Elon Musk calls to delete entire US government agencies

Elon Musk called for entire agencies to be deleted from the federal government as part of the push under President Trump to radically cut spending and restructure its priorities.

Fox – Seattle

- Mississippi receives more than $2 in federal funding for every $1 paid in income tax.

- Federal transfers make up 34.2% of Mississippi’s state and local revenue, placing it twelfth-highest in the nation.

- The average Mississippi resident receives $9,077 back from the federal government compared to taxes paid, the sixth-largest return in the U.S..

Ever wonder how much Mississippi gets back from the federal government vs. taxes paid? Several studies look at how much states contribute to and take from the U.S. Here’s what we know about how the Magnolia State ranks, where the money goes.

The U.S. House of Representatives recently passed a budget that would extend President Donald Trump’s 2017 tax cuts and plans for $4.5 trillion in tax cuts over a decade.

Trump reportedly said he doesn’t want cuts to Medicare, which insures people 65 and older and those with disabilities.

Experts have expressed concern cuts could be coming to programs like Medicaid, which insures about one in five Americans. According to KFF, about 24% of the Mississippi population is covered by Medicaid or the Children’s Health Insurance Program (CHIP).

For every $1 paid in income tax in Mississippi, the state takes in $2.53 in federal funding,” according to a SmartAsset review of state budgets published in 2022. The state pulled more than 47% of state revenues from federal sources. It was the seventh-highest in the nation, and the state had the 11th-largest percentage of federal workers.

A different study ranks the states and give a breakdown of how much, per person, Mississippi residents benefit from federal dollars. Here’s what we know about what federal funds get spent on, how much you might get back from the U.S. government in Mississippi.

What does most federal money sent to states cover?

According to the Office of Management and Budget, the federal government sent state and local governments $1.1 trillion in fiscal year 2024, which accounted for about 16% of federal spending. That amount spiked sharply during the COVID-19 pandemic and has fallen since 2021 but is not yet at pre-pandemic levels.

About 53% of federal transfer spending to states, $584.9 billion, covered Medicaid and CHIP, per OMB and the U.S. Department of the Treasury. Other funds went to highways ($64.3 billion), K-12 education ($59.3 billion) and SNAP food assistance ($55.7 billion) in addition more than $351 billion that served other programs.

According to a USA Facts analysis of U.S. Census Bureau data, federal transfers to state and local governments made up about 34.2% of state and local revenue in Mississippi in fiscal year 2022. The state got $12.3 million and ranked 12th-highest nationally when looking at percentage of revenue coming from federal dollars.

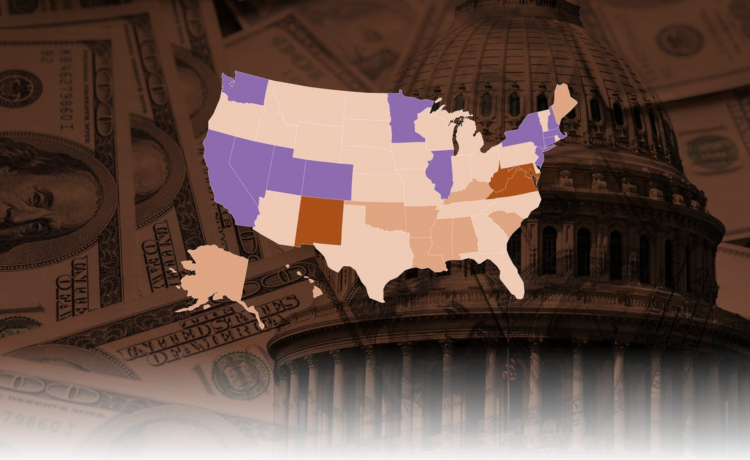

See how each state gives to the US, gets federal money back

The Rockefeller Institute of Government, a public policy think tank, took a different approach and looked at each state’s tax payments and the federal money that residents and the state government get back.

The factors include:

- Direct payments to residents: These include social security payments, retirement, education, food aid and other public assistance programs.

- Federal grants: This includes Medicaid funding, transportation, infrastructure and more.

- Contract and procurement spending.

- Wages paid to federal employees.

Looking at the breakdown per capita, the average Mississippi resident gets $9,077 back from the federal government compared to the taxes they pay. It was the sixth-largest return in the nation.

The Rockefeller Institute estimated the state gets back $2.21 per tax dollar paid.

How does Mississippi get the most federal money?

In a per capita breakdown of 2022 dollars, Mississippi sent the most funds to the federal government through:

- Individual income tax: $9,759.

- Social insurance taxes: $9,094.

- Corporate income taxes: $2,225.

- Excise taxes: $931.

- Other taxes: $63.

Mississippi residents get tax dollars back via:

- Grants: $31,550.

- Grants: $8,890.

- Contracts: $5,377.

- Wages: $2,931.

How much does Mississippi rely on federal funds?

A WalletHub ranking shows Mississippi ranks fifth on a list of the states most-dependent on federal funds. Overall, the state had a score of 63.39.

Residents were ranked seventh-most dependent on federal support in the nation, and the state government was ranked ninth in the U.S. The project looked at factors such as return on taxes paid to the federal government and share of federal jobs to determine residents’ dependency. State-level dependency was based on the percentage of the state budget that came from federal funds.

WalletHub noted that states that voted Republican in the 2020 election had a higher dependence on federal assistance than those that leaned Democrat.

Mississippi also scored high for having both high tax rates and a low GDP per capita (or output amount per person).

Contributing: Sara Chernikoff, Ken Alltucker

Bonnie Bolden is the Deep South Connect reporter for Mississippi with Gannett/USA Today. Email her at [email protected].