The news of where IPEplus Fund 1 was registered is important because it is part of a bunch of offshore funds, almost all of them registered out of Bermuda, which Hindenburg alleges were used by Vinod Adani, the older brother of Adani group chairman Gautam Adani, to manipulate the share prices of some of the conglomerate’s group companies in the past.

On Sunday, 360 One Wam (formerly IIFL Wealth Management), which managed IPEplus and Global Dynamic Opportunities Fund, told the exchanges that IPEplus Fund was a “fully compliant and regulated fund” that was set up in October 2013 and closed in October 2019.

“IPEplus Fund 1 is registered as a Bermuda Limited Liability investment fund,” a spokesperson for 360 One Wam told Mint on Wednesday in response to a questionnaire.

Mauritius financial services regulator denies Hindenburg claim

After Hindenburg’s Mauritius claim, the island country’s financial services regulator in a press statement on Tuesday denied the fund being registered there. “We wish to clarify that IPE Plus Fund and IPE Plus Fund 1 are not licensees of the FSC and are not domiciled in Mauritius,” the Mauritius Financial Services Commission said in the statement.

On Saturday, Hindenburg Research said Global Dynamic Opportunities Fund, a Bermuda-based fund, had invested in IPEplus Fund 1. Subsequently, Buch and her husband Dhaval, in a statement on Sunday, acknowledged their hitherto unreported investment in IPEplus Fund 1.

“The investment in the fund referred to in the Hindenburg report was made in 2015 when they were both private citizens living in Singapore and almost 2 years before Madhabi joined Sebi, even as a Whole Time Member,” the Sebi chairperson and her husband said in a joint statement.

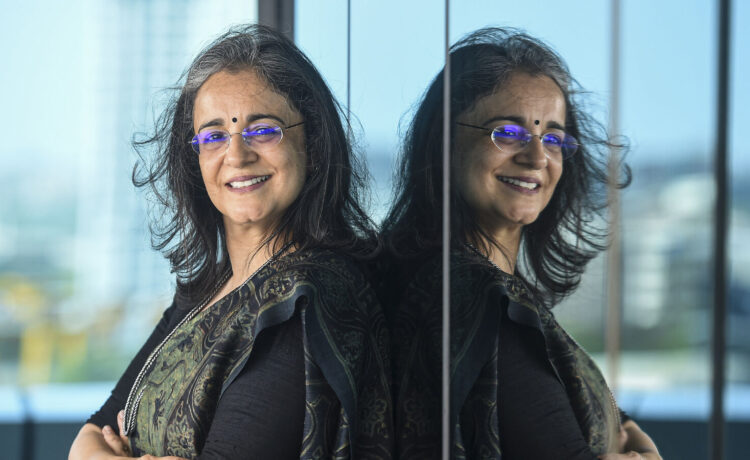

Buch’s four-year stint as a whole-time member of the Securities and Exchange Board of India was between April 2017 and October 2021, after which she became the first woman chairperson of the market regulator in March 2022. Her current three-year term ends in February next year.

“The decision to invest in this fund was because the Chief Investment Officer, Anil Ahuja, is Dhaval’s childhood friend from school and IIT Delhi and, being an ex-employee of Citibank, J.P. Morgan and 3i Group plc, had many decades of a strong investing career,” Buch and her husband said in the joint statement. “The fact that these were the drivers of the investment decision is borne out by the fact that when, in 2018, Ahuja left his position as CIO of the fund, we redeemed the investment in that fund.”

According to Hindenburg, the Global Opportunities Fund is the parent entity of a complex offshore fund registered out of Bermuda. Vinod Adani allegedly used the offshore fund to invest in Indian markets with money siphoned from over-invoicing of power equipment brought in from China to India in the past decade by the Adani Group, according to an earlier investigation by the Financial Times, which was also cited by Hindenburg.

Global Dynamic Opportunities Fund (GDOF), which is nested under GOF, also invested in IPEplus Fund.

“Whistleblower documents show that Madhabi Buch, the current Chairperson of Sebi, and her husband had stakes in both obscure offshore funds used in the Adani money siphoning scandal,” said Hindenburg. “We find it unsurprising that SEBI was reluctant to follow a trail that may have led to its own Chairperson.”

Adani Group has strongly denied these charges.

“We completely reject these allegations against the Adani Group which are a recycling of discredited claims that have been thoroughly investigated, proven to be baseless and already dismissed by the Hon’ble Supreme Court in March 2023,” Adani told the Exchange on Sunday, in a statement, titled “Hindenburg Report – A Red Herring”.

“It is reiterated that our overseas holding structure is fully transparent, with all relevant details disclosed regularly in numerous public documents. Furthermore, Anil Ahuja was a nominee director of 3i investment fund in Adani Power (20072008) and, later, a director of Adani Enterprises until 2017.”

Offshore funds are set up in tax haven countries like Bermuda, Cayman Islands and Mauritius as these entities disclose sparse or no details about the ownership of these vehicles. Various step-down entities are then set up to make it challenging for regulatory agencies to ascertain the ownership of these funds.

Following the Hindenburg report, Mint reported on 11 August that Sebi chief Buch continues to own 99% of a Mumbai-based consulting firm Agora Advisory. However, she transferred ownership of Singapore-headquartered Agora Partners to her husband, two weeks after she took charge as Sebi chair.

Meanwhile, the joint statement cited earlier also said that the two consulting companies set up by her in India and in Singapore became immediately dormant on her appointment with Sebi. However, the company is still shown to be classified as active by the ministry of corporate affairs (MCA).

Rohit Jain, managing partner at law firm Singhania & Co said that as per Section 455 of the Companies Act, 2013, to change its status to a dormant company, a company must have no significant accounting transactions, meaning no business activity except essential payments such as Registrar fees, compliance payments, and office maintenance.

“Additionally, the company should not have conducted any business or filed financial statements or annual returns for the last two financial years. To retain its dormant status, the company must maintain a minimum number of directors, file the required documents, and pay an annual fee,” said Jain.

Documents from MCA showed that since Madhabi Puri resigned as a director of Agora Advisory Pvt Ltd in March 2017, the consultancy firm has made an aggregate profit of ₹1.8 crore on the back of ₹3.8 crore in revenues between FY18 and FY24.

Interestingly, in FY18 and the following financial year, Agora Advisory had no income, leading to losses in both years. While it made a loss of ₹11,566 in FY18, losses were at ₹8,140 in FY19. Financial details of the Singapore-based Agora Partners Pte were not available.