There’s no need to still pay a “loyalty tax” to the banks.

By Wolf Richter for WOLF STREET.

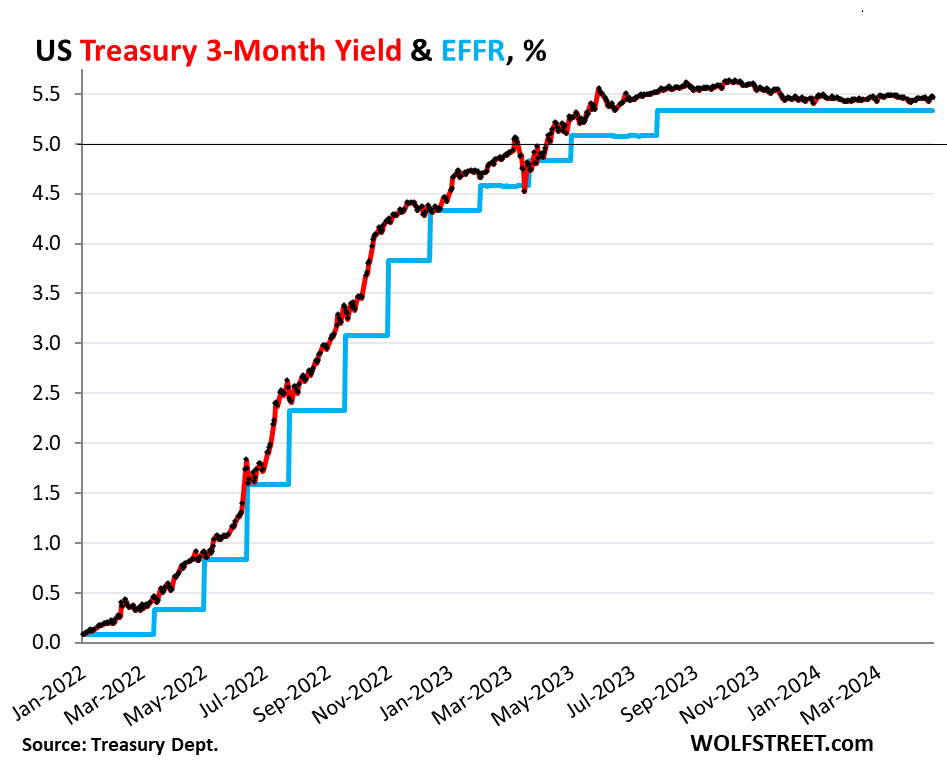

It’s sort of an anniversary: Treasury bills of three months or shorter have been selling at auction with yields over 5% since mid-April 2023. And since mid-May 2023, they have been selling with yields in the 5.2% to 5.6% range. Money market funds and CDs followed. These were finally reasonable returns, up from the ridiculous near-0% that had been in effect until January 2022.

Yields on low-risk short-term investments have come a long way since March 2022, when the Fed’s rate hikes started, and they have stayed over 5% for a year, and it looks like they’re going to stay there for longer, as Rate-Cut Mania has been obviated by resurging inflation.

The three-month Treasury yield closed at 5.48% on Friday. The effective federal funds rate (EFFR), which the Fed targets with its headline policy rate, has been at 5.33% since the last rate hike in July 2023. These used to be normal-ish yields two decades ago, and would have been considered low for many years before then, but here they are again. For a lot of investors, it’s the first time in their investing lives that they’re seeing those yields.

Those yields are not a gift from God, but a result of resurging inflation that has been eating into everything, and that finally belatedly forced the Fed’s hand.

Americans hate, hate, hate inflation. But they’re liking the 5%-plus yields on their cash, and put a lot of cash to work by yanking it out of their bank accounts and putting it in 5%-plus T-bills, money market funds, and “brokered CDs” that they bought through their brokerage accounts.

And that has forced banks to compete for deposits, to keep deposits from fleeing, and to attract new deposits to replace those that did flee, by offering attractive interest rates. And Americans have flocked to those CDs too, and they are switching back and forth, arbitraging rate differences, thereby keeping banks on their toes.

Money market funds (MMFs) that are tagged “retail” had swollen to $2.43 trillion as of April 3, but then there was a $300 billion dip around April 15 Tax Day when taxpayers withdrew cash to pay taxes. By April 24, the balance was down to $2.40 trillion, according to the weekly measure by ICI (Investment Company Institute).

This includes MMFs that invest in government instruments, such as T-bills; MMFs that invest in tax-exempt securities; and MMFs that invest in non-Treasury assets.

MMFs held by Households: A broader measure of MMF balances held by households, released by the Fed as part of its quarterly Z1 Financial Accounts, jumped to $3.6 trillion at the end of Q4, up from $2.6 trillion during the 0% pandemic era, and up from $1.6 trillion before the rate-hike cycle of 2017-2018.

Households are indirectly among the holders of institutional funds because the institutions include employers, trustees, and fiduciaries who buy those funds on behalf of their clients, employees, or owners.

MMFs are mutual funds that invest in relatively safe short-term securities, such as Treasury bills, repos in the repo market, repos with the Fed – what the Fed calls “Overnight Reverse Repos” (ON RRPs) – high-grade commercial paper, and high-grade asset-backed commercial paper, all of them with short maturities.

Total MMFs held by households and institutions spiked to $6.36 trillion by the end of Q4, according to the Fed’s data.

Banks have to compete with T-bills and MMFs.

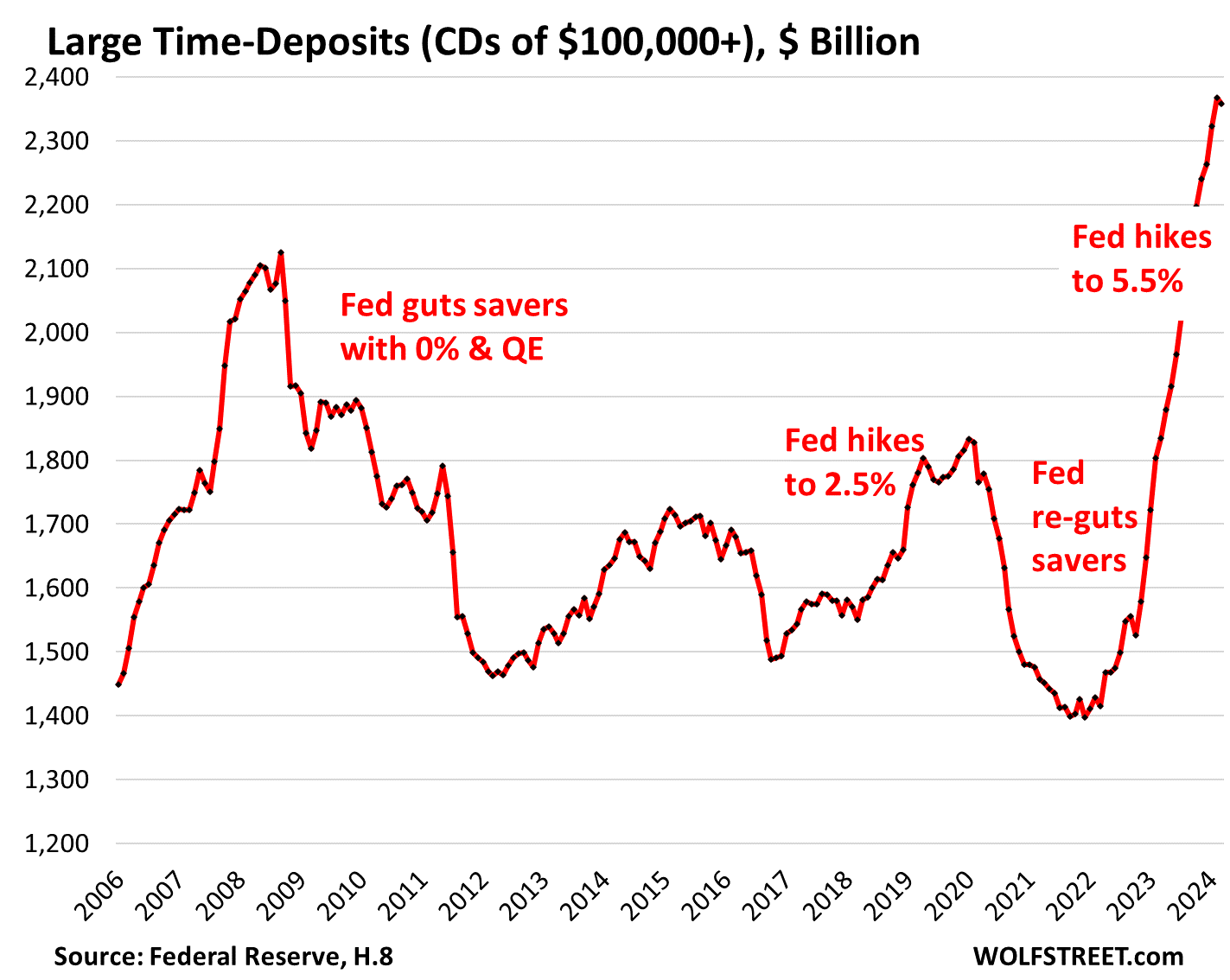

Deposits are loans from customers to the banks and form the backbone of bank funding. When depositors yank their cash out, banks can collapse, and do collapse, see Silvergate Capital, Silicon Valley Bank, Signature Bank, and First Republic. When customers yank their money out because the bank’s interest rates on CDs or savings aren’t high enough, banks attempt to offer more attractive rates, but not across the board – that would be far too expensive – but to new money, and this initially happens with brokered CDs. That’s the first phase of banks reacting to T-bills and MMFs.

But as customers are starting to flee in larger numbers, it becomes imperative to retain the cash from existing customers by offering them competitive rates on cash they already have at the bank, and that’s the second phase, which started last year.

And so banks are offering CDs that yield 4% or 5% and more, even to their existing customers, and people have flocked to them. For banks, CDs (“time deposits”) provide funding that is more stable than savings or checking accounts whose cash can be yanked out instantly via electronic fund transfers.

Large Time-Deposits (CDs of $100,000 or more) surged by nearly $1 trillion since the Fed began its rate hikes, to $2.37 trillion by the end of February 2024, up from $1.40 trillion in March 2022. Last month, they dipped a hair to $2.36 trillion in preparation for Tax Day, according to Federal Reserve data released this week.

The Fed’s interest rate repression during the Financial Crisis caused banks to slash the interest rates on CDs to near-0%. The cashflow of yield investors, such as savers, was sacrificed at the altar of asset-price inflation. And CD balances plunged, as deposits mostly reverted to other types of bank accounts that paid nothing and whose balances continue to swell.

Small Time-Deposits (CDs of less than $100,000) surged from just $36 billion in May 2022 to $1.1 trillion in January and have stayed there through March, according to Fed data.

These small CDs reflect what regular folks are doing with their savings, and they too are now finally earning some income on their investments:

Treasury bills: There are currently $6 trillion of T-bills outstanding, and the pile keeps growing amid huge T-bill auctions. We don’t know the amounts of T-bills that households have stashed away, but it’s significant.

T-bills have terms of one year or less. At auction, they’re sold at a discount, and they’re redeemed at face value. The amount of the discount represents the interest earned over the entire period. They have become attractive instruments for yield investors and savers. They buy them through their broker or directly from the government at TreasuryDirect. They can set them up on auto-rollover so that maturing T-bills are replaced automatically with new T-bills purchased at auction. As settlement dates line up, cash doesn’t sit there unused.

Dodging the loyalty tax. For banks, deposits are the primary source of funding. Higher deposit rates raise the cost of funds for banks, and so they’re loathe to raise interest rates they pay on deposits, and they will raise only the minimum necessary to retain deposits, and they will offer higher rates to get new deposits. They love customers who don’t compare or who don’t pay attention or who feel stuck earning nearly nothing on their savings accounts and checking accounts. It’s free money for banks.

And there are still trillions of dollars in bank deposits that are earning nearly nothing. Some is inevitable, such as with transaction accounts. But other deposits should be moved somewhere else if the bank fails to offer competitive interest rates. There are lots of options today to dodge this loyalty tax. And the 5% interest rates are much-needed compensation for the loss of purchasing power due to inflation.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()