Andrii Dodonov

Written by Nick Ackerman, co-produced by Stanford Chemist.

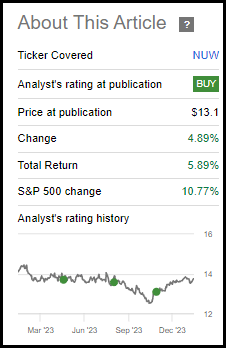

Risk-free rates were dropping dramatically after reaching highs last October, not seen since the Global Financial Crisis. More recently, risk-free rates did see some reversal of those declines, and the 10 Year Treasury Rate pushed back above the 4% level. That’s pushed interest-rates sensitive investments such as municipal bonds back down a bit once again. One fund that I believe is worth considering in the municipal closed-end fund space is the Nuveen AMT-Free Municipal Value Fund (NYSE:NUW).

Since our last update was shortly after rates started falling, the performance of NUW has been quite good. Though, the discount remains deep and attractive.

NUW Performance Since Prior Update (Seeking Alpha)

NUW Basics

- 1-Year Z-score: -0.29

- Discount: -9.90%

- Distribution Yield: 3.71%

- Expense Ratio: 0.61%

- Leverage: 0.72%

- Managed Assets: $279.5 million

- Structure: Perpetual

NUW’s investment objective is “current income exempt from regular income taxes, and its secondary objective is to enhance portfolio value and total return.” In an attempt to achieve this, the fund will invest in:

Municipal securities that are exempt from federal income taxes, including the alternative minimum tax (AMT). The Fund invests at least 80% of its managed assets in municipal securities rated investment grade at the time of investment, or, if they are unrated, are judged by the manager to be of comparable quality. The Fund may invest up to 20% of its managed assets in municipal securities rated below investment quality or judged by the manager to be of comparable quality, of which up to 10% of its managed assets may be rated below B-/B3 or of comparable quality. The Fund may invest in inverse floating rate municipal securities, also known as tender option bonds. The Fund’s use of tender option bonds to more efficiently implement its investment strategy may create up to 10% effective leverage.

NUW can leverage up to 10%, but it generally hasn’t even done that. Instead, their latest leverage ratio comes to 0.72% based on $2 million in borrowings. This is more of just having the option as they state that the “Fund may borrow for temporary or emergency purposes and invest in certain instruments, including inverse floating rate securities that have the economic effect of leverage.”

That makes NUW essentially a non-leveraged fund, so that’s one less variable we have to consider when it comes to considering this CEF.

Performance – Appealing Discount

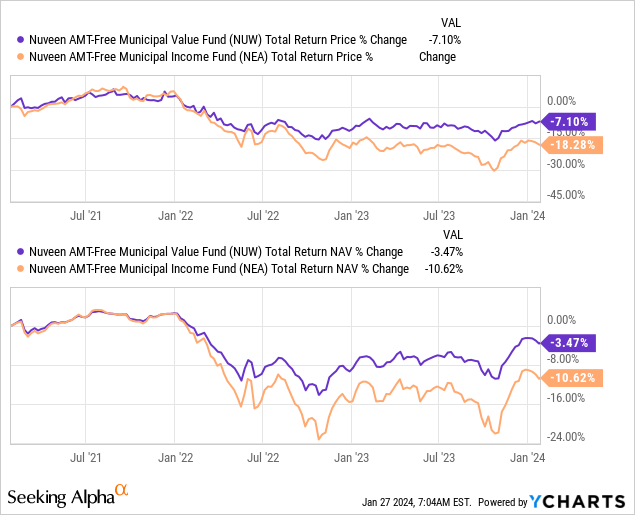

Being a fund with nearly no leverage in the muni space certainly helped this fund relative to some of its larger and leveraged sister funds in the last couple of years. NUW was able to see much more limited total return losses during the last three years, which includes when rates were being aggressively increased by the Fed. Below is a comparison with Nuveen AMT-Free Quality Municipal Income Fund (NEA), which is pretty comparable but significantly larger and leveraged.

Ycharts

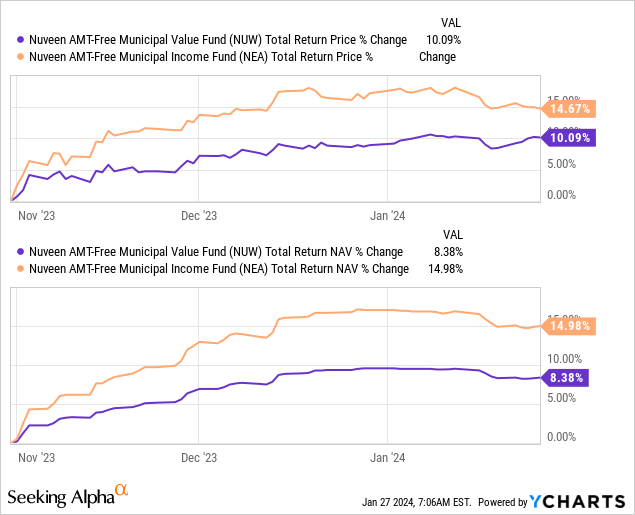

Of course, that does mean that when risk-free rates were dropping as fast as they were from October, NUW may not experience as much upside either. We can clearly see that playing out when we look at the last day of October and compare it to today. In this case, NEA clearly outperformed by a significant margin.

Ycharts

Even with that material outperformance during this period, we can see from the previous 3-year chart that it still wasn’t enough to outperform NUW. So it will still require even further significant rebounding to continue for it to catch up essentially.

I’m okay with not investing in leveraged municipal funds as the leverage still costs more than what the fund can earn on the underlying holdings. It should make it for a smoother ride overall. Rates aren’t expected to go back to zero, but they can stay higher for longer. If rates linger higher for longer, then choosing a non-leveraged option will continue to perform better. If rates are slashed aggressively and the risk-free rate drops meaningfully further, then NUW will still participate in the upside; it just won’t be as strong, relatively speaking. That’s a risk I’m willing to take.

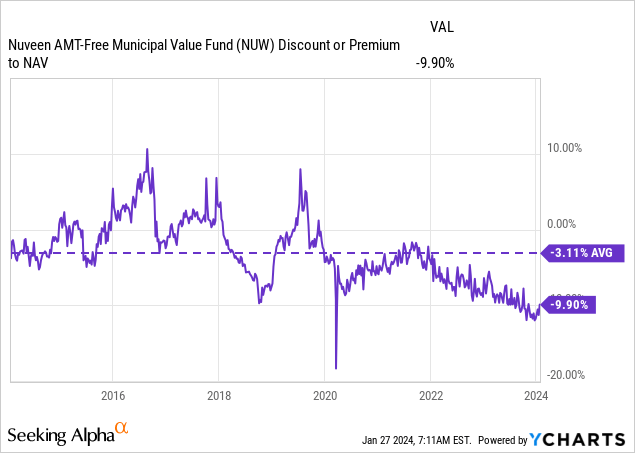

NUW is also trading at a substantial discount, which makes it appealing to consider as well. If interest in the muni bond fund space comes back into vogue due to a lower rate environment, we could see additional demand spur this fund’s share price back toward parity with its NAV.

Ycharts

Distribution – Tax-Free Income

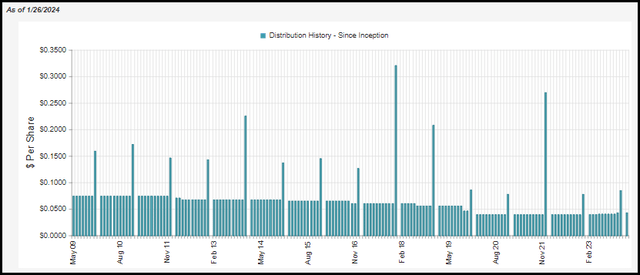

As a muni fund, they aren’t necessarily paying the most attractive distribution rate that gets investors’ interest. Though thanks to the tax-free nature of the vast majority of its distribution, the taxable equivalent yield helps make it a bit more appealing.

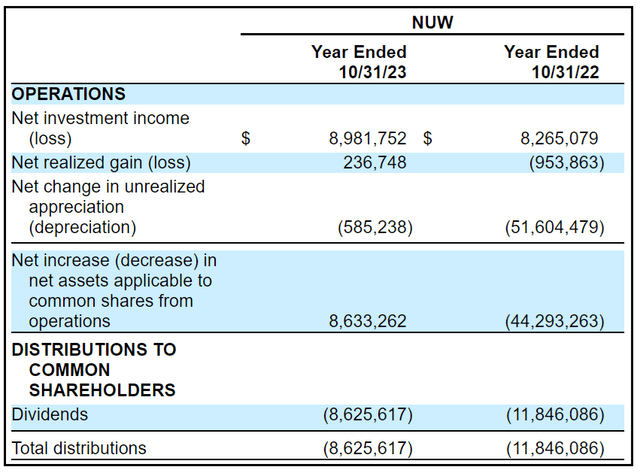

We have to say the vast majority because, for 2023, we saw $8,621,293 as tax-free but $4,324 paid out as ordinary income. In 2022, the tax-exempt income was $8,231,947, with $538,802 as ordinary income. They also had $3,075,337 in long-term capital gains. Those LTCGs were primarily paid out through a special distribution in late 2021.

With that being said, the current distribution rate comes to 3.71%. If you’re in the 24% tax bracket, you are looking at a 4.88% taxable equivalent yield. In the 35% tax bracket, you are looking at the taxable equivalent yield of 5.71% – not to mention it’s also AMT-free, too.

NUW Distribution History (CEFConnect)

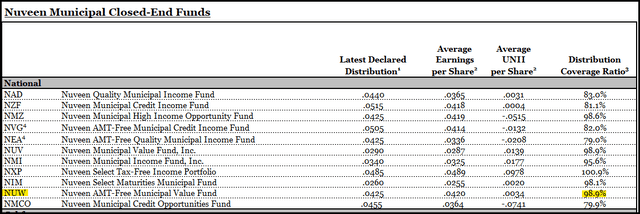

As far as coverage, the fund did see a slight dip in coverage below the 100% level, but it was only marginal. Earlier this year, coverage was over 100% before they raised the distribution. That said, it’s still much stronger than the sister fund NEA, which may have raised its distribution, but that only made its distribution coverage suffer.

It seemed like a move driven simply to try to narrow the leveraged fund’s discounts after having to cut their payouts massively through the rate hiking period. That means that the funds will rely more on interest rate cuts to boost capital appreciation and reduce borrowing costs.

NUW Latest UNII Report (Nuveen)

Further, looking back at the full year rather than the last three-month period shows us that the fund had seen NII coverage at 100%. This reflected some of the periods before the fund increased its distribution.

Overall, the main attraction isn’t the distribution rate for NUW. Instead, it is the combination of earning some tax-free AMT-free distributions while waiting for potential appreciation with lower rates. If the discount narrows in the future, that would be an additional total return driver for investors.

NUW’s Portfolio

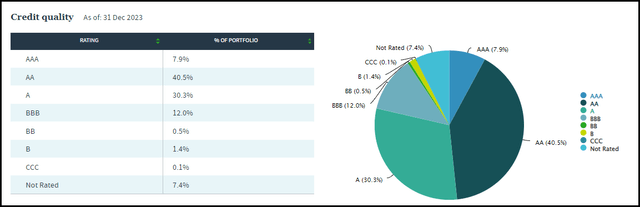

Another primary feature of municipal bonds is they are incredibly safe. In general, investment-grade munis have rarely seen significant levels of defaults. It’s not impossible to have a default; it is just that it is quite rare, relatively speaking. That’s good news for investors in NUW looking for safety because the overwhelming majority of the portfolio is invested in investment-grade munis.

NUW Portfolio Credit Quality (Nuveen)

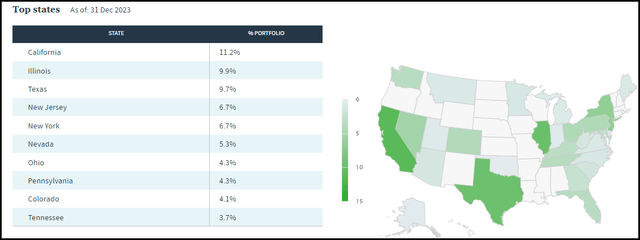

Looking at the top state exposure, California, Illinois, Texas, New Jersey and New York all make an appearance as the largest weightings in the fund. This isn’t that unusual, as these are some of the primary issuers.

In fact, between California, New York, Texas, Illinois, and Florida, those five states are nearly half of all the bonds on the market, according to Charles Schwab. Florida doesn’t make a top spot for NUW’s portfolio, but they do have some exposure and combined those five particular states account for 41.1% of NUW’s weighting. That still leaves a fair bit of diversification away from those states and elsewhere to help provide less dependence on a select few.

NUW State Exposure Breakdown (Nuveen)

Further, the fund invests in hundreds of holdings that are tied to different projects that add more diversification. In total, the fund holds a total of 343 holdings. The top ten has a few positions near the top that are relatively larger weightings, but those allocations quickly diminish by the time we get to number ten.

The total portfolio has an average effective duration of 7.34 years. Duration is the measure of interest-rate sensitivity, and for every 1% change in interest rates, the fund should move 7.34% – that’s upward if rates are declining and downward if rates are rising.

The fund’s average bond price, when not including zero-coupon bonds, comes to $99.65. So, there is limited upside in terms of receiving par back at maturity. When including the zero coupon bonds, the average bond price for the portfolio comes to $95.14. Of course, that doesn’t mean that the underlying portfolio can’t exceed the $100 par level. If rates drop far enough, it could be quite likely that they will start trading at a premium. The average bond price for NUW in our prior update came in at $92.42. So we’ve already seen the average price rise, thus resulting in the appreciation we saw in the fund since that update.

Conclusion

NUW provides diversified municipal bond exposure to investors and primarily tax-free and AMT-free distributions to its shareholders. Increasing interest rates put a damper on the fund’s performance, but that headwind could quickly turn into a tailwind if rates move lower. The fund’s discount is also attractive, which could be an additional factor in boosting an investor’s total returns going forward.

The fund is essentially a non-leveraged fund as they will often avoid utilizing leverage, and if they do, they limit themselves to a maximum of 10%. That reduces the fund’s risk in an already relatively safe portfolio of high-quality investment-grade muni bond holdings.

Being non-leveraged has its pros and cons. Right now, rates are still quite high, so the benefits of borrowing tend to be marginal if they have a positive spread at all. High-quality portfolios don’t come with high-yield characteristics. As an example, going back to NEA. The average annualized leverage cost came to 4.75%, with the average coupon in its portfolio at 3.94%. On the other hand, it isn’t all bad news for leveraged muni funds. Should a recovery start to take place and rates go further or faster than anticipated, a leveraged fund could see significantly more upside.