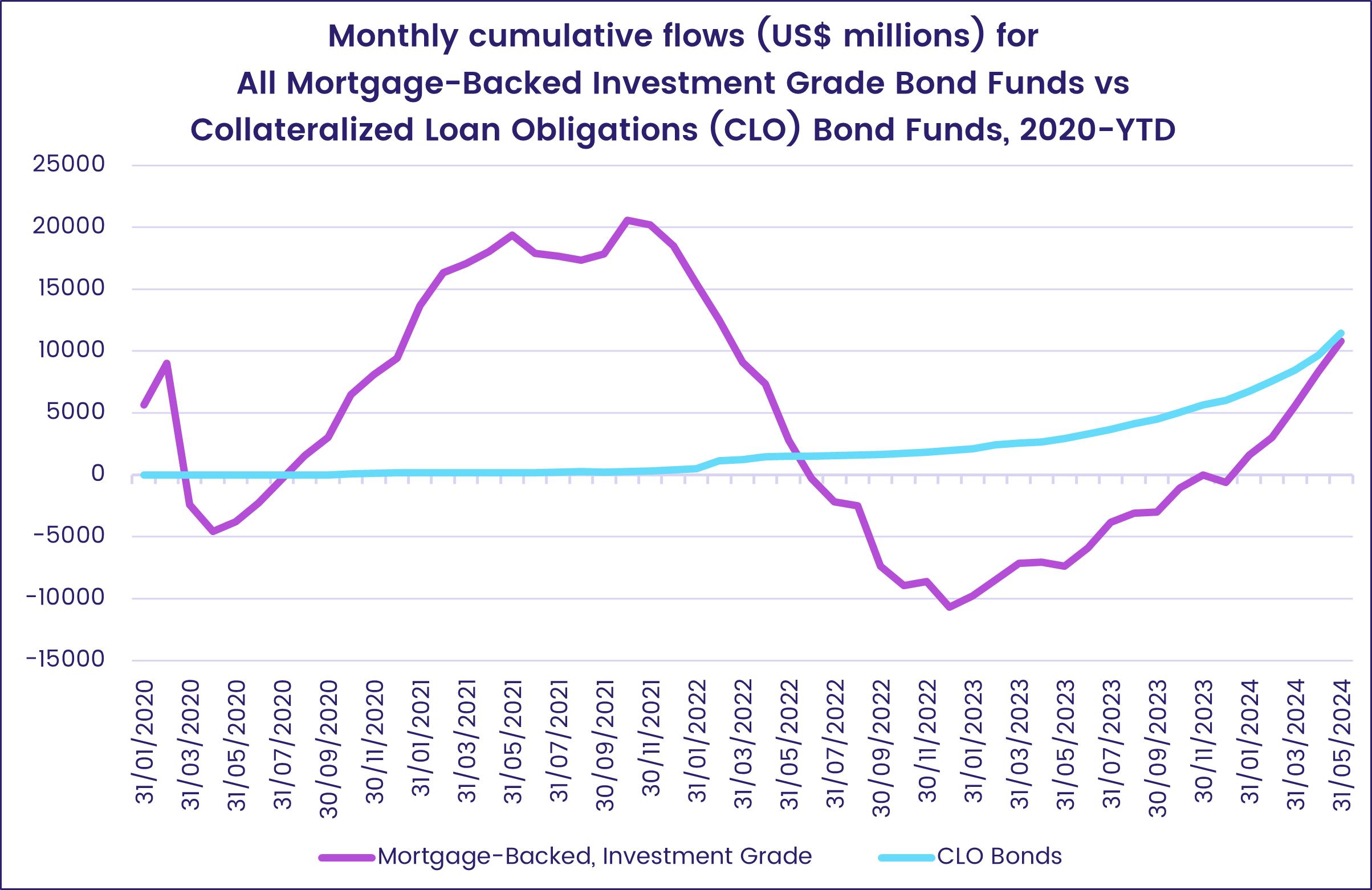

Signs of easing price pressures in the US and parts of Europe translated into a third straight outflow for Inflation Protected Bond Funds and growing appetite for asset classes linked to the fortunes of real estate. Mortgage-Backed Bond Funds chalked up their 24th consecutive outflow, and their third largest since the beginning of 4Q23, and flows into Collateralized Loan Obligation (CLO) Funds were the highest in six weeks and the third highest since EPFR started tracking this sub-group in 2019.

Emerging Markets Hard Currency Bond Funds were hit with further redemptions that offset the modest inflow recorded by their local currency counterparts. At the country level, both China and Korea Bond Funds posted their third biggest inflow year-to-date.

Fears that France will draw the ire of the so-called ‘bond vigilantes’ did not stop more money flowing into Europe Bond Funds, with retail share classes absorbing fresh money for the 40th week running. Redemptions from France Bond Funds were less than $1 million.

US Sovereign Bond Funds pulled in more money than funds with corporate mandates for the third time over the past four weeks.

Did you find this useful? Get our EPFR Insights delivered to your inbox.